عرض العناصر حسب علامة : تكنولوجيا

رسالة ماجستير: تفعيل استخدام تكنولوجيا المعلومات في الفحص الضريبي للحد من الفجوة الضريبية

هدفت الدراسة تفعيل استخدام تکنولوجيا المعلومات في الفحص الضريبي للمسجلين بالضريبة على القيمة المضافة VAT على الضريبة المستحقة والفجوة الضريبية

المحاسبون: قلقون من التكيف، وليس استبدالهم

مهما كانت مخاوفهم، فإن التقدم المستمر للتكنولوجيا لن يحل محل المحاسبين -ولكنه سيتطلب منهم تغييرًا كبيرًا، وفقًا لجيسون ماركس، الرئيس والمدير التنفيذي لشركة Wolters Kluwer Tax & Accounting.

معلومات إضافية

-

المحتوى بالإنجليزية

Accountants: Worry about adapting, not being replaced

By Daniel Hood

October 29, 2021 9:00 AM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Jason Marx of Wolters Kluwer addressing the 2021 CCH Connect conference

Jason Marx of Wolters Kluwer addressing the 2021 CCH Connect conference

Whatever their fears, the perpetual advance of technology isn’t going to replace accountants — but it will require them to change significantly, according to Jason Marx, president and CEO of Wolters Kluwer Tax & Accounting.

“Accountants need to think much more about adaptation than replacement,” Marx told attendees at the company’s annual user conference, being held this week in Austin, Texas. “Technology improves efficiency, by removing manual steps and by reducing human error. It drives straight-through processing, rather than replacing accountants, and it frees them to focus on the more strategic work requiring creativity, collaboration and imagination.”

That is, of course, only true if they take advantage of the tools at hand: Marx contrasted a 2019 Robert Half survey in which accountants overwhelmingly reported being concerned about the potential for technology with a 2021 Wolters Kluwer study that showed that just 7% of small firms — and only an astonishing 2% of large firms — believe that they are maximizing their use of technology.

He believes that tax and accounting professionals are more than up for the challenge, however. “You are part of a profession that has proven its grit, its determination and its resilience over and over,” he told conference attendees. “You have served as the quiet heroes behind the scenes to keep businesses running during very, very difficult times. You’ve been balancing the implications of new tax regulations, accelerating market trends for technology and for mobility, a real war for talent, and urgent client demands around the clock.”

To help them understand and face all those challenges, he explained five broad market trends that are shaping accounting, and that they’ll need to bear in mind as they move forward.

1. The move to the cloud

“The pandemic served as catalyst for establishing the value and flexibility of cloud software,” Marx said. “It’s brought factors like high availability, lower costs for disaster recovery, business continuity, remote workforce management and business agility,” and the shift has only been accelerating.

2. The shift to remote work

While this move is driving a need for both tighter collaboration and efficiencies in the client experience, its impact is really being felt internally. “Staff experience has become much more relevant, with the increasing impacts of the war for top talent, which were certainly aggravated by the pandemic,” Marx explained.

3. The growing requirements for real-time data exchange and reporting

“This is being driven by automated source data capture by regulatory reporting that requires consistent data, and the growing importance of APIs that allow firms to treat platforms like our own CCH Axcess as a central hub,” according to Marx.

4. Emerging tech enabling higher-value work

By reducing manual data entry and by improving accuracy, emerging and advanced tech tools — and at least 90% of firms are hoping these tools will help them achieve improved results next tax season, according to a 2021 Wolters Kluwer survey cited by Marx. “Forty percent of all firms said they were innovators or early adopters of technology, and 54% of large firms, and all of them reported higher confidence levels and better results than firms that label themselves as slower to adopt.”

5. Legislative and regulatory change

The volume, speed and intensity of legislative and regulatory change is getting overwhelming. “There is no doubt that the pace of regulatory has changed over the last several years — well, you know it; you live it. It’s pretty much non-stop, and we don’t see that changing,” said Marx. “Many of you wonder if we will ever see a return to a normal tax season, but planning for tax season is becoming more complicated by late changes to filing deadlines and forms.”

