عرض العناصر حسب علامة : IFRS

مؤسسة المعايير الدولية لإعداد التقارير المالية تقدم تحديثًا جوهريًا لموقعها على الويب

معلومات إضافية

-

المحتوى بالإنجليزية

Welcome to the IFRS Foundation’s updated website!

The site may look familiar, but we have done a lot of work behind the scenes to give you an enhanced digital experience. The updated website brings together content from three sites—ifrs.org, archive.ifrs.org and eifrs.org—into a single website.

An improved search function and advanced options for customising how you search and receive information, including a new IFRS Standards Navigator, will enhance your experience with IFRS Standards and related information. We have also refreshed our ‘Follows’ tool, which enables you to decide what type of alerts we will deliver to your inbox and how often.

If you are a registered user or subscriber, you will need to update your details when you sign in for the first time.

ملخص اجتماع الأمناء في 26 يوليو متاح الآن

اجتمع أمناء مؤسسة المعايير الدولية لإعداد التقارير المالية عن طريق مؤتمر الفيديو في 26 يوليو 2021 لمراجعة التقدم المحرز نحو الإنشاء المقترح لمجلس معايير الاستدامة الدولية (ISSB) ضمن هيكل حوكمة مؤسسة المعايير الدولية لإعداد التقارير المالية.

معلومات إضافية

-

المحتوى بالإنجليزية

Trustees publish summary of 26 July 2021 meeting

The Trustees of the IFRS Foundation met by video conference on 26 July 2021 to review progress towards the proposed establishment of an International Sustainability Standards Board (ISSB) within the governance structure of the IFRS Foundation. A summary of the meeting conclusions is available here.

In particular, Trustees discussed arrangements for seed capital for the new board, consistent with their request following their 16 June 2021 meeting.

استجابة مؤسسة المعايير الدولية لإعداد التقارير المالية (IFRS) لبيان وزراء مالية مجموعة العشرين

نشر وزراء مالية ومحافظو البنوك المركزية لمجموعة العشرين بيانًا رسميًا عقب اجتماعهم في البندقية، إيطاليا، في 10 يوليو 2021، مشيرًا إلى مؤسسة المعايير الدولية لإعداد التقارير المالية.

معلومات إضافية

-

المحتوى بالإنجليزية

The G20 Finance Ministers and Central Bank Governors published a Communique following their meeting in Venice, Italy, on 10 July 2021, referencing the IFRS Foundation.

The Communique states:

“We will work to promote implementation of disclosure requirements or guidance, building on the FSB’s Task Force on Climate-related Financial Disclosures (TCFD) framework, in line with domestic regulatory frameworks, to pave the way for future global coordination efforts, taking into account jurisdictions’ circumstances, aimed at developing a baseline global reporting standard. To that aim, we welcome the work programme of the International Financial Reporting Standards Foundation to develop a baseline global reporting standard under robust governance and public oversight, building upon the TCFD framework and the work of sustainability standard-setters, involving them and consulting with a wide range of stakeholders to foster global best practices.”

Commenting on the Communique, Erkki Liikanen, Chair of the Trustees, said:

We welcome the G20 Finance Ministers and Central Bank Governors’ recognition of the IFRS Foundation’s work to establish a new board focused on sustainability-related disclosure standards that meet the information needs of global capital markets. The necessary preparatory work is progressing with other investor-focused standard-setting organisations. This will provide the basis for development of a global baseline of investor-focused disclosure standards that jurisdictions can combine with their public policy requirements and use in their legal frameworks.

The Trustees are currently consulting on proposed changes to the Foundation’s Constitution to accommodate the creation of a new board within the Foundation’s governance structure. The consultation is open for comment until 29 July 2021.

تحديث المعايير الدولية لإعداد التقارير المالية لشهر يونيو 2021 للمنشآت الصغيرة والمتوسطة

تحديث المعايير الدولية لإعداد التقارير المالية للمنشآت الصغيرة والمتوسطة هو ملخص فريق العمل للأخبار والأحداث والمعلومات الأخرى حول معايير IFRS للشركات الصغيرة والمتوسطة وأنشطة الشركات الصغيرة والمتوسطة ذات الصلة.

معلومات إضافية

-

المحتوى بالإنجليزية

Note from Jenny Carter, SMEIG Member

Jenny Carter is Director, Accounting and Reporting Policy at the UK Financial Reporting Council (FRC).

The FRC sets the national accounting standards for entities that do not apply UK-adopted International Accounting Standards. Our main Standard is FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland, which is based on the IFRS for SMEs Standard with some significant modifications. Part of my role in leading the FRC’s work on standards and related guidance in respect of corporate reporting is to ensure UK accounting standards are kept up to date. This is something I have worked on for a number of years, in different roles, and I was delighted to be appointed to the SMEIG to share my experience with the Board.

