عرض العناصر حسب علامة : الاقتصاد

رسالة دكتوراه: العلاقة التبادلية بين عجز الموازنة العامة المصرية ومعدل التضخم

يعتبر عجز الموازنة العامة من أهم المسائل والقضايا التي يولي لها الباحثون اهتماماً كبيراً في دول العالم المختلفة، لأن نجاح هذه الدول يقاس بمدى نجاح سياستها المالية والاقتصادية والاجتماعية.

لماذا يعد الذكاء الاصطناعي هو مستقبل المحاسبة؟

بعد عقود من التوقف في مختبرات الأبحاث، أصبح الذكاء الاصطناعي (AI) جاهزًا للظهور في أوقات الذروة، مما يؤدي إلى تغيير إن لم يكن تعطيل جميع قطاعات الاقتصاد التي تولد الكثير من البيانات (البيانات الضخمة)، من التكنولوجيا إلى التمويل والاتصالات والطاقة والرعاية الصحية، التنقل أو التصنيع.

معلومات إضافية

-

المحتوى بالإنجليزية

After decades stuck in research labs, artificial intelligence (AI) is ready for prime-time, transforming if not disrupting all the sectors of the economy that generate lots of data (big data), from tech to finance, communications, energy, healthcare, mobility or manufacturing.

More than most other industries, accounting hasn’t seen much innovation since the creation of double-entry bookkeeping - a process of recording both profits and losses - and considered one of the greatest advances in the history of business and commerce.

That was over 500 years ago!

However, the good news is that applying AI and machine learning technologies to bookkeeping, is becoming a reality with most of the major accounting software vendors (Intuit, OneUp, Sage, and Xero) currently offering capabilities to automate data entry, reconciliations and sometimes more.

PROMOTED

In our upcoming research report on the future of accounting, we expect that by 2020, accounting tasks - but also tax, payroll, audits, banking… - will be fully automated using AI-based technologies, which will disrupt the accounting industry in a way it never was for the last 500 years, bringing both huge opportunities and serious challenges.

Artificial intelligence will not eliminate accountants

“Having machines to do all these tedious and repetitive tasks could sound scary for many accountants because they are also very time-consuming and thus very lucrative,” explained Stephanie Weil, CEO of Accounteam, a Silicon Valley-based accounting firm. “However, if the AI system is well configured, it can eliminate accounting errors that are generally hard to find and thereby reduce our liability and allows us to move to a more advisory role.”

In an upcoming research study, we also tested the automation capabilities of 4 of the most popular AI-enabled cloud-accounting solutions available in the market today (OneUp, QuickBooks Online, SageOne, and Xero) and rank them against our Accounting Automation Index (AAI) which evaluates the accuracy of their AI engines to automatically recognize transactions coming in from bank feeds and generate the correct accounting without any user intervention.

OneUp proved to be the most effective with an Automation Index rate of 95% after 5 months of use, followed by QuickBooks Online (77%), Xero (38%) and SageOne (30%).

Despite being very promising, the accuracy of the machine learning algorithms used in most of today's solutions still needs to significantly improve in efficiency to avoid accounting errors and really fulfill their promise of automation.

رسالة ماجستير: أثر استخدام المعايير المالية لمحاسبة الاستدامة على تحسين الإفصاح المحاسبي وتعزيز ثقة المستثمرين

تهدف الدراسة الى معرفة أثر استخدام المعايير المالية لمحاسبة الاستدامة (معيارFNO101 ) على تحسين مستوى الافصاح المحاسبى للتقارير المالية وتعزيز ثقة المستثمرين من خلال توفير البيانات المالية وغير المالية التي تساعد المستثمرين في عملية اتخاذ القرارات و تحسين عملية الاستثمار وجذب رؤوس الأموال

معلومات إضافية

- البلد مصر

التخطيط الاستراتيجي وقت الازمات

لم تقم التكنولوجيا بتزويدنا بكرة بلورية بعد، لذلك لا يمكن لأحد ان يرى المستقبل ولكن بالنسبة للذين يشغلون مناصب قيادية مالية من الضروري ان نجعل التخمينات الأكثر تعليماً ممكنة وأن يتم تصحيحها في كثير من الأحيان

