عرض العناصر حسب علامة : EY

الثلاثاء, 23 نوفمبر 2021 12:05

إعادة تعيين عضوين من أعضاء لجنة تفسيرات المعايير الدولية لإعداد التقارير المالية

أعاد أمناء مؤسسة المعايير الدولية لإعداد التقارير المالية تعيين عضوين من أعضاء لجنة تفسيرات المعايير الدولية لإعداد التقارير المالية

معلومات إضافية

-

المحتوى بالإنجليزية

16 March 2021

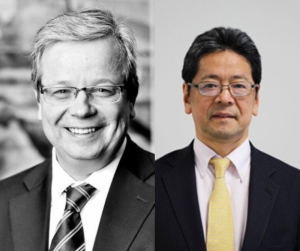

IFRS Foundation Trustees reappoint two IFRS Interpretations Committee members

The Trustees of the IFRS Foundation, responsible for the governance and oversight of the International Accounting Standards Board, have today announced the reappointment of Guy Jones and Goro Kumagai to the IFRS Interpretations Committee.

Their second three-year terms commence on 1 July 2021.

Guy is a partner in the Toronto office of EY’s Professional Practice Group and a member of EY’s Global IFRS Policy Committee.

Goro is the Senior Fellow of the Markets Strategic Intelligence Department at Mizuho Securities, the investment banking arm of Mizuho Financial Group.

The Interpretations Committee works with the Board in supporting the application of IFRS Standards and comprises 14 members drawn from various jurisdictions and professional backgrounds.

The Foundation is currently recruiting new members for the Interpretations Committee. - البلد الأردن

نشر في

محاسبة و مراجعة

موسومة تحت

الأحد, 13 يونيو 2021 16:05

ثلاث خرافات حول الذكاء الاصطناعي

قد تكون المفاهيم الخاطئة الشائعة تمنع الشركات من تحقيق القيمة الكاملة المحتملة لاستثماراتها في الذكاء الاصطناعي

معلومات إضافية

-

المحتوى بالإنجليزية

Three myths about AI

In brief

Myth 1: AI should be implemented away from the business units. In reality, the ultimate value of AI is realized when it is at the heart of the business.

Myth 2: AI and IoT should be considered separately. In reality, companies that are capturing benefits from AI have coupled the capability with IOT to extract greater value.

Myth 3: When it comes to data, quantity over quality is the goal. In reality, well managed and reliable data drives more impactful insights.

As companies emerge from the pandemic and look to reframe their future, artificial intelligence (AI) will be a cornerstone of their technology ecosystem. This is a moment of profound significance, and there is an opportunity not only to rethink how to create value, but the very definition of value — for example, agility versus predictability; innovation versus strategic planning; operating model versus systems thinking.

It’s impossible to overstate the impact of AI and data in this reframing, yet there are some prevailing myths that could impede the adoption of AI. In this article, we explore findings from EY Tech Horizon survey, leadership perspectives on technology and transformation, across 570 global businesses, to identify and address some of these misconceptions.

Myth 1: It’s better to delay investment and keep AI away from core operations and data

Our survey found that 55% of organizations are reluctant to invest in AI in the next two years. Many companies believe they should approach AI with caution, and they pilot AI in a separate business unit away from the core operations and data. Of course, AI does carry some risks to core operations and data – like any new technology, it needs to be secured against potential privacy breaches and cyber threats, and implementations must not compromise resiliency in any way.

But this cautious approach, while understandable, may prevent organizations from gaining any value from AI. At the other end of the spectrum, our survey also shows that transformative leaders are heavily investing in AI: 45% of corporates say AI technologies will account for the largest share of investment in the next two years. And this group is more likely to extract value from the technology – because of their data strategy.

If companies want to solve their complex business problems using AI, it’s imperative that they put data at the heart of their businesses. This will not be easy though. Our data shows that only a few companies have a truly integrated approach to using data across the business. In fact, just 4% of corporate companies say their approach to using data is highly sophisticated because it’s at the very core of their business model. Worryingly, a significant proportion of corporates (15%) do not use data in any way at all.

