عرض العناصر حسب علامة : التدقيق والمراجعة

معيار ارتباطات الإجراءات المتفق عليها AUP سيصبح ساري النفاذ قريبا

لا تنسى! أصبح معيار ارتباطات الإجراءات المتفق عليها AUP المعدل الصادر عن IAASB ساري النفاذ اعتبارًا من 1 يناير 2022

معلومات إضافية

-

المحتوى بالإنجليزية

Don’t Forget! IAASB’s Revised AUP Standard Becomes Effective as of January 1, 2022

ERIC TURNER, PHIL MINNAAR | NOVEMBER 29, 2021

Agreed-upon procedure (AUP) engagements are widely used in many jurisdictions. Demand for AUP engagements continues to grow, particularly related to needing increased accountability around funding and grants. Changes in regulation have also driven increased demand for AUP engagements, especially from smaller entities, as increased audit exemption thresholds in some jurisdictions prompt stakeholders to look for alternative services to an audit or other assurance engagements.

In December 2019, the International Auditing and Assurance Standards Board (IAASB) approved International Standard on Related Services (ISRS) 4400 (Revised), Agreed-Upon Procedures Engagements to respond to this growing demand.

AUP Engagements

In an AUP engagement, the practitioner performs procedures that have been agreed upon by the practitioner and the engaging party. The practitioner communicates the procedures performed and the related findings in the AUP report. The engaging party and other intended users consider for themselves the appropriateness of the AUP and findings reported by the practitioner and draw their own conclusions from the work performed by the practitioner.

ISRS 4400 (Revised) promotes consistency in the performance of AUP engagements and intends to address public interest issues relevant to AUP engagements, for example:

Responding to needs of stakeholders—the scope is broadened to include both financial and non-financial matters;

Professional judgment—new requirement and application material on the role of professional judgment in an AUP engagement;

Independence—new requirements and application material on disclosures in the AUP report relating to the practitioner’s independence;

Engagement acceptance and continuance considerations—new requirements and application material addressing conditions for engagement acceptance and continuance in an AUP engagement;

Use of a practitioner’s expert—new requirements and application material to address using the work of a practitioner’s expert in an AUP engagement; and

AUP report restrictions—new application material on the practitioner’s considerations if they wish to place restrictions on the AUP report.

The revised ISRS will be effective for AUP engagements for which the terms of engagement are agreed on or after January 1, 2022. For engagements covering multiple years, practitioners may wish to update the terms of engagement so that the AUP engagements will be conducted in accordance with the revised standard.

Other Resources That Can Help You Get Ready for Our AUP Standard

With the revised AUP standard coming into effect soon, these two resources from IAASB and the International Federation of Accountants (IFAC), can help you get ready:

IAASB’s ISRS 4400 (Revised) Fact Sheet, which includes a high-level overview of significant changes, to help you navigate and apply the standard.

IFAC’s Agreed-Upon Procedures Engagements, which outlines what an AUP engagement is, identifies the benefits to clients of offering such services, and explains when an AUP engagement is appropriate. It also includes examples of financial and non-financial subject matters, six short case studies with example procedures that might be applied, and two illustrative AUP reports.

مقالات .. الاعتداء على المهن تدقيق الحسابات نموذج

الدورة التدريبية: أساسيات تدقيق الأمن السيبراني

معلومات إضافية

- البلد عالمي

- نوع الفعالية برسوم

- بداية الفعالية الأربعاء, 08 ديسمبر 2021

- نهاية الفعالية الخميس, 16 ديسمبر 2021

- التخصص تكنولوجيا

- مكان الفعالية كل دورة في مكان مختلف

الدورة التدريبية: تطوير ملاحظات المراجعة

معلومات إضافية

- البلد عالمي

- نوع الفعالية برسوم

- بداية الفعالية الأربعاء, 08 ديسمبر 2021

- نهاية الفعالية الإثنين, 13 ديسمبر 2021

- التخصص مراجعة داخلية

- مكان الفعالية كل دورة في مكان مختلف

البث المباشر الثالث على LinkedIn حول المعيار الجديد المقترح لعمليات تدقيق المنشآت الأقل تعقيدًا