رسالة ماجستير: أثر إدماج المعلومات المحاسبية عن التنوع البيولوجي وخدمات النظم الايكولوجية في عمليات اتخاذ القرارات على دعم الاستدامة التنافسية لمنشآت الأعمال

استهدف هذا البحث دراسة مدى تأثير إدماج المعلومات المحاسبية عن التنوع البيولوجي وخدمات النظم الإيكولوجية في نظام معلومات المحاسبية الإدارية على زيادة فعالية عمليات إتخاذ القرار ودعم الاستدامة التنافسية لمنشآت الأعمال

دراسة ماجستير: العواقب الاقتصادية لمستوى جودة الإفصاح وفقاً للتقارير المتكاملة: أدلة وقرائن عملية مبكرة من بيئة سوق الأسهم المصري

تمثل هدف القضية البحتية المطروحة من قبل الدراسة الحالية: في تقديم أدلة تفسيرية وقرائن عملية مبكرة من بيئة سوق الأسهم المصري، للعواقب الاقتصادية لمستوى جودة الإفصاح وفقاً للتقارير المتكاملة في عدة نواحي محاسبية قبل التطبيق الإلزامي لتلك التقارير في بيئة الأعمال المصرية.

معلومات إضافية

- البلد مصر

إنفوجرافيك.. تركيز المنظمات الغير الربحية علي مواردها المالية

في جميع أنحاء البلاد، تواجه المنظمات غير الربحية تحديات مالية غير مسبوقة عندما تكون خدماتها في أمس الحاجة إليها.

الدور الأساسي للمدراء الماليين في تعزيز الصحة العقلية للموظفين

بالنسبة للمحاسبين المهنيين، تزيد مشكلات الصحة العقلية من مخاطر عدم تحديد الأخطاء في التقارير المالية أو اكتشاف مؤشرات الاحتيال.

معلومات إضافية

-

المحتوى بالإنجليزية

The following is a contributed piece from Russell Guthrie, CFO of the International Federation of Accountants (IFAC). Opinions expressed are author's own.

The coronavirus pandemic has put a long-overdue spotlight on mental health. Clinical studies have found a strong correlation between pandemic-related anxiety and behaviors, such as hopelessness or substance abuse, that companies cannot afford to ignore. Implementing an organizational framework to support mental health is not only the right thing to do, it's smart for business. With the potential to alleviate human and financial costs, support for mental health should be seen as core to the finance function’s role in promoting sustainable value creation.

In 2019, the World Health Organization estimated that mental health issues cost the global economy upward of $1 trillion per year. In the wake of the past year, that cost is likely to increase considerably, reinforcing the need for mental health to be a key priority for employers and organizations worldwide.

Addressing mental health successfully, however, will require the involvement of the entire C-suite — not just HR, and not just the CEO. The finance function must be a pivotal part of the conversation both in supporting the adoption of company initiatives and in examining the cultural values of the accountancy and finance profession globally.

Long-term growth and value creation

Creating a culture of understanding must be a critical priority for CFOs. Failing to care for employees can mean falling behind as an organization, particularly in sectors where a company’s best asset is its human capital. A 2020 Gallup survey found that two-thirds of full-time workers polled were facing burnout at least some of the time, and those people were three times more likely to look for another job. It’s both more humane and more cost-effective to support your talent’s well-being rather than risk a mass exodus and face the high price of attrition — especially if you have developed a reputation for burning out your employees.

Russell Guthrie

Courtesy of IFAC

Effectively addressing mental health by establishing the appropriate infrastructure to support employees can also play a determinant role in attracting and acquiring new talent. According to a recent report by the International Federation of Accountants (IFAC) and the Association of Chartered Certified Accountants (ACCA), Generation Z — the group of 18-25-year-olds entering the workforce during the pandemic — cites mental wellbeing as a top priority when seeking employment.

CFOs must be advocates for the crucial relationship between employee mental health and a company’s bottom line. Fatigue, burnout and other signals of strained mental health stand in opposition to the creativity, collaboration and stamina required to stoke growth and resiliency within companies.

A unique threat

The finance function — and, more specifically, accountancy profession — is innately people-centered, relying on equal parts technical and non-technical capabilities. Professional accountants, in particular, are responsible for critically reviewing information and large sets of data to ensure accuracy and compliance with laws and regulations, as well as evaluating conflicts of interest — a job that demands mental acuity, attention to detail and good judgement. Unsurprisingly, when people are under mental strain, it is increasingly difficult to focus on the task at hand.