4 تغييرات ستستمر في المحاسبة لفترة طويلة بعد انتهاء الوباء

لقد أثرت التأثيرات بعيدة المدى لوباء COVID-19 على كل صناعة في جميع أنحاء العالم، ولم يعد خبراء حماية البيئة محصنين.

معلومات إضافية

-

المحتوى بالإنجليزية

4 changes that will stick with accounting long after the pandemic is over

By Justin Hatch

October 12, 2021 3:24 PM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The COVID-19 pandemic’s far-reaching effects have touched every industry around the world, and CPAs are not immune. Not only were CPA firms working to help the businesses they serve survive economic challenges, but they were fighting their own battles as well. According to one survey, approximately 90% of CPA firms reported concerns for their company, ranging from health to finances and operations. Despite the challenges, firms also reported facing the challenges with innovations like using cloud technology and innovation.

Necessity is the mother of invention — or in some cases, reinvention. The accounting industry was forced by COVID-19 to evolve almost overnight, and not all of the changes that occurred will be going away. Here are some of the adaptations that will be part of the industry going forward.

Adaptability

coronavirus-mask.jpgCPAs have learned to adapt quickly to changes in their work, whether it be major financial programs like the Paycheck Protection Program or adjusting the way they work with clients. Clients have come to expect continually up-to-date information from their CPA anytime they need it, and there will be no going back. Customers will expect their accountants to be able to come up with solutions at the drop of a hat, whether or not there is an international crisis.

Not only will customers continue to demand more agility from CPAs, but there will always be rapid changes that require accountants to think on their feet. CPAs stood tall when the challenge arose in 2020, and the pandemic only made them more able to face any new obstacles in the future.

Better communication

A lack of in-person interaction could be detrimental for some, but for CPAs, it may have actually been a boon. Trying to work remotely with clients forced CPAs to communicate more effectively. Cloud-based dashboards, video conference calls, chatting online, and sending frequent emails are the norm now, whereas both CPAs and clients may have been reluctant to give them a try before.

Clients couldn’t be left hanging during a pandemic that had major financial implications. They needed fast, insightful information about new programs and how they could help their business, and it was up to CPAs to stay on top of it all and boil it down for them. The result is CPAs who are better communicators for future clients as well.

Flexible work environment

COVID-19 brought about a sudden adjustment as workers moved from conference rooms to living rooms. Though many businesses, including CPA firms, later began bringing workers back, the office landscape has likely changed for good. More workers are staying in their home offices full time or choosing a hybrid option, with some working from home and some in the office. This shift not only affects the way a CPA firm runs internally but also how it will serve its clients — many of whom are shifting to more remote work as well.

CPAs and clients alike learned to work with each other from a distance, and that will add a level of flexibility going forward that will benefit everyone. Businesses will come to rely on their accountants outside of more traditional meetings and scheduled reports, and CPAs will be able to answer the bell from anywhere if needed.

Expanded services

The Paycheck Protection Program was a much-needed life preserver for struggling businesses in 2020, but the intricacies of the program were a lot to work through. Applications, required paperwork, loan forgiveness and other factors could make the program confusing for business owners. CPA firms reported expanding services to help businesses take advantage of the program, making up 39% of new services offered to clients.

Although this service was directly related to the pandemic, firms will continue to expand their offerings even after the pandemic is in the past. In a 2021 survey, 33% of firms reported they anticipated adding new services like financial advisory, cash flow and risk advisory in the next year.

Many of the changes brought on by COVID-19 were already in motion in the industry, but firms got the extra push they needed to move forward. Businesses have been seeking more advisory services from their CPAs for years, and many firms have begun to expand their offerings. The pandemic, and the severe economic impact it had across industries, helped move the transition along.

CPAs have fought alongside their clients through the COVID-19 pandemic, and their work has been vital to businesses’ success through the crisis. The lessons learned from the pandemic will have a long-lasting impact on the profession as CPAs continue to adapt and grow for the benefit of their clients.

