عرض العناصر حسب علامة : ACCA

الدور الأساسي للمدراء الماليين في تعزيز الصحة العقلية للموظفين

بالنسبة للمحاسبين المهنيين، تزيد مشكلات الصحة العقلية من مخاطر عدم تحديد الأخطاء في التقارير المالية أو اكتشاف مؤشرات الاحتيال.

معلومات إضافية

-

المحتوى بالإنجليزية

The following is a contributed piece from Russell Guthrie, CFO of the International Federation of Accountants (IFAC). Opinions expressed are author's own.

The coronavirus pandemic has put a long-overdue spotlight on mental health. Clinical studies have found a strong correlation between pandemic-related anxiety and behaviors, such as hopelessness or substance abuse, that companies cannot afford to ignore. Implementing an organizational framework to support mental health is not only the right thing to do, it's smart for business. With the potential to alleviate human and financial costs, support for mental health should be seen as core to the finance function’s role in promoting sustainable value creation.

In 2019, the World Health Organization estimated that mental health issues cost the global economy upward of $1 trillion per year. In the wake of the past year, that cost is likely to increase considerably, reinforcing the need for mental health to be a key priority for employers and organizations worldwide.

Addressing mental health successfully, however, will require the involvement of the entire C-suite — not just HR, and not just the CEO. The finance function must be a pivotal part of the conversation both in supporting the adoption of company initiatives and in examining the cultural values of the accountancy and finance profession globally.

Long-term growth and value creation

Creating a culture of understanding must be a critical priority for CFOs. Failing to care for employees can mean falling behind as an organization, particularly in sectors where a company’s best asset is its human capital. A 2020 Gallup survey found that two-thirds of full-time workers polled were facing burnout at least some of the time, and those people were three times more likely to look for another job. It’s both more humane and more cost-effective to support your talent’s well-being rather than risk a mass exodus and face the high price of attrition — especially if you have developed a reputation for burning out your employees.

Russell Guthrie

Courtesy of IFAC

Effectively addressing mental health by establishing the appropriate infrastructure to support employees can also play a determinant role in attracting and acquiring new talent. According to a recent report by the International Federation of Accountants (IFAC) and the Association of Chartered Certified Accountants (ACCA), Generation Z — the group of 18-25-year-olds entering the workforce during the pandemic — cites mental wellbeing as a top priority when seeking employment.

CFOs must be advocates for the crucial relationship between employee mental health and a company’s bottom line. Fatigue, burnout and other signals of strained mental health stand in opposition to the creativity, collaboration and stamina required to stoke growth and resiliency within companies.

A unique threat

The finance function — and, more specifically, accountancy profession — is innately people-centered, relying on equal parts technical and non-technical capabilities. Professional accountants, in particular, are responsible for critically reviewing information and large sets of data to ensure accuracy and compliance with laws and regulations, as well as evaluating conflicts of interest — a job that demands mental acuity, attention to detail and good judgement. Unsurprisingly, when people are under mental strain, it is increasingly difficult to focus on the task at hand.

For a professional accountant this may heighten the risk of not identifying errors in financial reports or impact one’s ability to spot indicators of fraud, both of which can have far-reaching consequences. It’s not enough, however, to recognize what is at stake. Leaders have to promote a culture that will mitigate those risks.

By nature, the accountancy profession is built on the expectation of perfection. Working against a standard of excellence — with little room for error — professional accountants face numerous internal and external pressures. And particularly now, as the global economy recovers from the impacts of COVID-19, professional accountants are facing increasing stress as the institutions they support focus on rebuilding.

Such high expectations create an environment ripe for the deterioration of mental health. This, coupled with the general stigma surrounding mental health, often results in hesitation to recognize or address fatigue, depression, or any other mental health issues.

Mental health must be included among the tenets of ethical and good business performance. A robust financial system is the bedrock of any thriving economy, and the people who uphold the rigor of high-quality accounting have to be a top priority.

Building the infrastructure

Mental health must be considered part of an organization’s environmental, sustainability and governance (ESG) strategy and approached as would the provision of any other basic human right. Just as global standards are a critical vehicle for reaching sustainability goals, a similarly rigorous approach will help companies, both large and small, establish the necessary infrastructure to properly support employee well-being.