This is the main challenge that organizations need to overcome. Beatriz Sanz Saiz, EY Global Consulting Data and Analytics Leader, says companies need to go the other way and embed AI and data deep into their core business. “The future is about a platform play, using AI to give meaning to data,” she says. “There’s no need to move data around. AI should be built into core processing.”

So what is causing 55% of organizations to delay their uptake of AI? They report that the biggest barriers to embracing such innovations are lack of transformation culture (32%), legacy technology (32%), lack of collaboration across departments (30%) and lack of skills internally to compete in the digital economy (27%). Skills are particularly a problem in the health sector, as 78% of companies focused on AI in the health sector agree that skills shortage is a major issue.

As companies address and adapt their tech frameworks and modernize their legacy technology infrastructure, they should consider the long-term benefits of enabling and accelerating AI strategy, whether that’s to deliver radical customer centricity, agility, insights and prediction, efficiency or growth. And where skills are concerned, laggards should take their lead from organizations who are extracting value and investing heavily in AI – they are also introducing new incentives to encourage workforce to upskill (58%) as well as enforcing mandatory training programs (57%).

The future is about a platform play, using AI to give meaning to data. There’s no need to move data around. AI should be built into core processing.

Beatriz Sanz Sáiz

EY Global Consulting Data and Analytics Leader

How EY can help

Artificial intelligence consulting services

Our Consulting approach to the adoption of AI and intelligent automation is human-centered, pragmatic, outcomes-focused and ethical.

Read more

Recommendations

Develop an enterprise data to leverage AI in core business operations

Build the AI strategy into the modernization of legacy applications and infrastructure to start realizing long-term benefits sooner

Offer incentives to future proof the workforce and deploy robust training programs in AI competencies to build skills in-house

Myth 2: AI and Internet of Things (IoT) do not overlap

AI and IoT technologies are evolving rapidly, and our survey found that the two are correlated: 54% of AI-focused companies also invested in IoT in the last two years, compared to 50% of overall corporates. Although only a small uplift, it still shows that those with an AI focus are also clued-up on IoT.

The investments AI-focused companies are making in IoT are paying off – 48% of AI-focused companies said IoT is having a very positive impact on their ability to innovate, compared to just 41% of corporates overall.

“Today’s technology is about measuring things,” says Dr. Aleksander Poniewierski, EY Global Digital and Emerging Technology Leader. “The way you measure processes or people’s behavior or an asset’s condition – that’s IoT. Then when you send this data to the cloud you need to have algorithms and methods to process this information – that’s AI.”

A connected vehicle is a good example of IoT and AI working together: IoT collects data such as speed, location and proximity to objects, and AI interprets this data to make recommendations such as slow down, turn left or stop.

Starbucks is also combining the technologies to great effect. The coffee giant has invested in connected espresso machines that can alert the company to when they need tuning or maintaining, reducing downtime and improving the customer experience.1

The companies that are the most advanced when it comes to AI are also developing expertise around IoT in tandem – an important strategic move. Organizations who want to drive a comprehensive transformation should embrace these crossovers and explore opportunities to integrate multiple capabilities. In doing so, they can develop new business solutions that deliver a holistic response to customer needs.

Recommendations

Explore AI and IoT integration opportunities across business processes to yield wider benefits simultaneously

Build PoCs and MVPs to test the solution with a “fail fast” mentality to explore more avenues for value creation

Myth 3: All data is good data

Data can come from a huge range of sources – business applications, website analytics, industrial equipment, wearables, social media – the list is endless. But quantity does not equal quality.

“To build a trusted AI system, companies need to have trusted data – data that is from a reliable source, is compliant, is accurate, is clean, is relevant and is transformed for intended purpose,” says Beatriz Sanz Saiz.

Poor data can stem from poor data-collection practices, which have to be stopped. “Traditional companies capture data from multiple applications such as CRM and ERP, from call centers and so on,” says Sanz Saiz. “People collecting this data don’t necessarily care about data quality. What companies need is to have a strong data governance structure in place to control and monitor the data they use to train AI models.”