البث الشبكي الخاص: الذكاء الاصطناعي: الرقابة وإدارة المخاطر والمساءلة

معلومات إضافية

- البلد عالمي

- نوع الفعالية برسوم

- بداية الفعالية الخميس, 30 سبتمبر 2021

- نهاية الفعالية الخميس, 30 سبتمبر 2021

- التخصص تكنولوجيا

- مكان الفعالية أونلاين

ثلاث أدوات إنتاجية لا يمكن لشركتك الاستغناء عنها

معلومات إضافية

-

المحتوى بالإنجليزية

productivity tools your firm cannot go without

After a busy season like we just had, I’m sure you’ll be in the market for anything that can make your life easier and more efficient. There are myriad tools out there tugging for your attention. Many are pretty good, but I’m not going to talk to you today about software for tax prep, bookkeeping or reconciliation, etc. I want to discuss four powerful, surprisingly affordable tools you can use to create better relationships with your clients. Good news, there is almost no learning curve required to start putting these tools to work for you today.

Reminder: Each of the four tools has a free version, but I strongly recommend paying a few bucks per month for the premium version. (Disclosure: The author has no commercial or promotional interests in any of the companies, products or services mentioned herein.) The premium features such as unlimited meeting time, personal branding, on-screen drawing features and more will make you look much more professional. Your client relationships are the most important things you have in your practice. Shouldn’t you be investing in them?

Zoom (video conferencing)

Zoom videoNo need to spend much time here. Virtually everyone has used Zoom. Many use the free version, but for just $15 per month, you get custom branding, unlimited meeting times, and plenty of other bells and whistles. To get more out of Zoom, see my article Work-from-home tools to master: Zoom for video conferencing.

Loom (video messaging)

Your clients and team members have complex questions all the time. Sometimes, tapping out an email response, text message or voicemail is not the best way to get your point across. There are times when you want to walk a client through a screen and show them something important on that screen while also allowing them to see your reassuring face. Loom is a handy screen-recording tool that allows you to do just that. It’s almost like having your client in the office with you.

Here’s a test: Next time a client has a question about their tax return, instead of calling them and talking them through it, send them a Loom video recording of you walking through their tax return. See what kind of response you get. I’ll bet they love it.

Video-messaging tools can save you a ton of time. And clients seem to pay closer attention to messages in video form than they do in voicemail or email form. My recent article has more about creating a video recap of your clients’ tax returns.

For more about incorporating Loom into your practice see my article Work-from-home tools to master: Video messaging.

The premium version of Loom is about $8 per month for custom branding, a video drawing tool and calls to action.

Calendly (automated scheduling)

Your clients don’t want to play phone tag or email tag with you and your team anymore. Instead of having everyone chasing their tails during busy season, send them a link to your online calendar. Calendly and other online scheduling apps let you control exactly when you want to make yourself available for client meetings, and when you don’t.

Clients simply click on the custom link you share with them and automatically book a meeting time without having to go through you or an administrative assistant. If a client must reschedule at the last minute, no problem. They just go to your Calendly link, find an open time slot, and rebook. No need to check with you or staff to see if the new time is convenient. For about $100 a year ($8 per month), Calendly essentially removes the need for a full-time staff person, and clients love using it because it’s so convenient.

For more about using Calendly to your advantage, see my recent article Take control of your calendar this busy season.

توقعات عن ارتفاع رسوم التدقيق بنسبة 62٪ هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

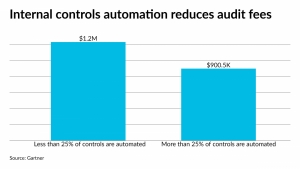

Clients anticipate that audit fees will increase in 2021 due to the impact of inflation, COVID-19, acquisitions and divestitures, according to a survey by Gartner.

The survey found that 62% of the companies polled are expecting audit fee increases this year, but that may be offset by technology savings. Organizations that automate at least 25% of their internal controls paid 27% lower audit fees on average, according to Gartner’s survey of 166 publicly traded and privately held companies. Of the respondents, 81% used a Big Four audit firm. Of the 166 organizations surveyed, Gartner analyzed 124 for the impact that internal controls automation had on the amount they ultimately paid in audit fees.

The survey revealed the steadily increasing amounts of audit fees, exacerbated by the inflationary pressures that have affected so many sectors of the economy this year as the U.S. and the rest of the world struggle to recover from the COVID-19 pandemic. The pandemic also accelerated the shift to technologies like remote audits over the past year, and the increasing use of automation for audits and internal controls as many auditors worked from home and away from their offices.