The right response will likely look different from region to region and from organization to organization, but the essential first step is simply making mental health part of the ongoing dialogue of the organization. From there, organizations must deploy initiatives for supporting employees and their ability to perform.

This will likely mean rethinking normalized processes to identify existing threats to well-being and potential barriers to care. For instance, some companies will need to reconsider the relentless focus managers place on productivity. Others will have to reevaluate insurance plans to consider coverage of mental health treatments. They should look to institute mental health literacy programs and leverage outside expert resources to empower employees to prioritize mental health and support those in their communities looking to do the same. Ultimately, leadership needs to be highly engaged in this effort. Successfully shifting corporate culture to prioritize mental well-being starts at the top.

While it’s not solely up to CFOs and the finance function to champion new and expanded norms for operating within the current reality, they are essential to creating a positive space to discuss and address employees’ mental health. It’s mission critical if we want to ensure businesses continue to operate as productively, sustainably, and ethically as possible.

كيف تقرر مستقبلك المهني بعد اجتياز اختبار جمعية المحاسبين القانونيين المعتمدين

بعد اجتياز اختبار جمعية المحاسبين القانونيين المعتمدين (ACCA) يجب عليك التفكير في المكان الذي ترى فيه نفسك في المستقبل، يمكن ان تسير حياتك المهنية بعدة طرق مختلفة اعتماداً على الاختيارات التي تتخذها خلال هذا الوقت.

خمسة مجالات لمحو الأمية المناخية للمحاسبين

وجهة نظر الاتحاد الدولي للمحاسبين بشأن العمل المناخي تحدد التأثير الهائل للمنظمات الأعضاء البالغ عددها 180 في الاتحاد الدولي للمحاسبين وما يزيد عن 3.5 مليون محاسب مهني في دفع التحول والتكيف مع تغير المناخ.

معلومات إضافية

-

المحتوى بالإنجليزية

IFAC’s Point of View on climate action outlines the enormous influence IFAC’s 180 member organizations and the over 3.5 million professional accountants yield in driving climate change transition and adaptation.

As Mark Carney, COP26 Finance Adviser and UN Special Envoy, put it at the 2020 IFAC/ACCA Climate Week event, the accountancy profession is essential in achieving a low-carbon transition. The contribution of an individual accountant will of course depend on their role but there are few roles that accountants undertake which do not require thinking about climate impacts and their financial consequences.

The transition to a below 2-degree Celsius Net-Zero world really needs climate-literate accountants who can take a climate-conscious approach to

advising their clients and employers on the risks, liability and reputational damage arising from corporate activity that negatively contributes to climate change;

supporting the strategic, operational and financial assessment of climate change and steering an organization toward the opportunities that decarbonization brings; and

providing investors the information they need to understand the current and prospective impact of climate-related matters on an organization and its financial position and prospects.

Becoming climate-literate isn’t a nice to do aspirational goal. A low-carbon transition is underway and will change how economies operate creating both uncertainty and significant opportunities. Politicians, regulators, and institutional investors, and asset managers have all elevated their game.

Governments and businesses are setting Net Zero emissions targets with about 120 governments and a fifth of the world’s 2,000 biggest listed companies having made Net Zero commitments. More than 40 asset managers including Vanguard and BlackRock, signed up to the Net Zero Asset Managers Initiative pledging to make their portfolios Net Zero by 2050 or earlier. The CEO of BlackRock, Larry Fink’s annual letter calls on all companies “to disclose a plan for how their business model will be compatible with a net-zero economy”.

Net Zero emissions commitments are a clear signal of the intent to achieving the Paris Agreement. About 60% of global emissions are now subject to such targets. Undoubtedly there is significant work to be done to meet such long-term ambitions not least companies putting in place clear strategies and robust short- and medium-term targets, and ensuring where possible future investments are clearly aligned. Climate Action 100+ has put in place a Net Zero company benchmark to help track business alignment with the Paris Agreement.

