عرض العناصر حسب علامة : IMA

الثقة الاقتصادية العالمية تنتعش بين المحاسبين

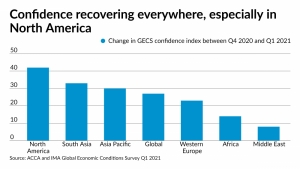

أظهر المحاسبون ثقة أكبر في الاقتصاد خلال الربع الأول من العام الحالي مقارنة بالعام الماضي، خاصة في أمريكا الشمالية، بحسب مسح جديد.

معلومات إضافية

-

المحتوى بالإنجليزية

Accountants expressed much higher confidence in the economy during the first quarter of this year compared to last year, especially in North America, according to a new survey.

The survey, by the Association of Chartered Certified Accountants and the Institute of Management Accountants, polled more than 1,000 senior accountants and finance professionals around the world, and found the biggest quarterly jump in confidence in a decade, thanks to increasing supplies of vaccines and continuing fiscal stimulus from many governments. The ACCA and IMA’s Global Economic Conditions Survey saw a nearly 30-point jump in the confidence index globally and more than 40 points for North America in the first quarter of 2021, compared to the fourth quarter of 2020. However, the two “fear” indices in the survey, which measure concern that customers and suppliers could go out of business, offered contrasting messages. Fear that customers would go out of business declined significantly while fear that suppliers would do so rose slightly higher. But both factors remain at relatively high levels, underscoring the high level of uncertainty that remains in the world economy.

The rollout of COVID-19 vaccines in recent months have helped improve economic confidence in many parts of the world. However, the growing number of COVID-19 variants that seem to spread more easily has also led to uncertainty and some European countries have been forced to retreat on their reopening plans. In many parts of the world, access to vaccines remains severely limited. Accountants in Western Europe, Africa and the Middle East did not register as much of an increase in economic confidence as those in North America and Asia.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

“This crisis is different as its root cause is health and not economic,” said IMA vice president of research and policy Raef Lawson in a statement Monday. “For now, global COVID-19 infections are high relative to the vaccination rate, so risks remain significant. But the huge government support provided to both households and companies over the last year leaves both well-placed to resume spending once the health crisis is over. There are likely to be permanent changes in the pattern of spending and other long-term economic consequences of the COVID crisis.”

Economic activity indicators for orders, capital spending and employment all increased to some extent in the first quarter of this year, according to the survey, echoing the level of confidence in the fourth quarter of 2019 before the spread of the COVID-19 pandemic.

“Having suffered the biggest recession for several decades in 2020, the global economy is on course for a relatively quick rebound,” said ACCA chief economist Michael Taylor in a statement. “The good news is that vaccination plans with continued policy support are on course to lift the global economy out of the COVID abyss this year.”

The report acknowledged that vaccination rates vary significantly across different countries, and vaccination can replace lockdown measures as a way to control COVID-19, allowing economic conditions to return to normal. But government policy is also crucial. A major fiscal stimulus in the U.S. is likely to have a positive spill-over impact on other economies around the world this year. Particularly in advanced economies, a large pile of savings accumulated during the periods last year when spending was severely limited, and those funds can provide a source of extra demand once economic conditions improve. Based on those criteria, the U.S. and the U.K. seem to have better growth prospects than the Eurozone, while China is likely to continue to experience strong growth. Emerging markets may also benefit from increased global demand, but vaccination rates will probably remain low in many countries through the rest of this year.

إعادة تفكير المحاسبين في استخدام التكنولوجيا السحابية

معلومات إضافية

-

المحتوى بالإنجليزية

Pandemic prompts accountants to rethink use of cloud technology

By Michael Cohn

April 21, 2021, 3:35 p.m. EDT

5 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

COVID-19 has been forcing accounting and finance teams to work remotely since last year, and that’s prompting reexaminations of how to use cloud technology for financial reporting in the future.

A report, released last month by the Institute of Management Accountants and the financial technology company Workiva, surveyed approximately 200 financial reporting professionals on their experiences and found that before the pandemic, their organizations placed a fairly low priority on technology-based financial reporting solutions. Two-thirds indicated they were behind other internal teams in competition for resources. About 30 percent of the respondents expressed interest in a technology-based solution for various activities around the documenting of management review processes and judgment areas. Approximately one out of five respondents said they have changed their prioritization or budgets for technology-based corporate reporting solutions for 2021 and into the post-pandemic period.

The pandemic forced most companies to shift toward a work-from-home environment last year, and that included their accounting department. While many employees have since returned to their offices at many organizations, others are continuing to do their work remotely. Despite the initial challenges, remote technology has mostly helped accounting and finance employees work safely from home, but it has also raised the question of whether companies should continue to rely on cloud technology after the pandemic eventually subsides.