Companies with fewer than 50 controls, and more than 25% of them automated, reported 52% lower audit fees relative to ones with less than 25% of their controls automated. In comparison, companies with 50 to 250, as well as more than 250 controls and more than 25% automated, showed 27% lower audit fees.

“With audit fees increasing significantly, finance leaders should take note that organizations with higher levels of internal control automation saw substantially lower external audit fees on average,” said Ashwani Gupta, director in the Gartner Finance practice, in a statement Tuesday. “The biggest decreases were seen in organizations using between 1 to 50 controls, suggesting that getting internal control automation started has potential cost benefits when it comes to audit. Automation of internal controls can play a role in not only reducing financial reporting and audit risks but also audit costs. As organizations invest in internal controls automation it will likely become a prominent argument for audit fee reductions in the future."

Audit fee spiked the most last year in the banking and insurance sectors, with 69% of respondents in each category reporting increases. Financial services companies have more complex accounting processes and financial reporting exposures needing more auditor hours. Insurance companies also experienced some of the highest number of internal controls relative to companies in other industries.

On the other hand, the technology and telecom sector showed the lowest impact on fees, with only 41% of respondents reporting increases for 2020. The companies that did report fee increases most often indicated they were sizable, with 22% of overall respondents reporting “significant” audit fee increases of 6% or more, compared to the fees paid in 2019.

The main factors driving audit fee increases ranged from inflation to COVID-19 related, but organizations that negotiated on audit fees and made a strong case with their primary auditing firm were able to get a flat fee or a lower than expected audit fee increase. Of the respondents who attempted to negotiate their fees, 45% said their fees declined by over 6%, while half were able to cut their fees by between 3 to 6%.

5 تحديات أخلاقية ستشتد مع زوال الوباء

لأكثر من عام، تم اختبار العالم من خلال التحديات الناتجة عن جائحة COVID-19. ردا على ذلك، أظهر المحاسبون مرونة هائلة

معلومات إضافية

-

المحتوى بالإنجليزية

5 Ethics Challenges that Will Intensify as the Pandemic Wanes

For more than a year, the world has been duly tested by the challenges resulting from the COVID-19 pandemic. In response, professional accountants have shown tremendous resilience. However, as jurisdictions around the world progress toward a more hopeful future, the ethics challenges the accountancy profession and stakeholders face are far from over.

In fact, they might intensify.

As the pandemic fades, many entities will be eager to demonstrate their potential by posting quick wins and an accelerating recovery. Others will continue to navigate the intricacies of government support schemes, and, as those taper, some entities will find themselves on the brink of insolvency. Just as the economic impacts of this crisis unfolded in an uneven and unpredictable manner around the world, so too will recovery efforts. Professional accountants must anticipate a continued period of heightened uncertainty and prioritize their ethics responsibilities all the more.

Since Q2 of 2020, members of a Working Group formed by the International Ethics Standards Board for Accountants (IESBA) and National Standard Setters (NSS) from Australia, Canada, China, South Africa, the U.K., and the U.S. have been meeting regularly to discuss the key ethics issues exacerbated by COVID-19. The Working Group’s charge is to develop implementation support to assist professional accountants in effectively applying the International Code of Ethics for Professional Accountants (including International Independence Standards) (the Code) when facing circumstances created by the COVID-19 pandemic.

Below is an examination of several ethics considerations that will be especially pressure tested during this period of recovery. Facing these conditions simultaneously demands renewed focus on the dynamics that exist in the relationship between professional accountants and entities as they face extraordinary circumstances for at least the next few years.

1. Pressures from an Uneven Economic Recovery: Accountants Must Be Agile Yet Resolutely Committed to the Code of Ethics

Every entity, sector, and jurisdiction will emerge from this global crisis differently. While at least one dose of the vaccine has been administered to approximately 60% of people in Israel, 52% in the U.K., 43% in Chile and the 45% in U.S. as of early May 2021, other countries do not anticipate vaccine availability increasing until at least the second half of the year. For professional accountants, that might mean working within employer organizations and serving client entities that are in vastly different stages of recovery. The truth of the matter is even when an economy fully reopens, there is likely to be at least 12-18 months more of rebuilding and playing catch-up that still has to occur. During this time of profoundly uneven progression, professional accountants will be under huge strain.