The significant threat of climate-related stranded assets is also driving central banks and financial supervisors to assess their role in ensuring the resiliency of the financial system and solvency of financial institutions (see Adapting Central Bank Operations to a Hotter World).

Capital markets have started to make decisions about the transition to renewable and sustainable energy with the cost of capital for fossil fuel options increasing. However, climate risk disclosure globally is inadequate. For climate risk to be fully reflected in company valuations every company, every bank, every insurer and investor needs to disclose their climate-related risks on a standardized basis.

Step-in accountants who need to acquire climate literacy in these five areas to provide relevant insights and analysis, reporting, and assurance to help organizations and their stakeholders make informed decisions to ensure business resilience.

Climate finance: Understanding the nature and magnitude of domestic and international climate finance and how climate finance flows and investments can support climate adaptation and mitigation actions.

Climate finance is the key to unlocking resource mobilization and capex decisions to finance low-carbon investments and products such as electric fleets or renewable energy generation. Mobilizing equity or debt finance to support new technologies and processes is usually critical to changing business models and supply chains. Options for green finance have significantly increased over recent years, through green bonds and sustainability-linked loans, for example, Virgin Money has launched sustainability-linked loans in Europe.

Decarbonization strategies and business models: Being aware of decarbonization strategies and plans where they exist, and the opportunities and challenges around different approaches to achieving Net Zero emissions reduction.

It is important to be familiar with various options for permanent carbon reduction and removal and their associated cost and benefits. Investments in low-carbon and novel solutions can often appear economically unviable because of high up-front capital costs so measuring economic returns, and other potential benefits over a longer period become important. Investments in R&D and innovation can be directed at enabling greater resource and energy efficiency, migration to circular business models, and avoiding the use or production of virgin materials (e.g., using bio-based raw materials like mycelium leather), and diversification into other energy forms.

It is also important to know your sector as decarbonization pathways are typically sectoral with approaches and technology options being unique to different sectors such as energy, transport, agriculture, manufacturing, and financial services. Also, be aware of carbon markets and policy and regulatory approaches and instruments for emissions abatement, and how carbon offsets can be an option for bridging the gap where technologies and resources to achieve zero emissions are not within reach.

Climate scenarios and risk assessments: Understanding climate scenarios and risk assessments and how they help to drive strategic decisions and support the assessment of investment/capex options as well as business cases for new products or mergers and acquisitions.

A comprehensive understanding of climate risk assessments and scenario modeling is necessary to support robust analysis of opportunities and risks in relation to different transition pathways. Scenario analysis is a critical element in bridging risk management and strategy and provides useful insights into how resilient strategies and business models are in the context of physical and transition risks. Risk assessments also support robust and useful disclosure by helping to quantify climate impacts and their potential financial impact in relation to revenues, expenditures, assets and liabilities under various climate scenarios.

Climate performance and data management: Being cognizant of climate science to establish relevant targets to reduce greenhouse gas (GHG) emissions, and establishing KPIs to assess performance against targets and strategic goals. Providing objective and reliable data and insights to help set and achieve appropriate emissions and other climate-related targets is also critical. Targets set by management drive actions to mitigate or adapt to climate risks and opportunities, It is important to be comfortable with

Metrics used to measure and manage risks and opportunities such as the current carbon price or range of prices used for assessing climate risks and making investment and strategic decisions

Metrics that reflect the impact of risks on financial performance.

Relevant climate-related KPIs need to be integrated into performance scorecards and alignment to incentives at different levels in the organization. It is also important to integrate climate-related information into existing financial and data management systems and internal control processes to ensure data supporting decision-making and reporting is reliable and verifiable.

Incorporating climate change into reporting and disclosure: Both preparers and auditors need to be attuned to the implications of climate-related matters as part of their financial and integrated reporting, and auditing and assurance responsibilities. It is important to be familiar with The Financial Stability Board’s Taskforce on Climate-related Financial Disclosures (TCFD) recommendations that are a catalyst for improving management processes for managing climate-related risk as well as enhancing financial-related disclosure. The TCFD recommendations are being used as the basis of tougher climate-related disclosure requirements in various countries.