For a professional accountant this may heighten the risk of not identifying errors in financial reports or impact one’s ability to spot indicators of fraud, both of which can have far-reaching consequences. It’s not enough, however, to recognize what is at stake. Leaders have to promote a culture that will mitigate those risks.

By nature, the accountancy profession is built on the expectation of perfection. Working against a standard of excellence — with little room for error — professional accountants face numerous internal and external pressures. And particularly now, as the global economy recovers from the impacts of COVID-19, professional accountants are facing increasing stress as the institutions they support focus on rebuilding.

Such high expectations create an environment ripe for the deterioration of mental health. This, coupled with the general stigma surrounding mental health, often results in hesitation to recognize or address fatigue, depression, or any other mental health issues.

Mental health must be included among the tenets of ethical and good business performance. A robust financial system is the bedrock of any thriving economy, and the people who uphold the rigor of high-quality accounting have to be a top priority.

Building the infrastructure

Mental health must be considered part of an organization’s environmental, sustainability and governance (ESG) strategy and approached as would the provision of any other basic human right. Just as global standards are a critical vehicle for reaching sustainability goals, a similarly rigorous approach will help companies, both large and small, establish the necessary infrastructure to properly support employee well-being.

The right response will likely look different from region to region and from organization to organization, but the essential first step is simply making mental health part of the ongoing dialogue of the organization. From there, organizations must deploy initiatives for supporting employees and their ability to perform.

This will likely mean rethinking normalized processes to identify existing threats to well-being and potential barriers to care. For instance, some companies will need to reconsider the relentless focus managers place on productivity. Others will have to reevaluate insurance plans to consider coverage of mental health treatments. They should look to institute mental health literacy programs and leverage outside expert resources to empower employees to prioritize mental health and support those in their communities looking to do the same. Ultimately, leadership needs to be highly engaged in this effort. Successfully shifting corporate culture to prioritize mental well-being starts at the top.

While it’s not solely up to CFOs and the finance function to champion new and expanded norms for operating within the current reality, they are essential to creating a positive space to discuss and address employees’ mental health. It’s mission critical if we want to ensure businesses continue to operate as productively, sustainably, and ethically as possible.

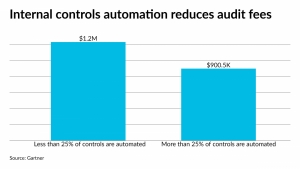

توقعات عن ارتفاع رسوم التدقيق بنسبة 62٪ هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

Clients anticipate that audit fees will increase in 2021 due to the impact of inflation, COVID-19, acquisitions and divestitures, according to a survey by Gartner.

The survey found that 62% of the companies polled are expecting audit fee increases this year, but that may be offset by technology savings. Organizations that automate at least 25% of their internal controls paid 27% lower audit fees on average, according to Gartner’s survey of 166 publicly traded and privately held companies. Of the respondents, 81% used a Big Four audit firm. Of the 166 organizations surveyed, Gartner analyzed 124 for the impact that internal controls automation had on the amount they ultimately paid in audit fees.

The survey revealed the steadily increasing amounts of audit fees, exacerbated by the inflationary pressures that have affected so many sectors of the economy this year as the U.S. and the rest of the world struggle to recover from the COVID-19 pandemic. The pandemic also accelerated the shift to technologies like remote audits over the past year, and the increasing use of automation for audits and internal controls as many auditors worked from home and away from their offices.

Companies with fewer than 50 controls, and more than 25% of them automated, reported 52% lower audit fees relative to ones with less than 25% of their controls automated. In comparison, companies with 50 to 250, as well as more than 250 controls and more than 25% automated, showed 27% lower audit fees.

“With audit fees increasing significantly, finance leaders should take note that organizations with higher levels of internal control automation saw substantially lower external audit fees on average,” said Ashwani Gupta, director in the Gartner Finance practice, in a statement Tuesday. “The biggest decreases were seen in organizations using between 1 to 50 controls, suggesting that getting internal control automation started has potential cost benefits when it comes to audit. Automation of internal controls can play a role in not only reducing financial reporting and audit risks but also audit costs. As organizations invest in internal controls automation it will likely become a prominent argument for audit fee reductions in the future."