Although entities within the scope of the IFRS for SMEs Standard value stability in the Standard, it is necessary to carry out periodic reviews to ensure that the Standard remains up-to-date and addresses relevant new financial reporting issues and ideas. In February 2021 the SMEIG held a two-day virtual meeting to discuss the feedback on the Request for Information Second Comprehensive Review of the IFRS for SMEs Standard published in January 2020 and develop recommendations to enable the Board to decide on the project’s direction. The SMEIG is made up of nearly 30 members from around the world with a range of interests in reporting by entities within the scope of the IFRS for SMEs Standard. The meeting was great opportunity to share views and perspectives and hear about financial reporting issues in other jurisdictions.

One of the first things to discuss was the approach to alignment with IFRS Standards, as this is key in considering whether individual IFRS standards within the scope of the second comprehensive review should be reflected in the IFRS for SMEs Standard. Most SMEIG members agreed with the staff’s preliminary thoughts that the feedback provides evidence for the Board:

to continue to base the IFRS for SMEs Standard on full IFRS Standards;

to consider the costs and benefits of aligning the IFRS for SMEs Standard with a new IFRS Standard, amendment to an IFRS Standard and IFRIC Interpretation (new requirement);

to develop any proposed amendments to the IFRS for SMEs Standard to reflect principles and important definitions in a new requirement; and

to determine whether and how the IFRS for SMEs Standard should be aligned with full IFRS Standards using the principles of relevance to SMEs, simplicity and faithful representation and including cost–benefit considerations when applying those principles.

Having discussed the alignment approach and principles, a significant amount of time was then allocated to discussing many of the more significant changes to IFRS Standards that have been made in recent years, such as financial instruments, revenue and leasing, and after applying the principles, the extent to which they might be incorporated into the IFRS for SMEs Standard.

In March 2021, the recommendations of the SMEIG were discussed by the Board, which tentatively decided to move the project onto the standard-setting work plan and work towards publishing an Exposure Draft. I am looking forward to being able to discuss the project further at future meetings, as the project progresses.

Update on the second comprehensive review of the IFRS for SMEs Standard

At its May 2021 meeting, the Board discussed whether and how to propose amendments to Section 2 Concepts and Pervasive Principles and Section 11 Basic Financial Instruments of the IFRS for SMEs Standard.

Aligning Section 2 with the Conceptual Framework for Financial Reporting (2018 Conceptual Framework)

The Board tentatively decided to propose:

retaining Section 2 as part of the IFRS for SMEs Standard;

aligning Section 2 with the 2018 Conceptual Framework and emphasising that the requirements in the other sections of the IFRS for SMEs Standard take precedence over what Section 2 would otherwise require;

undertaking a review for potential inconsistencies between a revised Section 2 and other sections of the IFRS for SMEs Standard when the Board has completed its deliberations on proposed amendments to the IFRS for SMEs Standard; and

retaining the concept of ‘undue cost or effort’.

Aligning Section 11 with IFRS 9 Financial Instruments (classification and measurement of financial assets)

The Board tentatively decided to propose an amendment to the IFRS for SMEs Standard, subject to the wording of the amendment, to supplement the examples in Section 11 with a principle for classifying financial assets based on their contractual cash flow characteristics. The principle would not change the existing examples in Section 11 and would only apply when an SME holds a financial asset that is not included in the examples listed in Section 11.

Next steps

In the coming months, the Board will continue to discuss the specific sections of the IFRS for SMEs Standard that could be amended to reflect new requirements in full IFRS Standards that are not currently incorporated in the IFRS for SMEs Standard. Any amendments that the Board decides to propose will be included in an exposure draft which will be open for comment.

Update on the advice from the EEG

The staff provided a project update on the second comprehensive review of the IFRS for SMEs Standard at the May 2021 EEG meeting. The staff also asked for EEG members’ views on the four selected topics for which the IFRS for SMEs Standard could be aligned with full IFRS Standards, as discussed in the Request for Information.

The first topic sought views on not introducing the requirement in IFRS 10 Consolidated Financial Statements that investment entities measure investments in subsidiaries at fair value through profit or loss. EEG members expressed mixed views on this topic depending on their knowledge of the type of investments held by SMEs.

The second topic on which views were sought concerned the potential alignment of the IFRS for SMEs Standard with the simplified approach for the impairment of financial assets set out in IFRS 9. The EEG members who commented on this topic do not support such alignment. They said the simplified approach in IFRS 9 could be too complex and costly for SMEs.

The third topic was whether to retain the existing hedge accounting requirements in Section 12 Other Financial Instrument Issues or to align with IFRS 9. One EEG member expressed the view that Section 12 should not include hedge accounting requirements.