We all face a new reality ahead. The pandemic created myriad opportunities for unethical behaviour. The uneven recovery might breed more of these opportunities. These might arise, for example, from increased estimation uncertainty because previous estimations established during the pandemic will be based on facts or assumptions that might no longer apply. In the context of audits of financial statements, pressures from the client and from the rapidly shifting landscape during the recovery might weigh on judgments and decisions regarding the use of non-traditional audit procedures without proper regard for the fundamental principles of objectivity, and professional competence and due care.

Agility will be a critical skillset in navigating the uncertain months and even years ahead. Importantly, while remaining nimble, professional accountants must continue to adhere to the Code, including applying its conceptual framework in these atypical situations.

2. Demands for Greater Support and Efficiency: Auditors of Financial Statements Must Carefully Consider Independence and Familiarity Issues

In the coming months, auditors of financial statements must balance a multitude of unexpected variables. Client demands will likely increase and fluctuate widely. Audit firms will be asked to do things, formally and informally, to support and advise their clients. It’s imperative that auditors continue to acknowledge that the provision of a non-assurance service to an audit client, including advice or recommendations, might create independence issues and heighten ethics pressures. For example, auditors must be cognizant of the pressure to turn a blind eye, act without due care, inadvertently take on a management responsibility for an audit client, or provide inappropriate opinions on the viability of business operations and assets that have likely fluctuated tremendously. In some jurisdictions, such as the U.K., missed filing deadlines and the failure on some companies’ part to apply for extensions have led to automatically downgraded credit ratings. As a result, companies are pressured to have their audits completed quickly at any cost. The ethical responsibility to comply with the Code’s fundamental principles of integrity, objectivity, professional competence and due care, as well as professional behavior must remain top of mind.

In the wake of particularly challenging financial periods, some entities – especially those that are small and less complex – might want to avoid the additional complications and costs of engaging more advisors and feel inclined to streamline professional support by turning to their auditors. Auditors that provide such non-assurance services (NAS) to audit clients must continue to comply with the Code’s NAS and Fee-related provisions. In particular, auditors should be on the lookout for changes that might affect an audit client’s ability to make all judgments and decisions that are the proper responsibility of management. Further, it is important that the pressures of the pandemic do not undermine the auditor’s obligation to identify, evaluate and address threats to independence that might arise from the provision of such NAS.

The business environment in which the broader accountancy profession operates has gone through unprecedented changes. Such changes have implications on employing organizations, the internal operations of firms, the clients they serve, as well as the nature of certain client interactions and relationships. For professional accountants to maintain the highest standards of ethical conduct, and where applicable, be independent, they must remain alert to new information and changes in facts and circumstances. For example, think about public companies that link the finance team’s compensation to the organization’s performance. In such instances—especially at a time when these companies might be struggling financially—professional accountants (both in business and in public practice) must be keenly attuned to what motivates management, and how these motivations might bias key performance factors or indicators such as revenue forecasting, assumptions and estimates.

3. Risks Regarding Rapid Digitalization: Accountants Must Be Alert to Cyber Crimes

The rapid speed of digitalization and tech adoption has raised questions about how accountants and firms are to identify, evaluate and address threats to compliance with the fundamental principles and independence that might be created by the development, use and implementation of technology. In Australia alone, 79% of small and medium businesses say they are expanding software purchases for a more digital future, according to a Gartner study. Nearly half say digital solutions upgrades are happening as a direct result of the pandemic. Even under the best circumstances, the acceleration of digital transformation presents risks. In crisis circumstances, those risks increase exponentially.