“What we found out is that, not just with the anecdotal information that we were hearing, is that financial reporting teams are able to get the job done during the pandemic,” said Shari Littan, director of corporate reporting research and policy at the IMA, who co-authored the report. “They felt that they had adequate tools for some areas that are more challenging than others. Inventory is one of them. Revenue assessment is another. But by and large, they felt that they could get the job done. What we wanted to know is this going to change your movement toward adoption of more elegant and efficient solutions? And what we found is that there is an appetite for more.”

The survey respondents seemed to prefer new systems for two areas: control ownership and succession, and assessing revenue expectations. “The succession part is really where we’re really seeing some interest,” said Littan. “One thing a cloud-based or collaborative platform can do is automatically assign who is going to oversee what and who is the second in command, someone else who can step in if that person is unavailable because during the pandemic more things are changing fast.”

The respondents from private companies expressed more interest in systems for accounting processes that require estimates and sorting data.

“When you need to access economic data, things are changing very fast and you have to depend on judgment-based estimates in a pandemic environment,” said Littan. “Or if there are climate events like we saw in Texas disrupting the process, things are moving so fast, and you have to get the right data for a decision that’s being assessed. It’s better to have tools rather than going out and finding the right data, stripping it out, because we’re dealing with unstructured data for building the reports. In the scenario of a pandemic or major weather event, you could be dealing with unknowns. You don't have enough data. You don’t have enough information. You can’t compare to a prior year. Some of your estimates have to be rethought from scratch.”

Accounting and finance teams are increasingly needing to assess such information, including for environmental, social and governance reports.

“There is still a sense at companies that technology for their financial reporting and accounting teams is less of a priority than technology solutions elsewhere in the company,” said Littan. “Yet that’s happening at the same time as we’re asking for more reporting, on ESG for example, more information, and more teams are working remotely.”

Cloud technology can help accountants respond to those needs more quickly. “One of the things we focus on at IMA for people who are on the corporate preparer side is the demand on the professional’s time,” said Littan. “We hear every day how they would like to be more involved, even more than they are now, in strategy, in planning and talent management, in developing business models, all of these other things that we want accounting and finance professionals to be able to do, but they are dedicating so much of their time to compliance and just getting the reports out while there are solutions available to them.”

Cloud-based systems can also help with workflow when building and reviewing reports. “When you’re using this type of software, the reporting requirements are built in, or they can be lined up and compared, so it eliminates that cutting and pasting,” said Littan. “What it also could help with is the management oversight and review process for those last steps of the report because if you’re using that system, it will document who reviewed certain documents and information in order to sign off on the reports’ various aspects, and it will record that. That can be really helpful down the road if there’s ever a look back on how certain decisions were made, what was the review, what was the oversight. That gets preserved. Another helpful aspect when people are working remotely is you don’t have a physical document for signoff. You don’t want documents sitting on 10 different people’s computers and different versions of them. The platform could help assign these things, so it could help with efficiency.”

Cloud technology can be challenging from a cybersecurity standpoint, and it can be difficult in a remote environment to have the proper internal controls in place and the management oversight and review when much of the staff is working remotely. But overall it’s proven to be invaluable for organizations that are forced to operate remotely in this now year-old environment of the pandemic.

ماكنالي الرئيس الجديد لمعهد المحاسبين الإداريين

عين معهد المحاسبين الإداريين رسمياً ج. ستيفن ماكنالي كرئيس لمجلس إدارة IMA العالمي، وهو يخطط للتركيز على الحضور المتزايد للمؤسسة على المستوى الدولي.

معلومات إضافية

-

المحتوى بالإنجليزية

New IMA chair McNally embraces global focus

By Michael Cohn

July 16, 2021, 4:24 p.m. EDT

7 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The Institute of Management Accountants officially appointed J. Stephen McNally as chair of the IMA’s global board of directors, and he plans to focus on the organization’s growing presence internationally.

McNally, who is CFO of the Plastic Technologies group of companies and previously spent a long career as a finance executive at Campbell Soup, will chair the IMA global board for fiscal year 2022, from July 1, 2021, to June 30, 2022. He will be succeeded by Gwen van Berne of the internet registry RIPE NCC in the Netherlands (see story).

The IMA, like other accounting organizations such as the AICPA, have been putting more emphasis on broadening their international presence. McNally also hopes to advance the IMA’s thought leadership and research, especially around the future of work, and to advance the use of technology strategies in the accounting and finance profession and support members in being effective, well-rounded management accountants and finance professionals. He also plans to help members in the small business sector recover from the impact of the COVID-19 pandemic.

McNally also will be chairing the IMA's Governance Standing Board Committee and be a member of the Nominating Standing Board Committee. He is a member of the IMA's Toledo Chapter and a former board liaison to the IMA Committee on Ethics.