Unfortunately, most companies still lack a strong data governance model. Our research shows that only 8% of corporate companies have a governance function for emerging technology that is well established and active. But AI-focused corporates are taking the lead in this regard, with 11% of them saying their governance function is well established. “AI could be part of the solution to fix data quality. For example, using algorithms to extract information from handwritten forms, fix data entry errors and match information across systems”, says Gavin Seewooruttun, EY Asia-Pacific Artificial Intelligence and Analytics Consulting Leader. Although only a small uplift, data governance is one of the most difficult and time-consuming elements of establishing a robust AI strategy, so even small gains can be significant.

Recommendations

Implement a strong and robust data governance structure to ensure trusted data informs business decisions

Define a clear strategy to capture, cleanse, stage and consume data so that it is secure and provides AI applications with the best quality sources

Introduce validation checks to ensure AI applications leverage only trusted data

Don’t let myths get between AI and your success

AI's potential to benefit companies, customers and society is enormous. But with hype comes confusion, and businesses must work hard to question misconceptions and look at AI with clarity –and define how AI investment can best deliver long-term value.

They can start by investing in robust, well-governed AI solutions that are deeply integrated not only into the core of their business operations, but also with other emerging technologies.

Greater adoption in turn leads to new mindsets that benefit the core business: for example, a well-established governance function for emerging technologies could help mitigate some of the perceived risks of AI and encourage a transformation culture.

And there are already success stories: 85% of the surveyed leaders who have seen financial gains are leveraging data and analytics insights to increase speed to innovate. To start realizing the benefits of AI, the best approach is “future-back”: organizations should ask themselves whether their business will still be relevant in two, five or ten years’ time. Then by working through future-back scenarios that incorporate AI into the strategy, organizations can flex and adapt to ensure they’re following a path to maintain relevance today — and 15 years from now.

By adopting redefined value levers –putting humans@center, enabling technology@speed and driving innovation@scale – and using their purpose to guide them, organizations can build adaptability into their businesses and enable bigger, better transformations, with AI prioritized as a long-term driver of value.

About the research

The analysis in this report draws on an extensive program of quantitative and qualitative research.

A survey of 570 C-suite and senior business leaders was conducted across 12 countries (US, Canada, Brazil, UK, Germany, France, Italy, Spain, Australia, Japan, China and India) and nine sectors (consumer products and retail; energy; health and life sciences; tech, media and telco; industrial; financial services; education; transportation and logistics; and hospitality). The 570 companies were split into two categories: 500 corporates and 70 start-ups. The data in this report refers to the 500 corporates only, unless otherwise stated. In addition, a number of in-depth interviews were conducted with leading digital transformation leaders.

نشر في

تكنولوجيا المعلومات

موسومة تحت

الثلاثاء, 02 مارس 2021 14:07

هل يمكن أن تكون حالة عدم اليقين اليوم هي أفضل فرصة لك للاستعداد؟

معلومات إضافية

-

المحتوى بالإنجليزية

Could today’s uncertainty be your best opportunity to prepare

At the start of 2020, the IPO market in MENA had looked promising, but the COVID-19 pandemic resulted in fewer listings muting the rest of the year. According to the MENA IPO Eye Q4 2020 report, total proceeds of the nine IPOs amounted to US$1.86b, which was still down by 94% compared to 2019 , primarily due to the listing of Saudi Aramco during 2019.

Naturally, during 2020, many IPOs were placed on hold, though activity picked up toward the end of the year. In fact, in Q4 2020, four MENA IPOs accounted for the strongest quarter of 2020, raising US$925m in total. During that time, three MENA markets, Dubai, Qatar and Morocco saw IPOs in markets that have been otherwise quiet in previous years.

The resulting impact of reduced oil demand and declining prices, due to the COVID-19 pandemic, had a considerable effect on both the drop in economic growth in the region and the MENA stock performance. Though valuations and equity markets in MENA experienced increased volatility and significantly higher daily trading values, the Tadawul recovered from its drop of nearly 30% to finish the year with a positive return of 3.60%.