Audit fee spiked the most last year in the banking and insurance sectors, with 69% of respondents in each category reporting increases. Financial services companies have more complex accounting processes and financial reporting exposures needing more auditor hours. Insurance companies also experienced some of the highest number of internal controls relative to companies in other industries.

On the other hand, the technology and telecom sector showed the lowest impact on fees, with only 41% of respondents reporting increases for 2020. The companies that did report fee increases most often indicated they were sizable, with 22% of overall respondents reporting “significant” audit fee increases of 6% or more, compared to the fees paid in 2019.

The main factors driving audit fee increases ranged from inflation to COVID-19 related, but organizations that negotiated on audit fees and made a strong case with their primary auditing firm were able to get a flat fee or a lower than expected audit fee increase. Of the respondents who attempted to negotiate their fees, 45% said their fees declined by over 6%, while half were able to cut their fees by between 3 to 6%.

كيفية الارتقاء بتجربة العملاء في عالم ما بعد كورونا؟

بالنسبة للشركات الاستهلاكية التي تجد نفسها في الوضع الطبيعي التالي، حان الوقت الآن لإعادة تصور ما يعنيه الوضع الطبيعي الجديد.

معلومات إضافية

-

المحتوى بالإنجليزية

How to elevate customer experience in a post COVID-19 world

By Sukesh Choubey

EY Global Delivery Services SAP, Microsoft and Supply Chain Leader

6 minute read

15 Feb 2021

Related topics

Consumer products and retail Supply chain E-commerce

Upvote 10

For consumer businesses finding themselves in the next normal, now is the time to reimagine what the new normal means.

Three questions to ask

How has COVID-19 shaped consumer behavior?

How can CPG companies gain a competitive advantage by embracing this new reality and adopting emerging trends?

How will frictionless shopping solutions help CPG companies gain competitive advantage?

How EY can help

Customer experience

When it comes to serving the customer of the future, the answers lie in being client-centric, especially in today’s world.

Read more

Related article

How digital transformation opened new channels for growth

How digital transformation opened new channels for growth

With help from EY professionals, Royal Caribbean’s digital-first approach is trans…

26 Mar 2021 EY Global

We are all living in unprecedented times and the pandemic has radically impacted our everyday life. Each one of us has seen the impact the COVID-19 pandemic has had on the consumer psyche and businesses alike. During the lockdown, consumers stockpiled essential goods such as groceries, dry foods, and other household products, in wake of the impending crisis. This spike in demand for essentials disrupted the supply chains for most of the Fast-Moving Consumer Goods (FMCG) companies. On the other hand, non-essential (good-to-have-goods) product companies, such as apparel and luxury products, witnessed a sharp decline in sales. Other factors familiar to many included restricted travel, remote working and growing economic concerns.

Some of these changes in customer behavior seem to be an irreversible trend, forcing consumer goods companies, more than others, to realign themselves to the new normal. Consumer Products and Goods (CPG) companies can gain a competitive advantage by embracing this new reality and adopting emerging trends would help consumer businesses thrive in the new normal.

1. eCommerce acceleration

Online presence is no longer optional for CPG companies. Many small and medium companies did not invest in eCommerce until recently. With consumer shift to online channels, since the COVID-19 pandemic began, there has been a growing demand for eCommerce platforms. Leading grocery retailers prefer to reduce online friction by simplifying the buying experience for essentials with the use of apps. Curbside pickup has proved to be one of the most conducive frictionless solutions for both retailers and customers. A leading sports retailer converted some of its stores into fulfilment centers to manage online orders. Food and beverage players identified the shift in consumer behavior and launched online D2C channels during this period. In addition, there was growing disintermediation using B2B eCommerce portals by CPG companies for their sales representatives, especially during the pandemic.

Business buyers seek simple, flexible, on-demand ordering experiences – a process that works best for them, at the time they desire. Back in 2015, Forrester found that nearly 75% of B2B buyers said that buying from a website was more convenient and efficient than buying from a sales representative.1 It would seem very likely that, were the same research conducted in 2021, the percentage would be even higher. In the future, digital adoption is expected to grow further and would be a key driver for growth for many consumer businesses.