The final topic on which the views of the EEG members were sought was aligning the IFRS for SMEs Standard for issued financial guarantee contracts with IFRS 9. One EEG member disagreed with such an alignment; the member said that the requirements in Section 21 Provisions and Contingencies of the IFRS for SMEs Standard can be applied to such contracts.

Overview of feedback from recent outreach meetings with SME preparers

In March and April 2021, the staff conducted 18 virtual meetings with preparers who apply the IFRS for SMEs Standard (or a standard based on the IFRS for SMEs Standard). The preparers—drawn from eight jurisdictions—shared their views on the Board’s approach to developing the IFRS for SMEs Standard.

The purpose of the outreach meetings with SME preparers was to obtain additional feedback about:

their experience of applying the IFRS for SMEs Standard based on IFRS Standards; and

the information they are regularly asked to provide to lenders and other users of their financial statements to better understand users’ information needs.

The overriding messages from SME preparers are:

the IFRS for SMEs Standard should be kept simple;

preparers appreciate the substantially fewer disclosures that the IFRS for SMEs Standard requires compared to full IFRS Standards to reflect users’ information needs and cost-benefit considerations; and

preparers appreciate a stable platform for maintaining alignment with IFRS Standards as the IFRS for SMEs Standard is periodically amended compared to more frequent changes in IFRS Standards.

A summary of the feedback from the SME preparer can be accessed here.

Details of online resources for SMEs

The Board and the SMEIG provide educational materials to support the adoption and implementation of the IFRS for SMEs Standard. These materials are available on the Project page and include:

webcasts, podcasts and webinars; and

articles and other publications.

The IFRS Foundation has also made available a package of 35 supporting modules to help who wish to learn more about the IFRS for SMEs Standard, particularly those who apply the Standard and users of financial statements that are prepared in accordance with the Standard.

تحديث لجنة التفسيرات يونيو 2021 متاح الآن

تحديث IFRIC هو ملخص للقرارات التي توصلت إليها لجنة تفسيرات المعايير الدولية لإعداد التقارير المالية في اجتماعاتها العامة.

معلومات إضافية

-

المحتوى بالإنجليزية

Committee's tentative agenda decisions

The Committee discussed the following matters and tentatively decided not to add standard-setting projects to the work plan. The Committee will reconsider these tentative decisions, including the reasons for not adding standard-setting projects, at a future meeting. The Committee invites comments on the tentative agenda decisions. Interested parties may submit comments on the open for comment page. All comments will be on the public record and posted on our website unless a respondent requests confidentiality and we grant that request. We do not normally grant such requests unless they are supported by a good reason, for example, commercial confidence. The Committee will consider all comments received in writing up to and including the closing date; comments received after that date will not be analysed in agenda papers considered by the Committee.

TLTRO III Transactions (IFRS 9 Financial Instruments and IAS 20 Accounting for Government Grants and Disclosure of Government Assistance)—Agenda Paper 4

The Committee received a request about how to account for the third programme of the targeted longer-term refinancing operations (TLTROs) of the European Central Bank (ECB). The TLTROs link the amount a participating bank can borrow and the interest rate the bank pays on each tranche of the operation to the volume and amount of loans it makes to non-financial corporations and households.

The request asks:

whether the TLTRO III tranches represent loans with a below-market interest rate and, if so, whether the borrowing bank is required to apply IFRS 9 or IAS 20 to account for the benefit of the below-market interest rate;

if the bank applies IAS 20 to account for the benefit of the below-market interest rate:

how it assesses in which period(s) it recognises that benefit; and

whether, for the purpose of presentation, the bank adds the amount of the benefit to the carrying amount of the TLTRO III liability;

how the bank calculates the applicable effective interest rate;

whether the bank applies paragraph B5.4.6 of IFRS 9 to account for changes in estimated cash flows resulting from the revised assessment of whether the conditions attached to the liability have been met; and

how the bank accounts for changes in cash flows related to the prior period that result from the bank’s lending behaviour or from changes the ECB makes to the TLTRO III conditions.

Applying the requirements in IFRS Standards

The Committee observed that IFRS 9 is the starting point for the borrowing bank to determine its accounting for TLTRO III transactions because each financial liability arising from the bank’s participation in a TLTRO III tranche is within the scope of IFRS 9. The bank:

determines whether it bifurcates any embedded derivatives from the host contract as required by paragraph 4.3.3 of IFRS 9;

initially recognises and measures the financial liability, which includes determining the fair value of the financial liability, accounting for any difference between the fair value and the transaction price and calculating the effective interest rate; and

subsequently measures the financial liability, which includes accounting for changes in the estimates of expected cash flows.

The Committee noted that the questions the request asks are unrelated to the existence of an embedded derivative and, therefore, this agenda decision does not discuss the requirements in IFRS 9 with respect to the separation of embedded derivatives.