For example, the pandemic saw cybercrimes and fraud increase globally as unusual and remote circumstances were taken advantage of and new ways to exploit a broader and deeper range of organizations and individuals were found. In the U.S., cybercrime reports nearly doubled in 2020, according to the Federal Bureau of Investigation. The U.K. saw at least a 30% increase. In parts of Latin America, cybercrimes spiked 60% in the early months of COVID when compared to the same period in 2019. This stark trend is unlikely to abate during the recovery phase, highlighting the continuing challenges to adhering to the fundamental principles of integrity, objectivity, professional competence and due care and confidentiality, especially as companies might have skipped steps or cut corners on cyber security and related measures to keep doing business in the remote environment. Professional accountants and firms should consider whether circumstances may warrant the use of specialists during this time to assist in identifying, evaluating and addressing new risks, such as cyber threats.

Moreover, as jurisdictions see some return to pre-pandemic norms, many entities will likely choose not to return to fully in-person workplaces, and many professionals, including accountants will elect to continue working remotely where possible to preserve the flexibility afforded to them during COVID. Employing organizations must become ever more diligent and innovative in transitioning back to in-person work. It is critical to consider architecting hybrid or virtual protocols that consider best practices, including for example, data hosting and management functions while faithfully abiding by ethical obligations. The risks of complacency are far too great. Professional accountants must apply a deeper understanding of data analytics and technology to their work while being fully attuned to the ethical risks in order to uphold the profession’s good reputation.

As professional accountants continue to evolve ways of working in a world that is more hybridized, with companies operating from both offices and employees’ homes, several personnel factors should be considered. First are concerns about the skills required to operate effectively and ethically in a more digital environment. The profession will need to further invest in professional competencies regarding technology and information systems. Related to that are concerns around capabilities and learning for new talent, who might be at a disadvantage stemming from a lack of in-person interaction with more senior colleagues.

4. Burnout and Mental Health of Teams and Talent: Accountants Must Strive for Resiliency and Solutions

There is growing concern around mental wellness and the state of mind that is required to think critically, rather than just accept information at face value. More than a year into the pandemic, individuals are under immense stress and many are suffering emotionally. In 2020, various studies showed that many adults in jobs that did not normally require them to work outside of their homes reported symptoms of depression and anxiety.

The accountancy profession must be cognizant of the mindfulness required to act competently, with integrity and due care, and to be objective in exercising judgments without being compromised by bias. As such, professional accountants must be conscious of issues colleagues could be facing—and not talking about—that might impact judgments and ethical decision making.

The need for strong organizational culture, with established and open communication channels, as well as protocols for how to address circumstances where staff might not be able to bring their full mental acuity to a particular task or job, is essential as complexities and stressors proliferate.

5. Predisposition to Focus on the Past: Accountants Must Recognize the Shift and Focus on the Future

One of the biggest challenges professional accountants face amidst the pandemic recovery will be continuing to seek out a better understanding of the issues that still lie ahead and what the ethics consequences of them might be. For example, the pace of digital transformation and use of technology such as machine learning automation in products and services has been unprecedented. In addition to the challenges related to cyber security and fraud mentioned above, it is imperative the profession stay on top of responsible automation.

As trusted advisors, it is the duty of professional accountants to be competent in these advancements where they are involved in their development and implementation. This involves attaining and maintaining the knowledge and skill required for the job. In the context of today’s world, this means learning how to properly understand threats to the fundamental principles of ethics from the technology. As new or unresolved issues from the pandemic emerge, it will result in higher degrees of uncertainty which will make it increasingly difficult to keep a focus on evolving the profession for the future, but this will be a necessity. Together, professional accountants must acknowledge how the pandemic changed companies and social norms and strive to be a step ahead.

Professional accountants, like others in the workforce, are operating within an unusual context right now. Around the world, corporate priorities and public expectations are changing rapidly. These changes will have implications on the accountant’s role. For example, the rise in stakeholder capitalism and subsequent call for Environmental, Social and Governance (ESG) reporting are leading investors to not only seek more reliable and comparable information in the area of ESG reporting, but also obtain assurance on such information. Professional accountants must answer that call.

While we begin to realize life beyond COVID-19, we must all be increasingly thorough in assessing the impact these changes are having on views and perceptions about ethics requirements, especially as it relates to the relationship between the accountant and the entity. Just as the pandemic increased risks of unethical behaviour, efforts to rebuild will equally increase opportunities to evolve for the better.