Significantly better disclosure on climate risks is needed both for management and risk reporting and understanding the impact on key accounting estimates and judgements in assessing and reporting on financial position and performance.

Material climate risks for the current reporting period need to be incorporated in financial accounts where they have a financial effect such as impairment of assets and impact on results and cash flows. The Climate Disclosure Standards Board (CDSB), has issued guidance on the disclosure of the financial effects of climate-related issues on a company’s financial statements under existing IFRS Standards. Where the financial effects of climate risk are uncertain, it is necessary to include in the management or “front half” of the annual report forecasting of climate risks together with management assumptions, judgments and estimates.

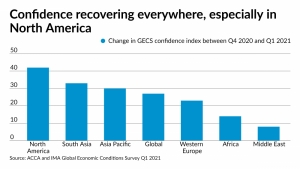

الثقة الاقتصادية العالمية تنتعش بين المحاسبين

أظهر المحاسبون ثقة أكبر في الاقتصاد خلال الربع الأول من العام الحالي مقارنة بالعام الماضي، خاصة في أمريكا الشمالية، بحسب مسح جديد.

معلومات إضافية

-

المحتوى بالإنجليزية

Accountants expressed much higher confidence in the economy during the first quarter of this year compared to last year, especially in North America, according to a new survey.

The survey, by the Association of Chartered Certified Accountants and the Institute of Management Accountants, polled more than 1,000 senior accountants and finance professionals around the world, and found the biggest quarterly jump in confidence in a decade, thanks to increasing supplies of vaccines and continuing fiscal stimulus from many governments. The ACCA and IMA’s Global Economic Conditions Survey saw a nearly 30-point jump in the confidence index globally and more than 40 points for North America in the first quarter of 2021, compared to the fourth quarter of 2020. However, the two “fear” indices in the survey, which measure concern that customers and suppliers could go out of business, offered contrasting messages. Fear that customers would go out of business declined significantly while fear that suppliers would do so rose slightly higher. But both factors remain at relatively high levels, underscoring the high level of uncertainty that remains in the world economy.

The rollout of COVID-19 vaccines in recent months have helped improve economic confidence in many parts of the world. However, the growing number of COVID-19 variants that seem to spread more easily has also led to uncertainty and some European countries have been forced to retreat on their reopening plans. In many parts of the world, access to vaccines remains severely limited. Accountants in Western Europe, Africa and the Middle East did not register as much of an increase in economic confidence as those in North America and Asia.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

“This crisis is different as its root cause is health and not economic,” said IMA vice president of research and policy Raef Lawson in a statement Monday. “For now, global COVID-19 infections are high relative to the vaccination rate, so risks remain significant. But the huge government support provided to both households and companies over the last year leaves both well-placed to resume spending once the health crisis is over. There are likely to be permanent changes in the pattern of spending and other long-term economic consequences of the COVID crisis.”

Economic activity indicators for orders, capital spending and employment all increased to some extent in the first quarter of this year, according to the survey, echoing the level of confidence in the fourth quarter of 2019 before the spread of the COVID-19 pandemic.

“Having suffered the biggest recession for several decades in 2020, the global economy is on course for a relatively quick rebound,” said ACCA chief economist Michael Taylor in a statement. “The good news is that vaccination plans with continued policy support are on course to lift the global economy out of the COVID abyss this year.”

The report acknowledged that vaccination rates vary significantly across different countries, and vaccination can replace lockdown measures as a way to control COVID-19, allowing economic conditions to return to normal. But government policy is also crucial. A major fiscal stimulus in the U.S. is likely to have a positive spill-over impact on other economies around the world this year. Particularly in advanced economies, a large pile of savings accumulated during the periods last year when spending was severely limited, and those funds can provide a source of extra demand once economic conditions improve. Based on those criteria, the U.S. and the U.K. seem to have better growth prospects than the Eurozone, while China is likely to continue to experience strong growth. Emerging markets may also benefit from increased global demand, but vaccination rates will probably remain low in many countries through the rest of this year.