Initial recognition and measurement of the financial liability

Applying paragraph 5.1.1 of IFRS 9, at initial recognition a bank measures each TLTRO III tranche at fair value plus or minus transaction costs, if the financial liability is not measured at fair value through profit or loss. A bank therefore determines the fair value of the liability using the assumptions that market participants would use when pricing the financial liability as required by IFRS 13 Fair Value Measurement. The fair value of a financial instrument at initial recognition is normally the transaction price—that is, the fair value of the consideration given or received (paragraphs B5.1.1 and B5.1.2A of IFRS 9). If the fair value at initial recognition differs from the transaction price, paragraph B5.1.1 requires a bank to determine whether a part of the consideration given or received is for something other than the financial liability.

The Committee observed that determining whether an interest rate is a below-market rate requires judgement based on the specific facts and circumstances of the relevant financial liability. Nonetheless, a difference between the fair value of a financial liability at initial recognition and the transaction price might indicate that the interest rate on the financial liability is a below-market rate.

If a bank determines that the fair value of a TLTRO III tranche at initial recognition differs from the transaction price and that the consideration received is for only the financial liability, the bank applies paragraph B5.1.2A of IFRS 9 to account for that difference.

If a bank determines that the fair value of a TLTRO III tranche at initial recognition differs from the transaction price and that the consideration received is for more than just the financial liability, the bank assesses whether that difference represents a government grant as defined in IAS 20. The Committee noted that if the difference represents a government grant, paragraph 10A of IAS 20 applies only to that difference. The bank applies IFRS 9 to account for the financial liability.

Do TLTRO III tranches contain a government grant in the scope of IAS 20?

IAS 20 defines government as referring to ‘government, government agencies and similar bodies whether local, national or international’. IAS 20 also defines government grants as ‘assistance by government in the form of transfers of resources to an entity in return for past or future compliance with certain conditions relating to the operating activities of the entity. They exclude those forms of government assistance which cannot reasonably have a value placed upon them and transactions with government which cannot be distinguished from the normal trading transactions of the entity’.

Paragraph 10A of IAS 20 requires an entity to treat as a government grant the benefit of a government loan at a below-market rate of interest and apply IAS 20 to account for that benefit. The benefit of a below-market interest rate is the difference between the initial carrying amount of the loan determined by applying IFRS 9 and the proceeds received. Paragraphs 7, 12 and 20 of IAS 20 specify requirements for the recognition of government grants in profit or loss.

The Committee observed that TLTRO III tranches would contain a government grant in the scope of IAS 20 only if it were determined that:

the ECB meets the definition of government in IAS 20;

the interest rate charged on the TLTRO III tranches is a below-market interest rate; and

the TLTRO III transactions with the ECB are distinguishable from the borrowing bank’s normal trading transactions.

The Committee observed that making these determinations require judgement based on the specific facts and circumstances. The Committee therefore said it is not in a position to conclude on whether the TLTRO III tranches contain a government grant in the scope of IAS 20.

The Committee acknowledged that judgement may also be required to identify the related costs for which the grants, if any, are intended to compensate. The Committee nonetheless concluded that if the TLTRO III tranches contain a government grant in the scope of IAS 20, the requirements in IAS 20 provide an adequate basis for the bank to determine how to account for that government grant.

Calculating the effective interest rate on initial recognition of the financial liability

For the purpose of measuring financial liabilities, Appendix A to IFRS 9 defines both the amortised cost of a financial liability and the effective interest rate. Calculating the effective interest rate requires an entity to estimate the expected cash flows through the expected life of the financial liability.

In calculating the effective interest rate for a TLTRO III tranche on initial recognition, the question arises as to what to consider in estimating the expected future cash flows and, specifically, whether the expected future cash flows reflect an assessment of whether the bank will satisfy the conditions attached to the liability. The Committee noted that the question of what to consider in estimating the expected future cash flows for the purpose of calculating the effective interest rate is also relevant to fact patterns other than that described in the request. The Committee therefore concluded that considering how to reflect uncertain conditions in calculating the effective interest rate is a broader matter, which it should not analyse solely in the context of TLTRO III tranches. This is because such an analysis could have unintended consequences for other financial instruments, the measurement of which involves similar questions about the application of IFRS Standards. The Committee is therefore of the view that this matter should be considered as part of the post-implementation review of the classification and measurement requirements in IFRS 9, together with similar matters already identified in the first phase of that review.

Subsequent measurement of the financial liability at amortised cost

The contractual terms of the TLTRO III tranches require interest to be settled in arrears on maturity or on early repayment of each tranche. There is therefore only one cash flow on settlement of the instrument.

The original effective interest rate is calculated based on estimated future cash flows at initial recognition as required by IFRS 9. The Committee noted that whether a bank adjusts the effective interest rate over the life of a tranche depends on the contractual terms of the financial liability and the applicable requirements in IFRS 9. Paragraphs B5.4.5 and B5.4.6 of IFRS 9 specify requirements for how an entity accounts for changes in estimated future cash flows.