أمازون والضرائب العالمية

معلومات إضافية

-

المحتوى بالإنجليزية

A U.S.-driven effort to reach a global accord on taxing big tech companies’ overseas profits is getting bogged down over ensnaring one firm in particular: Amazon.com Inc.

A Treasury Department proposal, which was distributed to other governments earlier this month and has been seen by Bloomberg, would subject about 100 of the largest and most profitable companies to greater taxation in countries where the firms’ users and consumers are located, as opposed to the countries where they’re headquartered.

The idea is that the new rules would apply to any large companies that exceed certain numbers, yet to be determined, for their annual revenue and profit margin. Before Treasury Secretary Janet Yellen this month jump-started efforts that the Trump administration had opposed, the talks focused on digital and “consumer-facing” businesses — definitions countries had struggled to reach agreement on.

An employee takes a package from the conveyor belt at an Amazon.com Inc. fulfillment center in Kegworth, U.K.Chris Ratcliffe/Bloomberg

The global talks, led by the Organization for Economic Cooperation and Development, are trying to address many countries’ concerns that tech giants — and other multinationals — aren’t being properly taxed under the current system of rules. The OECD effort seeks to replace the digital services taxes a growing number of countries are enacting to capture more revenue from companies like Google, Facebook and Amazon.

But Amazon’s unusual status as a low-margin tech giant is emerging as a sticking point in negotiations. Seattle-based Amazon recently reported a global operating margin across its businesses of 5.5 percent; that compares with Facebook’s margin of 45.5 percent and 27.5 percent at Google parent Alphabet Inc.

The U.S. proposal called for including only “the largest and most profitable” multinational corporations. It didn’t call for specific numbers, but both revenue and profitability thresholds would have to be set high to capture just 100 companies.

Two Italian government officials, speaking on condition of anonymity, said Amazon should be covered and there’s no reason why a global tax accord can’t capture companies with narrow profit margins but high revenue. Italy, the euro area’s third-biggest economy, has imposed a 3 percent tax on companies with overall revenue above 750 million euros ($903 million) and revenue from digital services in Italy above 5.5 million euros.

A European Commission spokesperson said Tuesday that while the U.S. proposal offers a “promising opportunity” for progress toward a deal, “we should not forget what the initial policy rationale was: a fairer taxation of the digital economy. It is essential that any proposal on the table also addresses this challenge.” A French finance ministry official said they are still examining the U.S. proposal to determine if it would cover all digital multinationals.

The U.S., however, has long opposed an agreement that singles out a particular slice of the economy, such as rules that only affect digital companies, and the new Treasury proposal is intended to make the plan’s scope more quantitative and objective.

U.S. officials are aware that other finance ministries are trying to get low-margin companies captured within the profitability threshold, according to people familiar with the matter, who said Amazon is the target of these discussions. The U.S. continues to oppose efforts to target any single company or sector, said the people, who asked not to be identified.

The U.S. Treasury and Paris-based OECD declined to comment. Amazon didn’t respond to a request for comment.

Not ‘discriminatory’

“We’ve made it very clear to our European counterparts that we will not support a tax that is discriminatory toward American companies,” Wally Adeyemo, the deputy Treasury secretary, said earlier this month on CNBC.

No matter how successful an accord might otherwise be in reshaping tax collection and satisfying calls for multinational firms to pay their fair share to governments, failing to apply it to Amazon — led by the world’s richest person, and a regular target for progressive U.S. lawmakers like Bernie Sanders and Elizabeth Warren over its low tax bill — would risk public opposition to ratification in the U.S. along with European nations.

“Ultimately, it must catch Amazon, otherwise it will be deemed a failure,” and countries might unilaterally introduce their own measures, said Tommaso Faccio, an official at the Independent Commission for the Reform of International Corporate Taxation, a group advocating for overhauling global taxes.

Negotiators are considering the U.S. pitch as nearly 140 countries work to find consensus on both the profit reallocation plan and a global minimum tax, and present it to Group of 20 finance ministers in early July. President Joe Biden recently proposed raising the U.S. minimum tax so the country can collect more revenue from multinational firms and help pay for a $2.25 trillion infrastructure and jobs package.