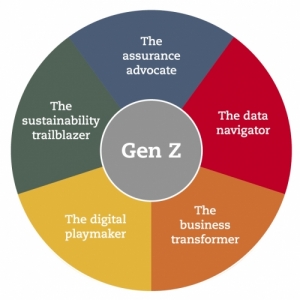

الجيل Z ومستقبل المحاسبة

10 في نصائح لمساعدتك على تأمين مستقبل مهني. شاهد خلاصة IFAC وACCA بينما يتم مشاركة الرؤى التي تم جمعها من أكثر من 9 آلاف من أقرانك.

معلومات إضافية

-

المحتوى بالإنجليزية

Amid a rapidly changing world, the first digital native generation is entering the workforce. This joint report from ACCA (the Association of Chartered Certified Accountants) and IFAC (the International Federation of Accountants) draws upon the responses of 9,000+ 18-25 year olds to gain insights into how Generation Z’s top concerns may influence what they want from their careers, what attracts them to organizations, and their views on accountancy, business, and the impact of COVID-19.

Groundbreakers: Gen Z and the Future of Accountancy examines how this generation’s priorities and skills will redefine work, provides guidance to Gen Z on navigating their careers as the workplace transforms, and outlines the strategies organizations should adopt to harness Generation Z’s potential and help them thrive.

كورونا تدفع واحدًا من كل عشرة شباب لتغيير مسارهم الوظيفي

يدفع الوباء واحدًا من كل عشرة شباب لتغيير مسارهم الوظيفي، وفقا لجمعية المحاسبين القانونيين المعتمدين (ACCA)

معلومات إضافية

-

المحتوى بالإنجليزية

A new poll commissioned by ACCA (the Association of Chartered Certified Accountants) suggests the Covid-19 pandemic has proved to be a time of career contemplation and change for young people.

There are around six million 16 - 24 year olds in the UK, and ACCA polled over 1,000 to better understand their views about jobs. While before the pandemic 21% wanted to pursue a professional career like accountancy, that figure has now increased to 30%.

Being on furlough has offered a lot of people already in work the chance to reassess and aim to take new qualifications to target a new job.

40% of those surveyed said financial security is most important to them in their job and that traditional career paths with qualifications helped increase the chances of that job and financial security. There was a fifty-fifty split on the numbers of people aiming to go to university and those who said it wasn’t for them. The numbers of people wanting to go into apprenticeships - or aiming to work and study at the same time - now matches the number of people wanting a place at university.

Helen Brand, chief executive of ACCA says: ‘The Covid-19 crisis has made many rethink career aspirations and their futures. This research, alongside a global survey we did earlier this year into Gen Z and their careers, shows how the pandemic has transformed aspirations about the world of work, while also shaking up how employers run businesses and organisations. The role of accountants is wider and more important than ever before, offering a secure and flexible career whatever your age.

‘For Gen Z, developing strategic accountancy skills offers a great launchpad into a career, with benefits our research shows that they crave – such as the opportunity to learn valuable skills and progress rapidly; to be paid well and enjoy greater security of employment; to enjoy a good work-life balance; with varied and meaningful work for organisations with purpose and values, and also the opportunity to make a contribution towards a better, fairer, more sustainable future for all.’

ACCA has three case studies of people who have been inspired to recently pursue a career as finance professional, making the change during and before the pandemic:

24-year-old Cristina Oprea from Greenwich in SE London was a chef in a nursery before being furloughed in Spring 2020. With some time to plan her future afresh, Cristina opted to study an accounting degree with the ACCA. Cristina now works as an Accounts Assistant for a care company while continuing her studies. She has now purchased her first property before the age of 25.

37-year-old Gaurav Kumar from Ashton-under-Lyne in Greater Manchester worked in the hotel industry looking after serviced apartments that were forced to close by the pandemic. While furloughed, he enrolled with the ACCA. He’d always loved working with numbers and has now started a new job at Barclays while he continues his studies.

37-year-old Craig Maclean from Cambuslang, on the edge of Glasgow, was a baker with Greggs for nearly 20 years. Wanting a career change, he’s now switched to studying at the University of the West of Scotland for an ACCA accredited degree. He’s also working at the university as a Finance Administrator.