Using Too Many Systems? Accounting Practice Management all in One Place

Canopy is a full-suite practice management software for accounting firms offering client management, document management, workflow, and time and billing...

SPONSOR CONTENT FROM CANOPY

“I’m really excited and honored to be in the role as chair for IMA,” he told Accounting Today. “Clearly, we’re in a very dynamic environment and it’s just going to continue to ramp up and change, so one of my key priorities or goals is to support our members in becoming future ready, not knowing what that future looks like, but being future ready to do their work. That’s through things like keeping the CMA up to date, and doing various webinars and articles, all around just helping our members prepare for the future of work.”

J. Stephen McNally

McNally also plans to contribute to the IMA’s thought leadership work, especially around the use of internal controls over financial reporting, using the COSO framework, originated by the Committee of Sponsoring Organizations of the Treadway Commission.

“One of the things I’ve always been impressed with is how IMA is such a leader within the management accounting and finance profession on various topics,” he said”. I’m personally partial to COSO and internal controls and enterprise risk management. I had the honor of representing IMA on the COSO Advisory Council back in 2011-2012 that updated the internal control framework. IMA also drives thought leadership in the areas of sustainability and DE&I and ethics and so many areas.”

A big priority as global chair will be the IMA’s work internationally. “Over the last 10 to 12 years, we’ve very much evolved from a very U.S.-centric organization to a global organization, with over 140,000 members in over 150 countries,” said McNally. “Therefore, for me, it’s imperative that we reach out and listen to the voice of our global members, understand what they need, what their wants and desires are, and how IMA can support them.”

He also wants to do more to support small and midsized businesses. “I spent a good chunk of my career at Campbell Soup, which is obviously a big public company, but now I’m CFO of a small private company, and it was just an eye owner for me how it’s so important that smaller and midsized businesses have the financial talent to be successful. Therefore, it’s so important that we, IMA, support our members in smaller and midsized businesses so they can support their organizations.”

One way the IMA will be supporting businesses is by helping them get through the pandemic as the organization makes plans to once again hold in-person meetings and conferences. “On the one hand, I absolutely am hoping that through vaccinations and through the virus itself becoming more and more under control, hopefully we do have an opportunity to go back to meeting in person and having those live events,” said McNally. “For finance and accounting professionals, it’s important that we play a key role within our organizations and think through helping our organizations be ready for the future, whether that future is tomorrow, or a month out, or six months out. Even things like how do you go back — being completely remote, or is it a hybrid, or is it fully in person? As accounting and finance professionals, we’re inquisitive. We ask questions. That’s one of the key things we need to do within our cross-functional leadership team is ask those questions, to pressure test the decisions to ensure we’re making the best decisions as a company or as an organization.”

The IMA has also been collaborating with the California Society of CPAs on research examining diversity, equity and inclusion in the accounting profession (see story), and that fits in with the group’s international growth.

“I’m very proud of the fact that in the last 10 years alone IMA has gone from being very much U.S.-centric to a global organization, and is now represented in over 150 countries,” said McNally. “Along with that comes the importance of really ensuring that as an organization we hear the voice of our global members. This year, I’m really excited that on July 1, the same day that I became global chair, we’ve actually launched a brand-new, board-level standing advisory committee. It’s our Global Markets Committee. And at the same time, we’ve now launched regional advisory committees in China, India and the Middle East. This is one way that we’re going to ensure that we better hear the voices of our diverse members. And I’m also proud for the first time ever, my successor, Gwen van Berne, will be the first non-U.S. chair of the IMA, so from a governance perspective, we’re pushing very hard to ensure we’re really embracing all kinds of diversity, and giving appropriate representation, whether it’s on our global board or our global technical advisory committees. But also, IMA has played a key role in terms of educating the broader profession and community in regards to setting the tone when it comes to ensuring diversity and equity in our profession and, through that awareness, working toward improving that fact.”

The IMA has also been encouraging accountants to develop technology skills in areas like data analytics as part of its Management Accounting Competency Framework, and McNally hopes to continue that work.

“As CFOs and just generally as accounting and finance professionals, I think we need to take a leadership role,” he said. “Clearly technology plays such an important role in preparing for the future, preparing our respective organizations to be successful. It starts with individuals cultivating a technology savvy mindset, and as individuals, doing what we can. I know I read up on things like RPA and blockchain and data visualization, just staying connected with what the technology trends are, and again as management accountants and finance leaders setting the tone within our own organizations, and evaluating where we are today. What systems do we have? What processes do we have? Where can we be better, more efficient, more effective? How can technology help with that? With that said, typically small and midsized businesses don’t have excess funds to invest, so it’s also very important that we think through the return on investment. What is the technology investment otherwise? That’s another place where the accounting and finance professionals can really make a difference within their cross-functional leadership team in ensuring that we’re asking the right questions, and pressure testing so that we invest in the right technologies for us at this moment in time.”