Paragraph B5.4.5 applies to floating-rate financial liabilities, the estimated future cash flows of which are revised to reflect movements in the market rates of interest. Periodic re-estimations of those cash flows to reflect such movements alter the effective interest rate. IFRS 9 does not elaborate on what is meant by floating rate. However, the Committee observed that a financial instrument with variable contractual cash flows—which can periodically be adjusted to reflect movements in the market rates of interest—is a floating-rate financial instrument.

The Committee also observed that a floating-rate financial instrument may consist of a variable interest rate element, which is reset to reflect movements in the market rates of interest (for example, the ECB rate on the main refinancing operations) plus or minus other elements, which are fixed and therefore not reset to reflect movements in the market rates of interest (for example, the fixed 50 basis points discount given by the ECB on particular TLTRO III tranches for a fixed period).

When considering how to account for changes in cash flow estimates, the Committee noted that paragraph B5.4.5 of IFRS 9 applies only to the variable interest rate element of a floating-rate instrument (as far as it reflects movements in the market rates of interest) and not to other interest rate elements of the instrument (which are typically not reset to reflect movements in the market rates of interest).

Paragraph B5.4.6 of IFRS 9 applies to changes in estimated future cash flows of financial liabilities other than those dealt with in paragraph B5.4.5, irrespective of whether the change arises from a modification or another change in expectations. However, when changes in contractual cash flows arise from a modification, an entity assesses whether those changes result in the derecognition of the financial liability and the initial recognition of a new financial liability by applying paragraphs 3.3.2 and B3.3.6 of IFRS 9.

The Committee considered a situation in which, as a result of a modification that does not result in derecognition or other changes in expected future cash flows, a bank estimates the final repayment cash flow relating to a TLTRO III tranche to be different from that used in determining the carrying amount. In such a situation, the bank adjusts the carrying amount to reflect the modification or other change in expected future cash flows and recognises the difference immediately in profit or loss. The bank therefore makes no adjustment to interest recognised in prior periods.

The Committee also noted that application of paragraph B5.4.6 of IFRS 9 relates to a bank’s estimates of expected future cash flows in calculating the effective interest rate on initial recognition of the financial liability. This is because, applying B5.4.6, the original effective interest rate is used to discount the revised cash flows.

The Committee observed that the question of whether conditions attached to the interest rate should be reflected in the estimates and revisions of expected future cash flows when determining the effective interest rate is part of a broader matter, which it should not analyse solely in the context of TLTRO III tranches. The Committee is therefore of the view that this matter should be considered as part of the post-implementation review of the classification and measurement requirements in IFRS 9, together with similar matters already identified in the first phase of that review.

Disclosure

If a bank determines that the ECB meets the definition of government in IAS 20 and that it has received government assistance from the ECB, the bank needs to provide the information required by paragraph 39 of IAS 20 with respect to government grants and government assistance that does not meet the definition of a government grant.

In addition, given the judgements required and the risks arising from the TLTRO III tranches, a bank needs to consider the requirements in paragraphs 117,122 and 125 of IAS 1 Presentation of Financial Statements, as well as paragraphs 7, 21 and 31 of IFRS 7 Financial Instruments: Disclosures. Those paragraphs require a bank to disclose information that includes its significant accounting policies and the assumptions and judgements that management has made in the process of applying the bank’s accounting policies and that have the most significant effect on the amounts recognised in the financial statements.

Conclusion

The Committee concluded that if the bank determines that the TLTRO III tranches contain a government grant in the scope of IAS 20, the requirements in IAS 20 provide an adequate basis for an entity to determine how to account for that government grant.

With respect to the question of whether conditions attached to the interest rate should be reflected in the estimates and revisions of expected future cash flows when determining the effective interest rate, the Committee concluded that the matters described in the request are part of a broader matter that, in isolation, are not possible to address in a cost-effective manner and should be reported to the Board. The Board should consider this matter as part of the post-implementation review of the classification and measurement requirements in IFRS 9.

For these reasons, the Committee [decided] not to add a standard-setting project to the work plan.

Economic Benefits from Use of a Windfarm (IFRS 16 Leases)—Agenda Paper 5

The Committee received a request about whether, applying paragraph B9(a) of IFRS 16, an electricity retailer (customer) has the right to obtain substantially all the economic benefits from use of a windfarm throughout the term of an agreement with a windfarm generator (supplier). In the fact pattern described in the request:

the customer and supplier are registered participants in an electricity market, in which customers and suppliers are unable to enter into contracts directly with each other for the purchase and sale of electricity. Instead, customers and suppliers make such purchases and sales via the market’s electricity grid, the spot price for which is set by the market operator.

the customer enters into an agreement with the supplier. The agreement:

swaps the spot price per megawatt of electricity the windfarm supplies to the grid during the 20-year term of the agreement for a fixed price per megawatt, and is settled net in cash. In effect, the supplier receives a fixed price per megawatt for the electricity it supplies to the grid during the period of the agreement and the customer settles with the supplier the difference between that fixed price and the spot prices per megawatt for that volume of electricity.

transfers to the customer all renewable energy credits that accrue from use of the windfarm.