Helen Brand concludes: ‘The pandemic has initiated a change in career outlook, and we also see this being played out on our global jobs board, ACCA Careers, which has recently seen a 43% year on year global uptick on usage. This shows a level of demand not seen before, and which we believe will continue.’

حدث: ثقة الجمهور في الضرائب، كيف يمكن تعزيز فعالية واستدامة وعدالة النظم الضريبية العالمية؟

معلومات إضافية

- البلد عالمي

- نوع الفعالية مجانا

- بداية الفعالية الأربعاء, 22 سبتمبر 2021

- نهاية الفعالية الأربعاء, 22 سبتمبر 2021

- التخصص ضرائب

- مكان الفعالية أونلاين

توقعات المحاسبين بالنسبة للاقتصاد هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

Accountants are anticipating the global economy will return to pre-pandemic levels in the second half of this year, despite worries about inflation, according to a new survey.

The quarterly Global Economic Conditions Survey, released Tuesday by the Association of Chartered Certified Accountants and the Institute of Management Accountants, indicated a swift and strong recovery in global confidence in the second quarter among the more than 1,000 senior accountants and finance professionals polled. There was a slight dip in global confidence in Q2, but it came after the biggest jump in confidence in the 10-year history of the survey during Q1.

The results revealed that accountants are mostly feeling optimistic about the economic recovery after global confidence plunged in late 2019 and 2020 as the COVID-19 pandemic spread across the world. However, inflation fears and the persistence of the coronavirus, including the virulent Delta variant, are tempering confidence a bit.

Health care workers test people at a COVID-19 testing site in the parking garage for the Mahaffey Theater in St. Petersburg, Florida.Eve Edelheit/Bloomberg

Why Lease Accounting Software Fails

9 Key Functional Deficiencies Driving Companies to Replace ASC 842 Software

PARTNER INSIGHTS

SPONSOR CONTENT FROM COSTAR

Compared with the Q1 survey, inflation expectations have increased significantly in North America, while in Western Europe, the accountants and finance professionals polled anticipate a modest increase in inflation over the next five years.

“To a large extent, the rise in inflation will be temporary, the result of collapsing demand last year, followed by a strong rebound that has resulted in rapid increases in commodity prices and supply shortages in some sectors,” said Michael Taylor, chief economist at ACCA, in a statement. “The rise in inflation can therefore be seen mainly as a welcome reflection of a strong recovery in demand that has resulted in supply shortages and a rebound in commodity prices, both of which are likely to prove temporary. For now, at least, underlying inflationary pressures are generally subdued.”

While survey respondents across various regions of the globe expect a modest increase in inflation over the next five years, a significant minority in North America anticipate much higher inflation. In all regions, at least two-thirds of the survey respondents expect inflation to be slightly or much higher than now.

Global activity indicators, such as orders, showed further improvement in the Q2 survey and are now above the level seen in Q4 2019, right before the pandemic began spreading widely across the world.

Overall, the global economy has now returned to its pre-pandemic size, driven largely by rapid growth in the U.S. and China, the two largest economies, but most other economies around the world still have plenty of ground to recover.

The two “fear” indices in the poll — measured by concern that customers and suppliers may go out of business — both fell in the Q2 survey, indicating that the extreme uncertainty generated by the COVID-19 pandemic has dropped back toward more normal levels.

The index of concern about operating costs grew in the Q2 survey and is now at its highest level since Q3 2019, probably due to inflation worries and labor and supply chain constraints. But concern remains below the level that would indicate a sustained large rise in inflation.

The survey found a very strong recovery underway in North America through the second half of 2021. While confidence remains high, it fell back slightly after an extremely strong bounce in the Q1 survey. The orders and employment indices on the survey both increased and reached their highest level on record. Continued progress with vaccinations, allowing economic conditions to return to normal, and the huge U.S. fiscal stimulus are driving recovery in the region.