Accountants need to monitor their organizations’ technology investments and make sure the money doesn’t get wasted. “Over my career, I saw too many times where investments were made in technology and you get yourself to that finish line of going live, and then the management team or the project team moves on, and you take away the budgets for training and such,” said McNally. “You can’t do that. If you’re going to make an investment in technology, it’s really important that you sustain it through the training, through the upgrades and such. That’s where we as management, finance and accounting professionals can make such a difference, especially because we’re the ones typically managing the budgets and have oversight of the budget and can ensure those investments are made for the long term.”

شارك في استطلاع "التنوع والإنصاف والشمول في الشرق الأوسط والهند في المحاسبة والمالية"

يدعوك IMA (معهد المحاسبين الإداريين) والاتحاد الدولي للمحاسبين (IFAC)، جنبًا إلى جنب مع شركاء البحث والمساهمين في الأبحاث، للمشاركة في استطلاع "التنوع والإنصاف والشمول في المحاسبة والمالية في الشرق الأوسط والهند".

معلومات إضافية

-

المحتوى بالإنجليزية

DE&I in Middle East & India Accounting & Finance

Participant Agreement

Question Title

* 1. IMA® (Institute of Management Accountants) and the International Federation of Accountants (IFAC), together with research partners and research contributors, invite you to participate in the “Diversity, Equity, and Inclusion in Middle East and India Accounting and Finance” survey. I understand that any data or information provided by me as part of this survey may be used by IMA and IFAC (collectively, the “survey sponsors”) in connection with this survey, other studies, or analyses performed by the survey sponsors or in connection with services provided by the survey sponsors or otherwise. I understand that any such data or information may be disclosed by the survey sponsors to research partner and contributor organizations and related entities or other third parties, including, without limitation, in publications, in connection with this survey or such studies, analyses, or services, provided that such data or information does not contain any information that identifies me or associates me with the responses I have provided to this survey. I understand disclosure of such data or information may be required by law, in which case, the survey sponsors will endeavor to notify me. I understand that this survey and the survey results are the proprietary property of the survey sponsors. The survey sponsors are not responsible for any loss sustained by any person who relies on the survey results. I am permitted to respond to the survey questions pertaining to my company including, without limitation, in accordance with the policies of my company and its board of directors (or similar governing body).

معهد المحاسبين الإداريين IMA يوسع جهود التنوع للمحاسبين

يخطط معهد المحاسبين الإداريين لزيادة جهوده لتعزيز تنوع أكبر في مهنة المحاسبة مع مدير جديد للتنوع والإنصاف والشمول، داريل جاكسون.

معلومات إضافية

-

المحتوى بالإنجليزية

IMA expands diversity efforts for accountants

By Michael Cohn

August 04, 2021, 4:58 p.m. EDT

7 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The Institute of Management Accountants is planning to increase its efforts to promote greater diversity in the accounting profession with a new director of diversity, equity and inclusion, Darryl Jackson.

As director of DE&I, he will lead the IMA’s efforts at creating more opportunities for all accounting professionals and closing a professionwide diversity gap. He also plans to develop ways to drive greater development, recruitment and retention in the accounting profession. Jackson most recently worked as a DE&I consultant for Marlon Moore Consulting. Before that, he was director of membership acquisition and engagement at the New York State Society of CPAs. He has been certified by Cornell University in diversity and inclusion, and plans to focus on four main areas: access, exposure, recognition and development.

The accounting profession has been moving slowly to expand its diversity and inclusion efforts, although the wave of Black Lives Matters protests last year and this year has been spurring commitments by more accounting firms and corporate America to increase their hiring and promotion of underrepresented groups. The IMA and the California Society of CPAs released a study in February showing that less than half of accountants (48%) believe the profession is equitable, while 43 to 55% of female, nonwhite and LGBTQIA respondents said they have left an accounting firm because they saw a lack of equitable treatment, with at least 30% leaving due to a perceived lack of inclusion (see story).

Advances in Tech brings together some of the latest software and technologies that are helping the industry move forward.

ACCOUNTING TODAY

Jackson hopes to encourage more companies to provide mentorship and sponsorship programs to provide a greater sense of inclusion for those who would otherwise leave the profession.

“I do see a lot of organizations creating or reviving mentorship programs,” he said. “In a lot of circumstances, a lot of organizations move to a mentorship program and then they create some type of employee resource group, where they allow employees who look alike and think alike to gather in these forums. Mentorship is great, but sponsorship is so much more important. I look at it as a mentor helps you build your brand, while a sponsor helps you sell your brand.”

