عرض العناصر حسب علامة : التقارير المالية

تقارير مركز جودة المراجعة CAQ عن الإفصاحات المناخية في التقارير المالية

أصدر مركز جودة التدقيق تقريرًا يوم الخميس حول المتطلبات الحالية لمراجعي الشركات العامة فيما يتعلق بالإفصاحات المتعلقة بالمناخ والمكان الذي قد يتجهون إليه.

معلومات إضافية

-

المحتوى بالإنجليزية

CAQ reports on climate disclosures in financial reporting

By Michael Cohn

September 09, 2021, 1:51 p.m. EDT

2 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The Center for Audit Quality released a report Thursday on the current requirements for public company auditors regarding climate-related disclosures and where they may be heading.

The report, Audited Financial Statements and Climate-Related Risk Considerations, discusses the items that public companies are currently reporting and how that information is material to their financial statements.The document aims to give investors and other stakeholders a better understanding of the current climate-related reporting and auditing requirements in the U.S. and how they are applied.

The CAQ report comes at a time when the Securities and Exchange Commission is considering requiring public companies to disclose more information about the climate risks their organizations are facing, as catastrophic disasters across the U.S. and other parts of the world demonstrate the increasing urgency of the climate change crisis. Investors and other stakeholders are also increasingly asking for more detailed climate-related disclosures and environmental, social and governance reporting.

Courtesy of the Center for Audit Quality

Climate-related risks are often considered and assessed by management and auditors during the preparation and auditing of financial statements. Under current U.S. GAAP, climate-related risks can have a direct impact on the financial statements, an indirect impact, or in some cases no impact at all. Understanding the current financial statement requirements can be a good starting point for investors and others as they weigh how and where to get the climate-related information they need to make capital allocation decisions and bridge any information gap that may lie ahead in any future rulemaking by the SEC or others.

Automate the Last Mile of the Tax Engagement Process – Assembly, Delivery, and E-Signing

SPONSOR BY CONTENT

SPONSOR BY SAFESEND

“Investors are increasingly using climate-related information to inform their investment decisions,” said Dennis McGowan, vice president of professional practice at the CAQ, in a statement. “The current disclosure system is market-driven rather than based on regulatory action, so it is important for investors to both consider what public companies voluntarily report as well as to understand what they are required to report in the financial statements under U.S. GAAP.”

In June, the CAQ hosted a roundtable discussion with investors, board members, auditors and public companies to talk about the SEC’s request for public input on climate change disclosures. The majority of participants supported greater climate disclosure requirements.

الندوة المشتركة على الويب: الخصم في التقارير المالية

معلومات إضافية

- البلد عالمي

- نوع الفعالية مجانا

- بداية الفعالية الجمعة, 09 يوليو 2021

- نهاية الفعالية الجمعة, 09 يوليو 2021

- التخصص محاسبة ومراجعة

- مكان الفعالية أونلاين

تقرير اجتماع مجموعة تنفيذ المشاريع الصغيرة والمتوسطة الحجم في فبراير 2021 متاح الآن

معلومات إضافية

-

المحتوى بالإنجليزية

SME Implementation Group February 2021 meeting report posted

The meeting report from the SME Implementation Group meeting held on 4–5 February 2021 is now available.

The meeting report, recordings of the meeting discussions, the agenda and other related papers are available on the meeting page. - البلد الأردن

ملخص اجتماع المجموعة الاستشارية لتصنيف المعايير الدولية لإعداد التقارير المالية في فبراير 2021

معلومات إضافية

-

المحتوى بالإنجليزية

Meeting note—IFRS® Taxonomy Consultative Group

The IFRS Taxonomy Consultative Group (ITCG) met remotely on 1 February 2021. This note,

prepared by the staff of the IFRS Foundation, summarises the discussion. Related papers and a

recording of the meeting are available on the meeting page.

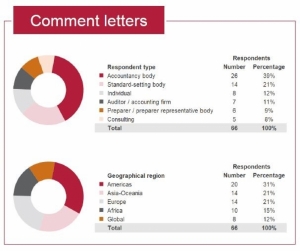

The ITCG discussed the feedback analysis on IFRS Taxonomy 2020—Proposed Update 4 General

Improvements and Common Practice—Presentation of information in primary financial statements.1

Feedback analysis on the Proposed IFRS Taxonomy Update 2020/4

1 The aim of the session was to provide the ITCG with a summary of feedback from the public on

the Proposed Update, and the planned response to that feedback.

2 Many ITCG members agreed with the planned response. No ITCG member said he or she

disagreed.

3 Some ITCG members explicitly agreed with the plan to:

a. research double tagging further and discuss this topic again at the June 2021 ITCG

meeting; and

b. go ahead with the proposal for double tagging for earnings per share because it is an

unusual case that merits its own approach.

4 One ITCG member does not consider the cases described in the paper to be instances of

double tagging. In this member’s view, the cases described simply reflect tagging of all

disclosed facts, and such tagging would apply regardless of how these facts are presented in a

printed report.