Vaccines will be key in maintaining the recovery in the U.S. and helping other regions of the world. “In addition to rapid deployment of effective vaccines, advanced economies have been able to deploy massive fiscal support measures that have maintained household disposable incomes, supported businesses, and prevented large rises in unemployment,” said Raef Lawson, vice president of research and policy at the IMA, in a statement. “Buoyant housing markets have supported consumer spending. This means that as economic conditions move toward normalization, economies are likely to recover very rapidly. In many emerging markets, vaccinations have made little progress, leaving them vulnerable to renewed waves of COVID-19 and variants with consequent restrictions that curtail economic recovery. This pattern seems likely to persist well into 2022.”

The U.S. economy is likely to grow by approximately 7% this year as COVID cases decline and vaccinations continue, according to the ACCA and IMA. Second-quarter GDP growth is likely to be close to the 7% annual rate, helped by a strong rebound in consumer spending. Growth may even strengthen during the second half of the year as employment continues to recover. A return to more normal economic conditions is being helped by the massive fiscal stimulus which by itself may add over three percentage points to GDP this year. Despite the recent spike in inflation, the Federal Reserve is expected to keep monetary policy in place, with interest rates close to zero.

كي بي ام جي KPMG توسع الخدمات البيئية والاجتماعية والحوكمة

تعمل KPMG على زيادة جهودها لتوفير الخدمات البيئية والاجتماعية والحوكمة للعملاء من خلال مبادرة جديدة تسمى KPMG Impact.

معلومات إضافية

-

المحتوى بالإنجليزية

KPMG has been increasing its efforts to provide environmental, social and governance services to clients through a new initiative called KPMG Impact.

The team will help clients improve their ESG performance while also carrying out KPMG’s own ESG commitments. Last year, KPMG U.S. worked with other businesses, investors, standard-setters, non-governmental organizations and international organizations through the World Economic Forum to create a set of 21 core metrics for companies to disclose their progress in the ESG areas of people, planet, prosperity and governance. KPMG has adopted those same metrics to guide its actions and measure and report its progress.

The move comes as more accounting firms wade into providing ESG reporting and assurance services for clients. ESG funds have become a popular vehicle for investors, and the Securities and Exchange Commission is weighing requirements for climate risk disclosures by companies. At the same time, at the global level, securities regulators around the world are pushing for greater consistency in reporting ESG metrics, encouraging standard-setters to align their various standards and frameworks more closely together. The International Financial Reporting Standards Foundation has been working on creating a proposed International Sustainability Standards Board that it would oversee alongside the International Accounting Standards Board. IFRS Foundation trustees explained how the structure would work during a webinar Wednesday.

Using Too Many Systems? Accounting Practice Management all in One Place

Canopy is a full-suite practice management software for accounting firms offering client management, document management, workflow, and time and billing...

SPONSOR CONTENT FROM CANOPY

This move toward greater sustainability reporting and assurance is one that KPMG has already been working on for years, but it’s taken on greater urgency as climate change risks appear to have grown with rising temperatures seen in the U.S. and across the globe.

The offices of KPMG in ChicagoTANNEN MAURY`/BLOOMBERG NEWS

“At the highest level for us, the backdrop for the rise of ESG is it’s all about trust,” said KPMG Impact leader Rob Fisher. “You see people looking to business as an ethical and effective leader to bring ESG aspirations to life, and the recent decline in trust that we see across institutions like government and media and so on affects our ability to come together and solve problems. That’s why a focus on organizations doing well across environmental, social and governance dimensions can really build trust with customers, employees, investors, regulators and really all stakeholders. We think ESG engagement will make businesses better by unlocking new value, building resilience and driving profitable and measurable growth both today and tomorrow.”

He has been working with clients on taking individual approaches to ESG reporting. “As I think about specific client conversations that I’m having, it’s that every business across all industries is on a unique ESG journey that reflects its stakeholders, challenges and opportunities,” said Fisher. “Effective engagement really has to be embedded throughout a company’s entire strategy and operations. Many of the clients we are working with are actually the leaders in their industries in areas like climate, the environment, social justice and so on, but they’re still looking for our help in how they bring it all together and figuring out the opportunities to improve.”

ESG encompasses not only the environment, but also social initiatives like diversity, equity and inclusion, and the firm is helping clients with those efforts as well. That includes providing assurance services.