Some companies are trying to encourage their employees to act as mentors and sponsors by offering financial incentives. “I’ve seen some companies tie sponsorship to bonus structures, where if you recommend someone who successfully completes a project, it’s reflected in your bonus,” said Jackson. “I think that’s key. When you start tying sponsorship and mentorship and the dollars, it makes everyone want to do it just a little bit better.”

He believes pay equity is important, but equity of opportunity is even more important. “We all know that talent and opportunity don’t go hand in hand, so it’s really important that there are equitable opportunities as well,” said Jackson. “That’s happening more and more. I think companies are beginning to see the perspectives of those that work there, the diversity of perspectives, and what we call diversity of thought is just as important as visible diversity.”

Diversity can mean different things, depending on the accountant’s perspective, but opportunity needs to be available for advancement. Accountant Cecelia Leung recently wrote a book, "Dear Accountant," in which she interviewed 20 accounting and finance leaders about their careers. “This book, 'Dear Accountant,' is a celebration of diversity in accounting and finance,” she said. “Initially, when I wrote the book, I really wanted to have a guide first not just in terms of ethnic background, but experience, because their experiences are going to be so much different for all of them. There are so many stereotypes for accountants. You look at someone who is a white male and you must think it’s so easy, but that has proven to be not true for most of them. A lot of people still struggle and have a lot of challenges. Diversity is a big part of it, but I think it all comes down to the individual, the determination to succeed and whether along the way there are people who help them get to where they need to be.”

Recruiting and retention efforts can be harmed when firms don’t seem to have a diverse staff and people at high levels. “We are seeing there is an issue specifically related to retaining and recruiting diverse talent, and it created an opportunity to dig a little deeper with organizations to really identify needs and challenges,” said Nikki Watson, senior manager of global accounts for Becker Professional Education, which recently introduced a DE&I certificate program. “Where are they having issues with reaching diverse talent and what are the issues with supporting and keeping talent? It created an opportunity for us to develop a series of courses that we thought would support organizations that would want to invest in DE&I initiatives and strategies within their organizations. I don’t think there is any secret that there is a diversity issue within the accounting profession, and I think it’s impacting all sizes of organizations from top to bottom. There are some issues as it relates to the hiring process, to onboarding, to career development, and it also relates to culture and whether or not an organization’s culture is inclusive and diverse.”

Jackson has plans to expand his work on diversity in the accounting profession at his new job at the IMA. “For me, the IMA position was so attractive because, in most roles, the director of diversity, equity and inclusion, or someone with a similar role, is normally stuck in the HR department, and they’re normally focused on recruitment and retention of diverse and underrepresented individuals,” he said. “While I think that’s really important, what was so attractive about IMA’s position is that it was externally facing. They wanted their director of diversity, equity and inclusion to really focus on the profession and not just the organization, and I think that’s really important. We look at the dismal statistics of representation within the accounting profession of different ethnicities and sexual orientations. I think it’s more important to focus on the profession as a whole rather than any individual organization. My mandate has been to create change, to change the world, and I’m really looking forward to that.”

One of his main focuses will be to improve access for underrepresented people to opportunities that can help further their career. He also wants to give them more exposure. “They aren’t exposed to development opportunities,” said Jackson. “They’re unexposed to promotional opportunities, and I think that’s very important as well.”

Along with access and exposure, he also wants to focus on promoting development and recognition. “Underrepresented people are historically not recognized for the great work they do,” said Jackson. “We can see that throughout our history where someone has done something great and helped revolutionize something, but not been credited for it. And then development is probably the most important because once we get these people in positions, once we get them recognized, once we provide them access, we want to make sure they have the skills to stay in these positions and continue to climb throughout their career.”

He plans to continue to partner with CalCPA on carrying out further studies on diversity in accounting, going beyond the U.S. to look at trends abroad. “That research was just the first step,” said Jackson. “That was very U.S.-centric. The next step is to expand that research globally, and that’s what we’re working on now in several regions around the world, mainly in Europe and the Middle East. I’m really excited about that as well, so we can get that same snapshot of what’s going on with diversity around the world.”

Besides CalCPA, he also plans for the IMA to work more with groups like the National Association of Black Accountants, the Association of Latino Professionals for America, and Ascend. “Partnership with other organizations is really important, and I look forward to partnering with other organizations such as NABA, ALPFA and Ascend to really do the hard work that needs to be done in the profession,” said Jackson. “I know it’s going to be a journey. It’s not going to be a sprint. It’s going to be more like a marathon. I tell everyone let’s not try to boil the ocean. Let’s do a few things great instead of trying to do a whole lot of things subpar. Do what we can to create some change.”

توقعات المحاسبين بالنسبة للاقتصاد هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

Accountants are anticipating the global economy will return to pre-pandemic levels in the second half of this year, despite worries about inflation, according to a new survey.