2. Digital In-store experience

With a growing affinity for online shopping, CPG companies need to reinvent the in-store experience to reduce friction and ensure customers see value in coming back to stores. Digital engagement has accelerated tremendously, and leading companies have innovated quickly to replace traditional, in-store experiences. As the economy has begun opening, physical stores have seen a slight uptick in consumer traffic. This indicates that physical outlets will have to test modified in-store layouts to prevent customers from being in crowded situations and enable contactless shopping solutions to address health concerns.

Leading retail chains have been testing store traffic control using advanced queue management techniques, one-path shopping designs, and queueless buying options for popular products. Frictionless solutions (e.g., scan-and-go, click-and-collect, drive-through checkouts), buying/try-out kiosks are also some formats that are being used to reduce physical touchpoints for customers. Athletic footwear (A&F) players have seen store shutdowns but have also benefited from continued technology investments. Some A&F organizations have ramped up content marketing and adjusted subscription prices for digital fitness programs. It’s likely stores will become more conceptual and experiential, with customers being engaged in a better way through digital athlete training regimes.

There is also a growing preference for AI store assistants to supplement the customer experience with product information and recommendations. AI can also answer questions as well as take orders for customized products that have a different color, stitching, size or accessories. Now is the time for consumer companies to invest in the data, technology and systems required to deliver exceptional consumer experiences. Organizations that can understand customers better and adapt faster are likely to be the next customer-experience leaders.

Consumer companies must invest in the data, technology and systems required so they are able to deliver the kinds of exceptional consumer experiences that will give them a competitive edge and position them as the next customer-experience leaders.

How EY can help

Customer engagement

In today’s world of empowered customers, competitive advantage shifts from being purely competing over product and price to building trust. To prosper, you need to consider a customer-centric marketing model built on unwavering trust and loyalty.

Read more

3. Dynamic and agile supply chain planning

During the lockdown, inventory management became a problem as people started stockpiling and manufacturing went on freeze temporarily. A spike in online sales, abrupt consumption patterns, disrupted supplies and unpredictable future have made organizations realize that what worked till now, will not work in the future. How can companies accurately forecast demand and capture the impact of situations such as a pandemic? An effective way would be greater collaboration for demand sensing between retailers and manufacturers, especially for anomalies. Furthermore, automation of sales operations and creating a digital environment to manage their entire supply chain is critical if companies need to build sales resilience.

4. Innovation in customer connect

While people continue to remain socially distant, bringing offline experiences online will ensure they continue to connect with the brands they identify with. Even though digital marketing has been a focus for CPG companies, greater impetus must be placed on leveraging new age communication channels to create deeper engagement with consumers. Some social media platforms have already enabled CPG companies to gain higher traction by personalizing communication compared to traditional marketing channels.

Additionally, influencer marketing, YouTube channels, blogs, etc., are all being used to create excitement around brands, new launches, etc., and drive the end-users toward purchase. Companies are constantly innovating new ways of connecting with consumers. Adopting technologies, including Augmented Reality (AR) and Virtual Reality (VR), will completely change the way brands communicate, launch new products and engage with consumers, all while ensuring the safety of consumers is not compromised.

As social distancing continues to be the norm, bringing offline experiences online will ensure continued customer engagement with an organization’s brand. The next step, however, must now be a bigger focus on leveraging new age communication channels with the aim of creating deeper consumer engagement.

To remain relevant and adapt to changing consumer behaviors, CPG companies must adopt agile operating models to lead in this dynamic environment. Digital is becoming an integral part of the customer’s purchase journey. Organizations need to analyze consumer consumption data in existing digital channels, modify assortments, build a robust network, and simplify and optimize UI/UX to enable a better customer buying experience. Physical stores should allow frictionless shopping, redesign store layouts, streamline store operations and reevaluate store networks to increase consumer confidence in physical channels. This must be supported by flexible delivery models and robust supply networks (fungible stores and warehouses).

A superior personalized experience can be achieved by enabling a seamless purchase journey for the consumer with close collaboration between physical and digital channels and being innovative in building omnichannel capabilities. In the long run, achieving these objectives will future-proof organizations and help them retain their competitiveness.

Show article references

Summary

The COVID-19 pandemic has created what many expect to be irreversible trends in customer behaviors. But there is a competitive advantage to be gained by CPG companies that embrace this new reality and adopt emerging trends, such as agile supply chain planning and innovative ways to connect with customers.