معلومات إضافية

- البلد عالمي

- نوع الفعالية مجانا

- بداية الفعالية الأربعاء, 17 نوفمبر 2021

- نهاية الفعالية الأربعاء, 17 نوفمبر 2021

- التخصص محاسبة ومراجعة

- مكان الفعالية أونلاين

ندوة IIA الافتراضية: أخذ تحليلات البيانات من التخطيط إلى التدقيق المستمر

معلومات إضافية

- البلد عالمي

- نوع الفعالية برسوم

- بداية الفعالية الثلاثاء, 02 نوفمبر 2021

- نهاية الفعالية الخميس, 04 نوفمبر 2021

- التخصص محاسبة ومراجعة

- مكان الفعالية أونلاين

دورة التدقيق لعام 2021: لم تعد إلى طبيعتها تمامًا

مع ظهور الوباء في أوائل عام 2020، اعتقد القليل من الناس فقط أنه سيستمر بعد عام ونصف. على الرغم من ارتفاع معدلات التطعيم، يستمر متغير دلتا في الانتشار في أجزاء من البلاد، ولم تعد الحياة اليومية إلى طبيعتها بالكامل.

معلومات إضافية

-

المحتوى بالإنجليزية

The 2021 audit cycle: Not quite back to normal

By Jeffrey Kranzel, Matt Wray

October 14, 2021 12:39 PM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

As the pandemic emerged in early 2020, few people believed it would still be going a year and a half later. Although vaccination rates are rising, the Delta variant continues to spread in parts of the country, and daily life has not fully returned to normal.

The 2020 audit cycle was unlike any other, with a host of accounting and reporting issues brought to the forefront by shifts to remote work, shuttered businesses and a standstill in deal activity. While some industries recover slowly and many organizations continue to operate remotely, robust capital markets have created a hot job market for accounting and finance professionals. This turn of events has spurred a unique set of challenges, and companies can expect to face seven key pressure points heading into the 2021 audit cycle. Here are some considerations to successfully navigate each hurdle:

Key person risk

audit-fotolia.jpgThe health impacts of COVID-19 plus a hot job market, dubbed “The Great Resignation,” have exposed the risk that exists for accounting and finance departments when a key person resigns or leaves abruptly, perhaps due to illness.

This disruption will likely continue through the 2021 audit cycle. Companies should manage this risk by cross-training employees on key processes or by leveraging technology solutions that make it easier for employees to assume other responsibilities quickly.

Audit coordination

audit committee

Picasa/endostock - Fotolia

Many organizations now find themselves short-staffed due to increased employee turnover, continued remote working, and a surge in deal activity requiring additional work from auditors. Due to these increased workloads, audit firms may not have the flexibility in their resource planning to delay fieldwork by a week or two, as they have often done traditionally.

Going into the 2021 audit cycle, companies need to engage with audit teams early on when planning for year-end fieldwork and consider shifting additional audit procedures from year-end to interim. Actions might include earlier reviews of significant transactions, encouraging audit teams to involve their specialists earlier than in prior years, and enhancing audit timeline management, while closely monitoring key milestones.

Deal activity

handshake-small.jpg

Zoran Mircetic

Deal activity has been robust throughout 2021 as companies explore acquisitions, divestitures, and other transactions. Many organizations have gone public, via special purpose acquisition companies or traditional initial purchase offerings, which hit record numbers in 2021. The result: Finance teams are stretched thin with diligence-related requests, proforma preparation, IPO readiness efforts, and other items, and much of this workload is incremental to routine financial close.

Each transaction presents a host of complex valuation and accounting issues that companies need to navigate with their valuation services providers and auditors. For example, a business combination requires entities to value goodwill and other assets to perform purchase price allocations. In addition, companies going public often need to value and account for complex financial instruments that may have been previously unrecognized.

Valuation issues associated with business deals require estimates and inputs that will ultimately be scrutinized by auditors and the Securities and Exchange Commission. To ensure success, organizations should engage accounting advisory and valuation services providers early and budget extra time for auditors to work through these areas.