The quarterly Global Economic Conditions Survey, released Tuesday by the Association of Chartered Certified Accountants and the Institute of Management Accountants, indicated a swift and strong recovery in global confidence in the second quarter among the more than 1,000 senior accountants and finance professionals polled. There was a slight dip in global confidence in Q2, but it came after the biggest jump in confidence in the 10-year history of the survey during Q1.

The results revealed that accountants are mostly feeling optimistic about the economic recovery after global confidence plunged in late 2019 and 2020 as the COVID-19 pandemic spread across the world. However, inflation fears and the persistence of the coronavirus, including the virulent Delta variant, are tempering confidence a bit.

Health care workers test people at a COVID-19 testing site in the parking garage for the Mahaffey Theater in St. Petersburg, Florida.Eve Edelheit/Bloomberg

Why Lease Accounting Software Fails

9 Key Functional Deficiencies Driving Companies to Replace ASC 842 Software

PARTNER INSIGHTS

SPONSOR CONTENT FROM COSTAR

Compared with the Q1 survey, inflation expectations have increased significantly in North America, while in Western Europe, the accountants and finance professionals polled anticipate a modest increase in inflation over the next five years.

“To a large extent, the rise in inflation will be temporary, the result of collapsing demand last year, followed by a strong rebound that has resulted in rapid increases in commodity prices and supply shortages in some sectors,” said Michael Taylor, chief economist at ACCA, in a statement. “The rise in inflation can therefore be seen mainly as a welcome reflection of a strong recovery in demand that has resulted in supply shortages and a rebound in commodity prices, both of which are likely to prove temporary. For now, at least, underlying inflationary pressures are generally subdued.”

While survey respondents across various regions of the globe expect a modest increase in inflation over the next five years, a significant minority in North America anticipate much higher inflation. In all regions, at least two-thirds of the survey respondents expect inflation to be slightly or much higher than now.

Global activity indicators, such as orders, showed further improvement in the Q2 survey and are now above the level seen in Q4 2019, right before the pandemic began spreading widely across the world.

Overall, the global economy has now returned to its pre-pandemic size, driven largely by rapid growth in the U.S. and China, the two largest economies, but most other economies around the world still have plenty of ground to recover.

The two “fear” indices in the poll — measured by concern that customers and suppliers may go out of business — both fell in the Q2 survey, indicating that the extreme uncertainty generated by the COVID-19 pandemic has dropped back toward more normal levels.

The index of concern about operating costs grew in the Q2 survey and is now at its highest level since Q3 2019, probably due to inflation worries and labor and supply chain constraints. But concern remains below the level that would indicate a sustained large rise in inflation.

The survey found a very strong recovery underway in North America through the second half of 2021. While confidence remains high, it fell back slightly after an extremely strong bounce in the Q1 survey. The orders and employment indices on the survey both increased and reached their highest level on record. Continued progress with vaccinations, allowing economic conditions to return to normal, and the huge U.S. fiscal stimulus are driving recovery in the region.

Vaccines will be key in maintaining the recovery in the U.S. and helping other regions of the world. “In addition to rapid deployment of effective vaccines, advanced economies have been able to deploy massive fiscal support measures that have maintained household disposable incomes, supported businesses, and prevented large rises in unemployment,” said Raef Lawson, vice president of research and policy at the IMA, in a statement. “Buoyant housing markets have supported consumer spending. This means that as economic conditions move toward normalization, economies are likely to recover very rapidly. In many emerging markets, vaccinations have made little progress, leaving them vulnerable to renewed waves of COVID-19 and variants with consequent restrictions that curtail economic recovery. This pattern seems likely to persist well into 2022.”

The U.S. economy is likely to grow by approximately 7% this year as COVID cases decline and vaccinations continue, according to the ACCA and IMA. Second-quarter GDP growth is likely to be close to the 7% annual rate, helped by a strong rebound in consumer spending. Growth may even strengthen during the second half of the year as employment continues to recover. A return to more normal economic conditions is being helped by the massive fiscal stimulus which by itself may add over three percentage points to GDP this year. Despite the recent spike in inflation, the Federal Reserve is expected to keep monetary policy in place, with interest rates close to zero.

معهد المحاسبين الإداريين IMA ينتخب الرئيس القادم

عين معهد المحاسبين الإداريين جوين فان بيرن، المدير المالي لمركز تنسيق شبكة الإنترنت الأوروبي ( RIPE NCC ) ، لتكون سادس رئيسة منتخبة

معلومات إضافية

-

المحتوى بالإنجليزية

IMA elects incoming chair

By Michael Cohn

The Institute of Management Accountants named Gwen van Berne, CFO of the internet registry agency RIPE NCC, as its sixth female chair-elect and the first to reside abroad.

Van Berne is based in the Netherlands and runs the finances of the official regional internet registry for Europe, the Middle East and parts of Central Asia. She will succeed Steve McNally, CFO of Plastic Technologies, as IMA chair next year.