Paragraph 9 of IFRS 16 states that ‘a contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration’. To control the use of an identified asset for a period of time, the customer—throughout the period of use—must have both the right to obtain substantially all the economic benefits from use of the identified asset and the right to direct the use of that asset (paragraph B9 of IFRS 16).

Paragraph B21 of IFRS 16 specifies that ‘a customer can obtain economic benefits from use of an asset directly or indirectly in many ways, such as by using, holding or sub-leasing the asset. The economic benefits from use of an asset include its primary output and by-products (including potential cash flows derived from these items), and other economic benefits from using the asset that could be realised from a commercial transaction with a third party’.

The Committee observed that, in the fact pattern described in the request, the economic benefits from use of the windfarm include the electricity it produces (as its primary output) and the renewable energy credits (as a by-product or other economic benefit from use of the windfarm).

The agreement results in the customer settling with the supplier the difference between the fixed price and the spot prices per megawatt of electricity the windfarm supplies to the grid throughout the 20-year term of the agreement. That agreement, however, gives rise to neither the right nor the obligation for the customer to obtain any of the electricity the windfarm produces and supplies to the grid. Although the customer has the right to obtain the renewable energy credits (which represent a portion of the economic benefits from use of the windfarm), the customer does not have the right to obtain substantially all the economic benefits from use of the windfarm because it has no right to obtain any of the electricity the windfarm produces throughout the period of the agreement.

The Committee therefore concluded that, in the fact pattern described in the request, the customer does not have the right to obtain substantially all the economic benefits from use of the windfarm. Consequently, the contract does not contain a lease.

The Committee concluded that the principles and requirements in IFRS Standards provide an adequate basis for a customer that enters into an agreement as described in the request to determine whether it has the right to obtain substantially all the economic benefits from use of an identified asset. Consequently, the Committee [decided] not to add a standard-setting project to the work plan.

Agenda decisions for Board consideration

Costs Necessary to Sell Inventories (IAS 2 Inventories)—Agenda Paper 2

The Committee considered feedback on the tentative agenda decision published in the February 2021 IFRIC Update about the costs an entity includes as the ‘estimated costs necessary to make the sale’ when determining the net realisable value of inventories.

The Committee reached its conclusions on that agenda decision. In accordance with paragraph 8.7 of the IFRS Foundation’s Due Process Handbook, the Board will consider this agenda decision at its June 2021 meeting. If the Board does not object to the agenda decision, it will be published in June 2021 in an addendum to this IFRIC Update.

Preparation of Financial Statements when an Entity is No Longer a Going Concern (IAS 10 Events after the Reporting Period)—Agenda Paper 3

The Committee considered feedback on the tentative agenda decision published in the February 2021 IFRIC Update about the accounting applied by an entity that is no longer a going concern.

The Committee reached its conclusions on that agenda decision. In accordance with paragraph 8.7 of the IFRS Foundation’s Due Process Handbook, the Board will consider this agenda decision at its June 2021 meeting. If the Board does not object to the agenda decision, it will be published in June 2021 in an addendum to this IFRIC Update.

Other matters

Work in Progress—Agenda Paper 6

The Committee received an update on the current status of open matters not discussed at its meeting in June 2021. - البلد الأردن

مجلس معايير المحاسبة الدولية يقترح نهجًا جديدًا يفتح الطريق لتحسين التواصل في الإيضاحات في القوائم المالية

يقترح مجلس معايير المحاسبة الدولية نهجًا جديدًا يفتح الطريق لتحسين التواصل في الإيضاحات في القوائم المالية.

مؤسسة المعايير الدولية لإعداد التقارير المالية تنشر تصنيف IFRS 2021

نشرت مؤسسة المعايير الدولية لإعداد التقارير المالية (IFRS) اليوم تصنيف المعايير الدولية لإعداد التقارير المالية 2021.

معلومات إضافية

-

المحتوى بالإنجليزية

24 March 2021

IFRS Foundation publishes IFRS Taxonomy 2021

The IFRS Foundation has today published the IFRS Taxonomy 2021.

The IFRS Taxonomy enables electronic reporting of financial information prepared in accordance with IFRS Standards. Preparers can use the IFRS Taxonomy to tag disclosures, making them easily accessible to investors who prefer to receive financial information electronically.