Leases

Lease contract, close-up

andia-faith/andiafaith - stock.adobe.com

While working through the 2021 year-end reporting and audit cycle, private companies should not lose sight of the new lease accounting standard, ASC 842, which private companies must adopt in January 2022. Public companies that have already adopted the standard can offer many lessons learned; notably, organizations can avoid underestimating the complexity and effort required for successful adoption by assessing and planning as early as possible in the process.

Taxes

Taxes-due-reminder

Africa Studio - Fotolia

Eighteen months after the CARES Act became law, most of the taxpayer-friendly provisions have expired. Companies should review these changes to ensure they are prepared for any 2021 tax provision impacts. Additionally, uncertainty remains on the details and timing of additional changes to U.S. tax law. For now, the federal rate remains at 21%. If the current budget proposal is passed and signed into law in 2021, then companies will have many U.S. federal tax changes to consider regarding year-end financial reporting. The uncertainty and timing of potentially significant tax reforms may require a quick response at year-end, so companies should coordinate proactively with tax teams and advisors to assess the impact of proposed changes.

Internal controls

SEC building with official seal

Joshua Roberts/Bloomberg

The robust capital markets have led many private companies to pursue strategies to become public, often with accelerated timelines. Certain SEC regulations may provide some relief around Sarbanes-Oxley compliance for newly public companies under emerging growth company rules or significant acquisitions during the year, although companies should be strategic about designing a control environment.

Strategies should properly prepare a newly public company for future SOX compliance, while also mitigating the risk of material misstatement in SEC filings. Being intentional and disciplined about internal controls and public company readiness can minimize the challenges of external reporting as a public company.

Going concern assessments

closed-bar.jpg

Dan Brouillette/Bloomberg

While some industries and sectors have fully recovered, others continue to struggle. For example, companies in sectors such as restaurants and entertainment are reliant on large group gatherings and face significant headwinds. When providing information to auditors, organizations in these sectors will find it challenging to demonstrate adequate liquidity to finance their operations over the next 12 months. Companies should engage auditors as soon as possible and ensure forecasts are updated in light of the dynamic environment.

مجلس مراقبة حسابات الشركات العامة يقدم إرشادات حول استخدام أدلة التدقيق من مصادر خارجية

أصدر مجلس مراقبة حسابات الشركات العامة PCAOB إرشادات بشأن بعض الاعتبارات التي يجب أن تكون لدى المدققين حول ملاءمة وموثوقية المعلومات التي يحصلون عليها من مصادر خارجية ويخططون لاستخدامها كأدلة تدقيق.

معلومات إضافية

-

المحتوى بالإنجليزية

PCAOB offers guidance on using audit evidence from outside sources

By Michael Cohn

October 07, 2021, 1:22 p.m. EDT

2 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The Public Company Accounting Oversight Board staff issued guidance Thursday on some of the considerations auditors should have about the relevance and reliability of information they get from external sources and plan to use as audit evidence.

The guidance also deals with the relationship between the quality and quantity of audit evidence.

The PCAOB has been working on an Audit Evidence project and weighing whether to make changes to its existing standard, AS 1105, Audit Evidence, given the widespread use of audit technology tools at firms and the ready availability of information from sources outside a company, both in the financial reporting process and as audit evidence.

Advances in Tech brings together some of the latest software and technologies that are helping the industry move forward.

ACCOUNTING TODAY

The current AS 1105 standard explains what qualifies as audit evidence and lays out the requirements for designing and performing audit procedures to obtain sufficient appropriate audit evidence. The PCAOB staff noted in its new guidance that the expanded use of information from sources external to a company is affecting the volume and nature of information available to auditors to use in the performance of their audits.

Courtesy of PCAOB

“We also understand from our ongoing research project on audit evidence that auditors are seeking additional clarity on applying the requirements in AS 1105 when using information obtained from external sources as audit evidence,” said the document. “As part of our ongoing project, we continue to conduct research activities on other matters that may affect obtaining and evaluating audit evidence.”

The PCAOB has been undergoing an overhaul this year after the ouster of its chairman William Duhnke and SEC chairman Gary Gensler’s plans to replace the rest of the board members (see story). Much of the standard-setting work of the board is in a holding pattern, making the staff guidance even more critical.