The move comes as the accounting profession tries to increase gender diversity in its ranks. Last month, the IMA released a report in conjunction with the California Society of CPAs showing a significant diversity gap at the senior ranks of the U.S. accounting profession (see story). The report found that men comprise 86 percent of the CFOs of Fortune 500 and S&P 500 companies and 77 percent of partners in accounting or finance functions at U.S. CPA firms.

“The accounting profession needs to be a trailblazer for a diverse and inclusive workplace,” said van Berne. “The IMA is doing a lot to make sure that we start off the conversation and also that we show in our actions that we really think this is a very serious matter. The study clearly shows a lot of work needs to be done in this area. if you look at the accounting profession, women actually comprise a greater proportion of the profession than men compared to the overall U.S. population, but based upon the workforce statistics, they are underrepresented in the senior roles.”

While many women are studying accounting in college and getting entry-level jobs, they don’t seem to be advancing at the same rate as men. “The accounting pipeline is filled with women, but we don’t see that same pipeline generating the senior roles,” said van Berne. “There we still see a majority of men. That same research study shows that in every 10 senior roles, only two are filled by women. It's very clear that we still have a lot of work to do to make sure that we get more gender equality. We are a firm believer that diversity leads to better results and more objective, unbiased decision-making. It can generate a kaleidoscope of views and insights and different personalities. It’s really important for accounting even more than for other professions. We really need to set the tone.”

The accounting profession is increasingly turning female. In 1983, 38 percent of accounting professionals were women. Fast forward to 2020, and the share of women is 61 percent. “Our profession is apparently becoming more female, but we don't see the same effect on all those levels,” said van Berne. “That’s something we hope to change, but it's not only about gender issues in the research.”

At the same time, ore than 90 percent of the profession’s executive leadership are white. In contrast, only 1 percent of partners at U.S. CPA firms in 2018 were Black, 2 percent were Latino and 4 percent were Asian. In corporate America, only 1.4 percent of CFOs at S&P 500 companies in 2019 were Black, 1.6 percent were Latino and 4.9 percent were Asian.

“It’s not only about the females, but also diversity,” said van Berne. “I really hope that we can go a bit quicker than the last 100 years have shown.” Women only got the vote in the U.S. in 1920, she noted, and in the Netherlands in 1919.

As CFO of RIPE NCC, van Berne is in charge of the finances of one of five regional internet registries in the world. She is also the treasurer of the Delft Chamber Music Festival in the Netherlands. “It was a difficult year for musicians with the pandemic,” she said. “These are really challenging times financially.”

Female leaders face not only the perennial problem of the “glass ceiling,” but also the “sticky workforce,” according to van Berne.

“With the internal barriers that women are facing, they sometimes hold themselves back,” she said. “They should take a bit more risk and negotiate more. The research study shows that a lot of women really feel that sometimes their working environment is not supportive. They experience a hostile work environment, which is not good, and they struggle with stereotyped expectations. If women are looking to move up into senior management roles and they are negotiating and taking risks, sometimes they are seen as being too aggressive or not a good team player. What we expect from women is that they are very sensitive and caretakers, which are all very important qualities and I think every leader should have them too. In my experience, sometimes you need more of the male skills because the CFO is a leader. I can’t always have my caretaker hat on.”

The IMA and CalCPA study found that 73 percent of females feel their leaders demonstrate unfair prejudice or bias against women that negatively affects promotion in the accounting and finance function. “I wish this were different and hopefully in the future it will be,” said van Berne. “This is for sure a conversation that we need to have with the men. That’s also important. You’ll never get there if you’re only going to discuss this with women alone. The inclusive part of it is what creates success in the end.”

إنفوجرافيك.. ستة اتجاهات كبرى للمحاسبين هذا العام

يتوقع الرئيس والمدير التنفيذي لمعهد المحاسبين الإداريين جيف طومسون ستة اتجاهات كبرى في مهنة المالية والمحاسبة هذا العام.

احتفال المعهد الأمريكي للمحاسبين القانونيين باليوم العالمي للمرأة

في الثامن من شهر مارس الذي يصادف اليوم العالمي للمرأة، شاركت رابطة المحاسبين القانونيين الدوليين عددًا من النصائح للشركات من أجل تقديم دعم أفضل للمهنيات وتطويرهم

معلومات إضافية

-

المحتوى بالإنجليزية

AICPA marks International Women's Day

By Sean McCabe

March 08, 2021, 12:27 p.m. EST

2 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

As March 8 marks International Women's Day, the Association of International CPAs shared a number of tips for firms to better support and advance female professionals.

“The global pandemic has highlighted the balancing act that women have performed for years managing their work and family lives,” said Crystal Cooke, director of diversity and inclusion for the Association and the Chartered Institute of Management Accountants, in a statement. “It’s incumbent that organizations recognize the challenges women face in their career progression and put practices into place to support their success.”