The IFRS Taxonomy 2021 is based on IFRS Standards as at 1 January 2021, including those issued but not yet effective.

The IFRS Taxonomy 2021 includes changes to the IFRS Taxonomy 2020 reflecting amended IFRS Standards:

Covid-19-Related Rent Concessions (Amendment to IFRS 16 Leases), issued by the Board in May 2020 (IFRS Taxonomy 2020—Update 1);

Property, Plant and Equipment—Proceeds before Intended Use (Amendments to IAS 16 Property, Plant and Equipment), issued in May 2020 (IFRS Taxonomy 2020—Update 3);

Amendments to IFRS 17 Insurance Contracts and Extension of the Temporary Exemption from Applying IFRS 9 (Amendments to IFRS 4), issued in June 2020 (IFRS Taxonomy 2020–Update 3); and

Interest Rate Benchmark Reform—Phase 2 (Amendments to IFRS 9 Financial Instruments, IAS 39 Financial Instruments: Recognition and Measurement, IFRS 7 Financial Instruments: Disclosures, IFRS 4 Insurance Contracts and IFRS 16 Leases), issued in August 2020 (IFRS Taxonomy 2020—Update 2).

The IFRS Taxonomy 2021 also includes new common practice elements and general taxonomy improvements to support high-quality tagging of:

disclosures related to IAS 19 Employee Benefits (IFRS Taxonomy 2020—Update 5); and

information presented in the primary financial statements (IFRS Taxonomy 2020—Update 4).

Access the files for IFRS Taxonomy 2021 and the supporting information.

تقرير اجتماع المجلس الاستشاري للمعايير الدولية لإعداد التقارير المالية (IFRS) لشهر فبراير 2021 متاح الآن

معلومات إضافية

-

المحتوى بالإنجليزية

IFRS Advisory Council February 2021 meeting report available

The IFRS Advisory Council met remotely on 23 February 2021 to discuss:

Update on the International Accounting Standards Board's work plan

Sustainability reporting

Post-covid-19 planning

Advisory Council Chair Bill Coen's report on the meeting is now available, summarising these discussions.

About the IFRS Advisory Council

The Advisory Council is the formal advisory body to the International Accounting Standards Board and the Trustees of the IFRS Foundation. It consists of a wide range of representatives, comprising individuals and organisations with an interest in international financial reporting.

The focus of the Advisory Council is to provide strategic support and advice to the IFRS Foundation, and it meets (in London, where possible) at least two times a year for a period of two days. - البلد الأردن

إعادة تعيين عضوين من أعضاء لجنة تفسيرات المعايير الدولية لإعداد التقارير المالية

أعاد أمناء مؤسسة المعايير الدولية لإعداد التقارير المالية تعيين عضوين من أعضاء لجنة تفسيرات المعايير الدولية لإعداد التقارير المالية

معلومات إضافية

-

المحتوى بالإنجليزية

16 March 2021

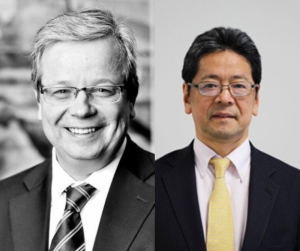

IFRS Foundation Trustees reappoint two IFRS Interpretations Committee members

The Trustees of the IFRS Foundation, responsible for the governance and oversight of the International Accounting Standards Board, have today announced the reappointment of Guy Jones and Goro Kumagai to the IFRS Interpretations Committee.

Their second three-year terms commence on 1 July 2021.

Guy is a partner in the Toronto office of EY’s Professional Practice Group and a member of EY’s Global IFRS Policy Committee.

Goro is the Senior Fellow of the Markets Strategic Intelligence Department at Mizuho Securities, the investment banking arm of Mizuho Financial Group.

The Interpretations Committee works with the Board in supporting the application of IFRS Standards and comprises 14 members drawn from various jurisdictions and professional backgrounds.

The Foundation is currently recruiting new members for the Interpretations Committee. - البلد الأردن

تقارير الشركات والاستدامة -نظرة مستقبلية

معلومات إضافية

-

المحتوى بالإنجليزية

Corporate and Sustainability Reporting – A Look Ahead

Published on March 2, 2021

Kevin Dancey

Chief Executive Officer at International Federation of Accountants (IFAC)

Dear Colleagues –

As professional accountants, the chief stewards of business information, we have both an important responsibility and a transformative opportunity to engage in and lead on upcoming changes in corporate reporting, specifically sustainability information. Frankly, there is no one better positioned than us. But make no mistake: if we don’t rise quickly to the occasion, demonstrate our competencies, and seize this significant opportunity, someone else will.

The purpose of my communication today is to update you on the ongoing work that IFAC is doing in this critical area, including where, with your help, we will take direct action, speak out, and endeavor to influence the journey to a more effective corporate reporting system.