The document discusses some examples of the types of externally sourced information that might or might not be used as audit evidence, including the year-end price of a publicly traded security on a stock exchange, pharmaceutical orders from wholesalers, historical loss information from other financial institutions, and weather data for predicting retail customer sales trends.

However, the guidance warns about the reliability of such information. “In general, information obtained directly by the auditor is more reliable than information obtained indirectly,” said the document. “For example, certain external information that is widely available can be obtained by the auditor directly from the source (e.g., the risk-free rate). External information whose distribution is more limited may need to be obtained by the auditor indirectly, for example, by extracting it from the information system of the company being audited (e.g., insurance claims data submitted to an insurer by a third-party health care provider). In this scenario, the effectiveness of the company’s controls over the external information may also affect the reliability of the information.”

توقعات عن ارتفاع رسوم التدقيق بنسبة 62٪ هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

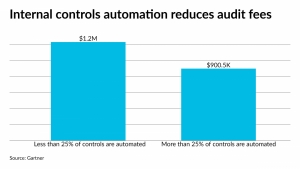

Clients anticipate that audit fees will increase in 2021 due to the impact of inflation, COVID-19, acquisitions and divestitures, according to a survey by Gartner.

The survey found that 62% of the companies polled are expecting audit fee increases this year, but that may be offset by technology savings. Organizations that automate at least 25% of their internal controls paid 27% lower audit fees on average, according to Gartner’s survey of 166 publicly traded and privately held companies. Of the respondents, 81% used a Big Four audit firm. Of the 166 organizations surveyed, Gartner analyzed 124 for the impact that internal controls automation had on the amount they ultimately paid in audit fees.

The survey revealed the steadily increasing amounts of audit fees, exacerbated by the inflationary pressures that have affected so many sectors of the economy this year as the U.S. and the rest of the world struggle to recover from the COVID-19 pandemic. The pandemic also accelerated the shift to technologies like remote audits over the past year, and the increasing use of automation for audits and internal controls as many auditors worked from home and away from their offices.

Companies with fewer than 50 controls, and more than 25% of them automated, reported 52% lower audit fees relative to ones with less than 25% of their controls automated. In comparison, companies with 50 to 250, as well as more than 250 controls and more than 25% automated, showed 27% lower audit fees.

“With audit fees increasing significantly, finance leaders should take note that organizations with higher levels of internal control automation saw substantially lower external audit fees on average,” said Ashwani Gupta, director in the Gartner Finance practice, in a statement Tuesday. “The biggest decreases were seen in organizations using between 1 to 50 controls, suggesting that getting internal control automation started has potential cost benefits when it comes to audit. Automation of internal controls can play a role in not only reducing financial reporting and audit risks but also audit costs. As organizations invest in internal controls automation it will likely become a prominent argument for audit fee reductions in the future."

Audit fee spiked the most last year in the banking and insurance sectors, with 69% of respondents in each category reporting increases. Financial services companies have more complex accounting processes and financial reporting exposures needing more auditor hours. Insurance companies also experienced some of the highest number of internal controls relative to companies in other industries.

On the other hand, the technology and telecom sector showed the lowest impact on fees, with only 41% of respondents reporting increases for 2020. The companies that did report fee increases most often indicated they were sizable, with 22% of overall respondents reporting “significant” audit fee increases of 6% or more, compared to the fees paid in 2019.

The main factors driving audit fee increases ranged from inflation to COVID-19 related, but organizations that negotiated on audit fees and made a strong case with their primary auditing firm were able to get a flat fee or a lower than expected audit fee increase. Of the respondents who attempted to negotiate their fees, 45% said their fees declined by over 6%, while half were able to cut their fees by between 3 to 6%.

دورة: التدقيق المحاسبي وضبط المخالفات والاحتيال وإدارة التحقيقات المالية

معلومات إضافية

- البلد عالمي

- نوع الفعالية برسوم

- بداية الفعالية الإثنين, 30 أغسطس 2021

- نهاية الفعالية الجمعة, 03 سبتمبر 2021

- التخصص محاسبة ومراجعة

- مكان الفعالية باريس (فرنسا)