Saudi Arabia remains a resilient active IPO market. With high valuations and government incentives, the region expects an additional ten listings to hit in 2021. In 2020, Tadawul introduced new initiatives as well as direct listings on Nomu, and the launch of their derivatives market supported by Muqassa, Tadawul’s clearing house. In Q4 2020, disclosures became mandatory in both Arabic and English and daily price fluctuation limits increased. All four IPOs on Tadawul reached their price fluctuation limit on the first day of listing (20% for Nomu and 10% on the main market). Nomu (the parallel market) price fluctuation limits were permanently increased from 20% to 30%. The region’s largest exchange is preparing for its own IPO, with the listing expected in 2022, which will make it the third publicly listed stock exchange in the region.

Despite the COVID-19 pandemic, 2020 was a big year for the UAE with new initiatives and its first IPO in years (Al Mal Capital REIT). The region’s new regulations offer added flexibility with the objective of increasing the number of listings. These developments include: changes to nationality requirements, flexibility in foreign ownership, and more. The ADX Second Market in Abu Dhabi saw four listings in 2020, while its shareholder ADQ launched Q Market Makers (QMM) which expects to enhance market liquidity on ADX. DFM also launched their equity derivatives platform and saw their first REIT IPO, bringing the total REIT listings to three in the UAE. Nasdaq Dubai also announced its expected 2021 launch of Growth Market for SMEs, supporting the frameworks developed by Dubai Financial Services Authority (DFSA). Key amendments were also made to the UAE Companies Law including:

IPO, mergers and acquisitions: public offerings from founders of private joint-stock companies (PJSCs) have increased from a cap of 30% to 70%, and will only be subject to a six-month lockup from the date of conversion to a PJSC.

Flexible foreign ownership: LLCs can now be 100% foreign owned as opposed to the previous 51% UAE-owned, unless carrying on “Activities of Strategic Effect”.

PJSC board members nationality requirements: The chairman and majority of directors are no longer required to be UAE nationals, unless related to Activities of Strategic Effect, which will then be determined by the cabinet.

In Qatar, news of a market introduction of the book-building process followed a meeting between Qatar Stock Exchange (QSE) and the Qatar Financial Market Authority (QFMA). The IPO of QLife and Medical (QLM) Insurance Company was the first for QSE since Baladna in 2019 and the third largest IPO in MENA in 2020, raising over US$179m. In Q4 2020, Qatar Investment Authority (QIA) acquired 10% of Borsa Istanbul A.S, the main stock exchange in Turkey, for US$200m.

After its IPO in Q4 2019, Boursa Kuwait officially became a listed company during Q3 2020 and saw its shares surge more than ten-fold on the first public trading day. Prior to the listing, the shares were being traded in the local OTC market. Shamal Az-Zour Al-Oula Power and Water Company also completed its listing in Q3 2020 after raising capital in 2019 and became the first publicly traded PPP company in Kuwait. In an otherwise quiet year, Kuwait also entered the MSCI Emerging Markets index in Q4 2020, which now includes seven companies, including the National Bank of Kuwait (NBK), Zain and Agility, among others.

In Oman, the pandemic resulted in reduced spending and new noteworthy tax implementations. As of April 2021, a VAT of 5% will be due, and income tax on high earners is expected in 2022. In 2020, the first IPO in MENA came from Aman REIF in Oman raising US$52.5m, the next expected IPO is Oman REIF scheduled for early 2021. The highly anticipated listing of government owned OQ (Oman Oil and Orpic Group) was scheduled to IPO in 2020 but never actualized, though in Q4 2020, they reported plans to invest in alternative energy projects.

In 2020, Bahrain Bourse announced its enhanced delivery-versus payment (DVP) model to activate the custody model in the market. In Q4 2020, it was also elected to become a member of the board of directors at the Arab Federation Exchange (AFE). 2020 was a year of expansion and sustainability focus. According to the Bahrain Economic Development Board, the country attracted US$885m in direct investments. This while, environmental social and governance (ESG) voluntary guidelines were introduced to promote sustainability and transparency in the market.

Though 14 companies were expected to IPO in Egypt in 2020, only Emerald Real Estate Investments managed to list, raising US$13m in Q1 2020. Privatization plans for state-owned companies were suspended mid-year, though Egypt announced plans to privatize three army-affiliated companies by early 2021. Parliament also approved a reduction of stamp duty on the sale of securities, and the Financial Regulatory Authority (AFRA) announced new Egyptian Accounting standards set to implement in 2021.