But first: why are professional accountants best positioned to meet this need?

All organizations need better information to measure and manage the risks they face, capitalize on the opportunities in front of them, ensure their long-term success, and report to the boards that oversee them. At the same time, a broad range of stakeholders are demanding enhanced reporting that is relevant, reliable, comparable, and assurable.

Professional accountants inside organizations—with their analytics skills, critical thinking, scope of influence and organizational understanding—play a central role in integrating business-critical information, introducing and managing better processes and controls, making and enabling business decisions, and reporting to stakeholders in a holistic, integrated way.

Professional accountants in public practice, including SMPs, possess the necessary expertise, objectivity, and independence to best provide advisory and assurance services to organizations to enhance confidence in this information and new forms of external reporting.

Regardless of where they sit, professional accountants—your members—are simply best placed to meet this need—cost effectively, with quality and integrity.

Before setting out IFAC’s go-forward corporate reporting agenda, a brief review of recent events:

Last September IFAC issued a call for the IFRS Foundation to create a global sustainability standards board alongside the IASB. Later that month, the Trustees of the IFRS Foundation published a Consultation Paper to assess demand for global sustainability standards and the Foundation’s potential role in meeting any demand.

In November, SASB and IIRC announced their intention to merge into the Value Reporting Foundation, further supporting the objective of unified and simplified sustainability disclosures.

In December, five internationally significant framework- and standard-setting institutions (CDP, CDSB, GRI, IIRC, and SASB) published a prototype climate-related financial disclosure standard that also incorporated recommendations from the TCFD.

The European Commission has continued to move forward on its Non-Financial Reporting Directive.

Earlier this month, IFRS Trustees announced definitive steps towards a decision on whether to announce the establishment of a new global sustainability standards board.

And this week, IOSCO provided strong support for a global approach overseen by the existing IFRS governance structures, which can be found here.

There is momentum. Change is afoot.

IFAC’s corporate reporting agenda over the next several months will focus on:

1. Advocating for a Global Approach to Sustainability Standards

We will likely see continued movement among the key framework and standard-setting initiatives mentioned above. Regardless of how the landscape evolves, IFAC will continue to support moving with speed to a global approach under the auspices of the IFRS Foundation to achieve globally consistent sustainability standards that lead to relevant, reliable, comparable, and assurable information. We recognize and support the need for supplemental requirements to reflect regional/jurisdictional policy priorities. But we emphasize the urgency of addressing at a global level the needs of investors and capital markets. IFAC will speak out, including through our engagement in the B20/G20 policy development process, in support of this global approach.

2. Encouraging Sustainability-Related Skills and Competencies

IFAC will continue to work with PAOs and through the International Panel on Accountancy Education to demonstrate that professional accountants not only have the skills and competencies needed to prepare, assure, and utilize this information, but also the expertise to build and evaluate necessary controls and processes related to sustainability. In identifying which existing foundational skills can be leveraged to meet new requirements, and in creating access to obtain new subject matter expertise, IFAC supports the positioning that professional accountants are best placed to meet the sustainability-related needs of organizations.

3. Championing an Integrated Mindset

The insight gained from both financial and sustainability-related (or “non-financial”) information is maximized when an integrated approach connects the two. Quite simply, financial and sustainability information are not two, disconnected silos. An integrated approach leads to better decisions that deliver long-term value creation—financial returns to investors while taking account of value to customers, employees, suppliers, and societal interests. Professional accountants working in companies must continue to foster an integrated mindset that connects financial and sustainability data, processes and analysis.

4. Advancing Assurance Services

Assurance is a necessary component of the evolving global reporting system and an imperative for our profession. One of the core competencies of the profession is working with experts in a variety of areas and that will certainly continue. IFAC will be reaching out to Member Bodies and Firms—to better understand current and best market practices, identify gaps, and develop a shared narrative that best positions professional accountants to perform sustainability assurance. In addition, IFAC is launching an effort with the IIRC tomorrow, aimed at helping to accelerate the development of assurance services for integrated reporting.

5. Positioning the Profession to Lead

Professional accountants are central to gathering, analyzing, and communicating high-quality information. Our role in sustainability-related reporting—and insights—represents an even greater opportunity to unlock value for companies and clients. We will have to integrate into our work new and diverse subject matters and technologies, but our core knowledge, skills, professional judgment, integrity, and code of ethics are already in place. The future potential of sustainability information is too important to not get it right; together we will actively make the case that our profession is well positioned to rise to this challenge.

Thank you in advance for staying abreast of the issues and lending your voice and energy to help ensure our profession stays front and center in this important conversation. Please keep us advised of key developments in your jurisdiction.

I look forward to keeping you up to date on our progress as we move forward through our Knowledge Gateway, our bi-weekly newsletter The Latest, and reporting out on other events we will be convening on this important topic.

Cheers!!