The focus on female professionals comes at a time when women make up more than half of all staff members in U.S. firms, but represent less than a quarter of partners and executive leadership. A report from the California Society of CPAs and the Institute of Management Accountants also found that 43 to 55 percent of female, nonwhite and LGBTQIA respondents polled have left a U.S. accounting firm due to a perceived lack of equitable treatment.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

The AICPA offers the following tips, based on responses from the recipients of its 2020 Most Powerful Women in Accounting Awards:

Be flexible: The COVID-19 pandemic has forced all of us to change the way we work and manage our lives. A study by McKinsey & Company found that 70 percent of women said childcare was their biggest concern compared to 40 percent of men. Employers should understand the added stress that comes from managing household responsibilities with the demands of work. This will likely require thinking outside the box for equitable and realistic solutions, such as flexible workhours or split days.

Make it OK to say “no”: Create an environment where those who are overwhelmed feel safe, and will not feel penalized or judged, for saying “no” to additional projects or responsibilities. Encourage women to ask for help when they need it and the option of taking wellness breaks to move, meditate, practice gratitude and embrace this time with their families.

Offer support: Show concern for your employees and offer them the support they need. Ask the important questions and really listen to responses: "How are you doing?" and "What can we do to assist you?" Then find a way to provide the support needed, which again could be unconventional.

Emphasize well-being and self-care: For nearly a year, your employees have largely lived the same day over and over. Many are juggling all their responsibilities, which have now seeped into their workday and therefore resulted in no boundaries. It’s important that you help the women in your organization find ways to successfully manage their mental health, stress and energy levels and to take some joy out of each day.

Be more inclusive: Look around you in important leadership meetings — online or in person. Are women and people of color (POC) well-represented? If not, reshape your invitation lists and include women and POC in meetings where strategy, vision and business critical decisions are being made, even if they aren’t partners yet. If you are unsure of how inclusive your organization is, the AICPA’s Accounting Inclusion Maturity Model can help identify areas of improvement

المحاسبون الإداريون المعتمدون أقل عرضة لتضرر رواتبهم أثناء الوباء

لم يكن المحاسبون الإداريون المعتمدون يتضررون من الراتب بسبب الانكماش الاقتصادي الناجم عن جائحة COVID-19 مثل غير الحاصلين على شهادة CMA، وفقًا لمسح نشره معهد المحاسبين الإداريين

معلومات إضافية

-

المحتوى بالإنجليزية

CMAs experienced fewer salary cuts during pandemic

By Michael Cohn

March 02, 2021, 3:58 p.m. EST

2 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Certified management accountants weren’t as hurt salary-wise by the economic downturn caused by the COVID-19 pandemic as non-CMAs, according to a survey released Tuesday by the Institute of Management Accountants.

The global survey found that CMAs were more confident in their job performance in comparison to non-CMAs and CPAs. Certified management accountants earned 58 percent more than non-CMAs and were less likely to experience a salary cut than non-CMAs (35 percent compared to 38 percent) across all regions. Globally, the difference in median total compensation between CMAs and non-CMAs was $29,000.

The COVID-19 pandemic caused widespread job losses and economic devastation in the U.S. and other parts of the world, but accountants fared relatively well compared to other jobs, especially in industries like restaurants, retail, tourism, leisure and hospitality.

“We have always known the CMA certification has a positive impact on compensation and job security,” said IMA director of research Kip Krumwiede in a statement. “This year is especially encouraging as CMA holders have been generally better off in maintaining both their jobs and compensation levels during the pandemic than those without the CMA.”

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

The difference in median compensation varied sharply by region, according to the IMA survey. Respondents from the Americas region indicated that CMAs earn 22 percent more in median salary and 25 percent more in median total compensation than non-CMAs. They reported the highest median salary and total compensation amounts, earning $103,000 and $115,000, respectively, compared to other regions. CMAs were 12 percent more likely to say their job had not been impacted than non-CMAs, and were 12 percent less likely to be making a career change.

The IMA awards the CMA designation and its annual salary survey tends to show how certificate holders earn more than their counterparts. Those holding the CMA certification were more likely to hold upper management job titles compared to non-CMAs, including directors (73 percent), CFOs (72 percent), and finance managers (66 percent). With CMAs becoming leaders in their companies, 85 percent of all respondents said the CMA gave them more confidence to perform their jobs at a high level and strengthened their ability to move across all areas of the business.

Comparing the impact of COVID-19 on CMAs against non-CMAs, the survey found CMAs were more likely to say their job had not been impacted by COVID-19 than non-CMAs (33 percent compared to 21 percent), and less likely to be making a career change due to COVID-19 (9 percent as opposed to 21 percent).