نشر في

موضوعات متنوعة

موسومة تحت

الأربعاء, 17 فبراير 2021 14:37

ارنست اند يونج EY ضمن أفضل 10 علامات تجارية عالمية لأول مرة في تصنيف brand finance

نشر في

موضوعات متنوعة

موسومة تحت

الأربعاء, 21 سبتمبر 2022 12:50

استقالة رئيس شركة كي بي ام جي في المملكة المتحدة بعد أيام من انتقاده للموظفين

استقال رئيس شركة KPMG في المملكة المتحدة بعد أيام من إثارة غضب واسع النطاق لإخباره الموظفين بالتوقف عن الشكوى من الوباء

معلومات إضافية

-

المحتوى بالإنجليزية

KPMG U.K. chair resigns days after slamming ‘victim card’ staff

By Michael Kapoor

February 12, 2021, 1:38 p.m. EST

KPMG’s U.K. chairman has resigned days after sparking widespread anger for telling employees to stop moaning about the pandemic.

Bill Michael, KPMG’s U.K. chair and senior partner since 2017, will leave the firm at the end of the month, admitting that his position had become “untenable.”

He had been placed under investigation after telling KPMG’s financial services consulting team to “stop moaning” and “playing the victim card” when employees voiced concern over possible cuts to their pay and pensions at a virtual meeting Monday.

Sean Gallup/Getty Images

“I love the firm and I am truly sorry that my words have caused hurt amongst my colleagues and for the impact the events of this week have had on them,” Michael said in an emailed statement Friday. “In light of that, I regard my position as untenable and so I have decided to leave the firm.”

Michael stepped aside from his position as chair on Wednesday for the duration of the investigation and apologized for his comments.

“It’s further evidence of a bullying culture and Bill Michael won’t be the only example of that,” said Prem Sikka, an accounting professor at Sheffield University. “They need to mend the culture and concentrate on improving audit quality rather than bullying staff.”

The pandemic has taken a toll on all professional services firms. KPMG said earlier this month that its partner profits would fall by 11 percent and it said in July, that it would cut as many as 200 jobs from its U.K. workforce.

Senior elected board member Bina Mehta has been named acting U.K. chair, with KPMG saying it would “undertake a leadership election in due course.” Mary O’Connor, KPMG’s head of clients and markets, will take over Michael’s role as senior partner.

“Bill has made a huge contribution to our firm over the last 30 years, especially over the last three years as chairman, and we wish him all the best for the future,” Mehta said.

The move comes as the so-called Big Four accounting firms have faced increasing criticism in Europe. Auditors are under greater scrutiny than ever after a series of high-profile lapses in recent years, with EY’s role in the collapse of German payments provider Wirecard AG now under the microscope.

In the U.K., KPMG has faced fierce criticism over its auditing of Carillion Plc, whose collapse prompted the government to launch a series of inquiries into auditing standards.

نشر في

موضوعات متنوعة

الإثنين, 15 فبراير 2021 16:13

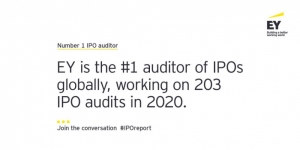

ارنست اند يونج أفضل مدقق حسابات اكتتاب عام عالميًا في عام 2020

معلومات إضافية

-

المحتوى بالإنجليزية

Supporting companies to go public and evaluate strategic transactions.

Initial public offerings (IPOs) can help companies raise the capital they need to unlock their growth ambitions, become market leaders and provide shareholders with greater liquidity alternatives. IPO-bound companies typically run multitrack strategies, assessing mergers and acquisitions alongside an IPO, and evaluating listing options around the world to raise capital and deliver an optimal valuation to shareholders.

Whichever route you take, early and holistic preparation is key, and our insights as a leader in IPO advisory can help show the way. Leveraging world-class frameworks like the EY 7 Drivers of Growth, EY can advise you on how to prepare for, and execute, a successful transaction, as well as sustain growth post transaction. The hard work of being a public company continues after the IPO.