5 The staff plans to finalise the IFRS Taxonomy Update, to be issued by the Foundation at the

end of March together with the IFRS Taxonomy 2021.

Other announcements

6 The staff announced that the planned technical updates to the IFRS Taxonomy would be

delayed to the IFRS Taxonomy 2022.2 ITCG members expressed no concerns about this delay - البلد الأردن

دعوة لتقديم أوراق بحثية حول إفصاحات الشركات التي من شأنها أن تفيد عمل مجلس معايير المحاسبة الدولية

معلومات إضافية

-

المحتوى بالإنجليزية

01 February 2021

IASB, Accounting in Europe and The British Accounting Review publish joint call for research papers on corporate disclosures

The International Accounting Standards Board (Board), together with Accounting in Europe and The British Accounting Review, has published a joint call for research papers on one or more of the following topics:

compliance with mandatory disclosure requirements;

specific areas of interest to the Board; and

alternative research approaches.

The deadline for submissions is 31 January 2022.

Access more details about the call for research and how to submit papers.

إعلان مؤسسة المعايير الدولية لإعداد التقارير المالية عن الخطوة الأولى لتجربتها الرقمية المستقبلية

تعلن مؤسسة المعايير الدولية لإعداد التقارير المالية (IFRS) عن الخطوة الأولى في إصلاح التجربة الرقمية المستقبلية

معلومات إضافية

-

المحتوى بالإنجليزية

25 January 2021

IFRS Foundation announces first step in overhaul of future digital experience

The IFRS Foundation today announced plans to move the Foundation’s three existing websites into a single, unified platform. The new platform will launch in April 2021 and represents the first step in the Foundation’s multi-year programme to enhance the digital experience it offers its stakeholders.

In 2019, the Foundation began to transition its technology infrastructure to modern, cloud-based systems that facilitate more efficient internal working practices while also permitting the Foundation to deliver over time an enhanced digital experience to its stakeholders around the world. As part of that programme, the Foundation is nearing completion of its work to consolidate three of its existing websites (public website, eIFRS and archive) into a single, unified online presence.

The new website will look familiar, but we have responded to feedback from website users by introducing new innovations, such as a new Standards navigator, enhanced personalisation options and an improved search facility. There are also further updates planned. These innovations have required a move to a new content management system, which will result in some actions for existing users. Therefore, the Foundation is providing advance notification to users of its websites of the following changes from April 2021:

Existing public website (www.ifrs.org): Most users of the public website will be able to access content as before. The web addresses for the main website sections, including the work plan and active projects, will remain as is, but links to other content may require updating. Those users that login to the public website using a username and password (to submit comment letters and manage ‘follows’) will be required to update their information and preferences on initial login.

eIFRS (eifrs.ifrs.org): The content of eIFRS, which includes IFRS Standards and related information, will be incorporated into the new public website, accessible via a new Standards navigator. If you are an existing subscriber to either eIFRS Basic (the free-of-charge subscription offering access to core IFRS Standards) or eIFRS Professional (the paid-for service to access all current and historic content related to IFRS Standards), you will get automatic access to the equivalent new service. You will also be able to access the old eIFRS platform until it is decommissioned at the end of December 2021. Upon first logging in to the new system, you will be asked to update your registration details. If you currently access eIFRS Professional without having to sign in with a username and password, it means you have direct access through a third party that has a licence agreement with the Foundation. The Foundation is working with all licence holders to provide you with access to the new service. Please liaise directly with your licence holder. All eIFRS Professional users will continue to have access to the legacy eIFRS platform until the end of 2021.

Archive (archive.ifrs.org): A previous version of the Foundation’s website has been available since 2017, hosting content that was not migrated to the current platform. Guided by data on traffic to the archive, the Foundation has now completed migration of most of the content from the archive to its public website. As a result, the archive site will be decommissioned once the new public website is launched. Any remaining content will be preserved and accessible on request.

Commenting on the announcement, Lee White, Executive Director of the IFRS Foundation, said:

Our new online platform presents one of the first tangible opportunities our stakeholders will have to benefit from the work that has been ongoing to modernise the Foundation’s digital infrastructure. We have exciting plans for our digital future, but also recognise the need to help minimise the burden on stakeholders as we transition to these new platforms.

Further details can be found within our frequently asked questions section.

تحديث المعايير الدولية لإعداد التقارير المالية لشهر ديسمبر 2020 للشركات الصغيرة والمتوسطة

تحديث المعايير الدولية لإعداد التقارير المالية للمنشآت الصغيرة والمتوسطة هو ملخص فريق العمل للأخبار والأحداث والمعلومات الأخرى حول معيار IFRS للشركات الصغيرة والمتوسطة

البحث عن متطوعين للعمل في المجلس الدولي لمعايير المراجعة والتأكيد

هل أن تصبح محاسبًا قانونيًا معتمدا CPA هو الخطوة المهنية الصحيحة؟

CPA هو اختبار المحاسب القانوني المعتمد (Certified Public Accountant) ينظّم من قبل معهد المحاسبين القانونيين المعتمدين في الولايات المتحدة الأمريكية AICPA