“There are four big buckets of work that we’re doing for clients,” said Fisher. “One, we’re helping clients develop a broader ESG strategy, and then the second part is how do you operationalize that strategy. We’re seeing a lot of interesting opportunities around transformational opportunities and the ability to create some value, and we’re really seeing financial institutions and private equity leaning in because of that. There’s a ton of investor demand in that regard. The fourth bucket is around helping companies figure out how to measure it, report it, and assure it. Certainly there are a number of different standards and different frameworks and metrics for reporting ESG data, and we’re really working with clients to help them understand, based on perhaps the specific interests of particular investors or the industry that they’re in, what frameworks are going to make the most sense to help them develop capabilities to measure their return on their ESG [efforts]. You want it to be accurate and fit for purpose disclosure type of reporting.”

Last month, KPMG submitted a comment letter to the SEC in response to the SEC’s request for public input on climate change disclosures. “Ours is really about a building block approach at a high level,” said Fisher. “We support a global baseline. Then there would be supplemental standards to serve specific jurisdictional needs. I think the importance of some sort of consistency at the global level is that, if we don’t have that, disclosures will be less consistent and comparable. Registrants are operating across multiple jurisdictions and their supply chains and their customer base are certainly going to be global. We really think it has to start with a baseline and then additional disclosures that would be necessary in the context of the U.S.”

Becker Professional Education has been seeing growing demand for its Continuing Professional Education courses on ESG, with Tim Gearty, national director and editor-in-chief at Becker, conducting 40 to 50 sessions per month on ESG for companies across industries.

“Europe seems to be taking the lead on this,” said Gearty. “We in the United States are catching up quickly, but the European Union clearly took the lead on this, and they’re pushing ahead. We’re still in a catchup mode, but we have a lot of great thought leaders that are working very diligently to make sure that our standards are ultimately measurable and that assurance can be given to them. One of the critical items is we have to be able to measure those standards both qualitatively and quantitatively before assurance can be given.”

Groups like the American Institute of CPAs, the Institute of Management Accountants, the International Federation of Accountants, and the Association of Chartered Certified Accountants have been encouraging members to get involved in ESG reporting. The ACCA published a new report Wednesday, “Rethinking Risk for the Future,” examining the role of the accounting profession in effective risk management amid the crises presented by climate change, the COVID-19 pandemic, and the resulting economic turbulence. The report discusses how accountants can help organizations not only detect and better understand the emerging risks and opportunities facing them, but also cultivate the mindsets needed to think in more of a long-term perspective.

The IFRS Foundation is aiming to establish the proposed International Sustainability Standards Board by November in time for the United Nations COP26 Climate Change Conference in Scotland, after recently receiving endorsements from the G-7 finance ministers and the International Organization of Securities Commissions. “There is a timeline we are working toward,” said IFRS Foundation vice-chair Larry Leva during Wednesday’s webinar. “There are now less than four months until the COP26 conference in November. ... We still have a tremendous amount of work ahead of us, but we remain on track to make a final decision in advance of the COP26 meeting in Glasgow. We have received a great deal of support and goodwill for this work, and there is a real determination to make this happen.”

“This is an area that our profession is best positioned to be working, whether it’s internally reporting on it or working externally to give assurance on it,” said Gearty. “We’re understanding the demand because the demand for ESG is coming from the SEC, national business councils, the World Economic Forum, the AICPA, the Global Reporting Initiative, the European Union, and of course asset managers for these funds. They’re all demanding standards, so whether it’s a sustainability fund or just a report that’s being issued by a company, they can be ultimately verifiable so the individuals in the public can rest assured that the information is accurate and not manipulated.”

ندوة: التنوع والشمول والانتماء -دعم جدول الأعمال في مكان العمل في مرحلة ما بعد الجائحة

معلومات إضافية

- البلد عالمي

- نوع الفعالية مجانا

- بداية الفعالية الأربعاء, 24 فبراير 2021

- نهاية الفعالية الأربعاء, 24 فبراير 2021

- التخصص محاسبة ومراجعة

- مكان الفعالية اونلاين