نشر في

موضوعات متنوعة

الثلاثاء, 19 يناير 2021 13:08

كيفية ظهور محاسبو جمعية المحاسبين القانونيين المعتمدين (ACCA) كقادة أعمال مؤثرين؟

في كثير من الأحيان يمكنك أن تُحبس في بيئتك الخاصة. جمعية المحاسبين القانونيين المعتمدين (ACCA) تفتح عينيك على العالم

معلومات إضافية

-

المحتوى بالإنجليزية

From Russia with Losevskaya

Language no barrier as Oxana brings her global view to Council

"Too often you can get locked up in your own environment. ACCA opens your eyes to the world"

Oxana Losevskya, Council member

There can be few economies in the world which have experienced as much change as Russia’s over the last generation.

When the command economy of the Soviet era collapsed the country was plunged into a market system. Millions were forced to find their feet quickly, and to make a living in a new way.

Entire professions were affected too – among them accountancy. Finance professionals had to grapple with an entirely new landscape, and were faced with the daunting task of guiding businesses into the strange world of capitalism.

It is a process which still goes on – but Russian accountants are increasingly emerging as leaders, creators and important partners for businesses in Russia.

‘It has changed,’ said Oxana Losevskaya, who comes to her work in Moscow with a global perspective. She was born and educated in Russia, but has also worked and studied in other countries, including Australia. She graduated in accountancy at the University of Sydney before returning to Russia where she followed her ACCA Qualification while working for EY, taking classes on Saturdays and Sundays

‘When I first began working in Russia, accountants were not considered to be the most important people in a business,’ she said.

Distinct path

‘Accountants were not so well established at the top of organisations. They lived in the shadow of the powerful CEOs, and their work was not seen to be as important as sales, or marketing. Finance was left behind. We were just the numbers people.’

Not any more.

‘We are far more likely to be seen as an important business partner now, with wide skills that go beyond making the sums add up,’ she said.

That is true of Oxana’s own work, as the partner of SL Partners in Moscow, a business strategy consultancy which advises companies on management and planning, financial modelling and valuation, performance analytics, digital transformation, due diligence, fundraising and mergers and acquisitions.

Oxana also says that ACCA is playing an important role in building the profession in the Russian-speaking world, by offering a distinct path into business for the leaders and entrepreneurs of the future. Crucially, it offers a Russian language option for students, which makes it stand out for ambitious young professionals in the region.

‘The prospects for growth for ACCA are enormous,’ said Oxana.

"I want to play my part in bringing ACCA to many more people all around the world. I want to be useful"

‘You have to remember that the Russian language is used in all of the countries of the old Soviet Union, 15 countries. There are already about 3m accountants in Russia alone, and I am certain that the profession will grow even more in popularity.’

Oxana is proud that ACCA is reaching out to people who want to build a career with fellow professionals who are equally committed to working ethically and in the interests of society. She has been advocating for ACCA since the day she qualified.

‘It has become so important in my career and in my life,’ she said.

‘Too often you can get locked up in your own environment. ACCA opens your eyes to the world.

‘I love the atmosphere when I go to an ACCA event. It is so friendly it is like a family. That is the feeling I am certain I will have on Council, and I want to play my part in bringing ACCA to many more people all around the world. I want to be useful’.

نشر في

موضوعات متنوعة

موسومة تحت

الثلاثاء, 15 ديسمبر 2020 12:43

خطر تعطل المواهب يلوح في الأفق في عام 2021

نظرًا لأن المدققين الداخليين يضعون اللمسات الأخيرة على تقييماتهم للمخاطر قبل إعداد خطط تدقيقهم لعام 2021، فهناك خطر واحد لا ينبغي إغفاله

نشر في

موضوعات متنوعة

الأربعاء, 21 سبتمبر 2022 11:06

استجواب كبير مسؤولي الحسابات في دويتشه بنك

نشر في

موضوعات متنوعة

موسومة تحت

الإثنين, 16 نوفمبر 2020 13:30

تسع عشرة رؤية أساسية لتحسين المرونة في الموجة الثانية

نشر في

موضوعات متنوعة