Business lines

Amazon CEO Jeff Bezos has consistently set low profit targets, preferring to invest in the business, which also reduces the company’s tax obligations. Amazon had 2020 sales of $386 billion, more than Facebook and Google combined, yet it paid less than either company in income taxes. Amazon’s retail business, which includes warehouses around the country and delivery services, costs more to operate than digital advertising businesses run by Google and Facebook.

One method under consideration for including Amazon in the rules would be to allow taxation on specific lines of business, rather than just companies as a whole, according to the people familiar with the matter. For example, if the rules considered the lucrative Amazon Web Services business — with an operating margin of 28 percent — separately from the company’s lower-margin retail arm, countries could still see some of the company’s profits reallocated.

While the U.S. isn’t completely opposed to targeting business lines, it prefers any such practice to be limited, the people said.

In public consultations on previous iterations of the OECD plan, companies have argued that business-line segmentation will become overly complex.

Or, negotiators could also find a different way of setting the revenue and profitability thresholds that does capture the company, Faccio said. That would also risk making the rules more convoluted, after the U.S. proposal sought to simplify what had become an overly complicated determination of which companies would be covered.

“The administration clearly saw the need to inject momentum,” and decided to limit the proposal’s scope in an attempt to get an overall agreement by July, said Alex Cobham, chief executive at the Tax Justice Network. “But the politics will look less smart if the most high-profile companies in terms of public concern about tax abuse turn out to be excluded.”

— With assistance from Spencer Soper, Laura Davison, William Horobin and Nico Grant

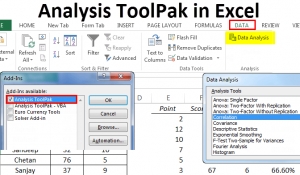

كيفية إضافة حزمة أدوات تحليل البيانات إلى Excel؟

كوفيد -19 تضخم تحديات النزاهة للشركات في الأسواق الناشئة

يظهر تقرير "النزاهة العالمية 2020" الصادر عن شركة EY تفاوت وتنوّع تأثيرات كوفيد-19 على السلوكيات الأخلاقية في الأسواق الناشئة

معلومات إضافية

-

المحتوى بالإنجليزية

As organizations transition from managing the COVID-19 crisis towards building economic resilience, the EY Global Integrity Report 2020 reveals some diversity regarding the impact on company ethics. The findings are part of a survey highlighting the views of 2,948 board members, managers, and employees from emerging markets around the globe. In the Middle East, the survey covers interviews with 175 respondents in the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA).

The report reveals that 63% of global respondents believe that businesses operating in emerging markets are likely to be impacted adversely by the current disruption.

The survey also highlights that regulatory scrutiny and remote working aggravate these issues. A total of 32% of global respondents in emerging markets said they believe that bribery and corrupt practices present the greatest risk to the long-term success of their businesses, roughly on a par with 30% of respondents in the UAE and 31% in KSA.

Globally, 30% of respondents believe that a cyber and ransomware attacks are a significant risk to the long-term success of organizations. This is lower than in KSA, where 32% believe it is a threat, but is significantly higher than in the UAE, where only 15% expressed concerns.

Mohammad Malkawi, KSA Forensic & Integrity Services Leader at EY, said:

“The disruption caused by COVID-19 poses a risk to ethical business conduct, making it imperative for corporations and firms of all sizes to continue being vigilant on compliance related issues. This holds true for organizations around the globe, as well as in the UAE, KSA and elsewhere around the region. Business leaders must make a firm commitment to encourage a culture of integrity and trust among all stakeholders. Particular attention must be placed towards risks of fraud, bribery and corruption, the threat of cyber attacks, and a constantly evolving regulatory environment. Ultimately, this will be the key towards creating long-term value and ensuring stability.”

The report highlights four key areas that organizations should consider to manage the risk of corporate misconduct more effectively:

Corporate integrity should be a top priority in management’s playbook

Business leaders are in a key position when it comes to taking difficult decisions. The report highlighted that 55% of global respondents in emerging markets say that their management communicates frequently with them on the importance of operating with integrity.

Voicing misconduct through whistleblowing channels

Globally, 37% of respondents in emerging markets say that they not reported concerns about integrity due to apprehensions about their career progression.

In the UAE, 29% reported keeping concerns to themselves because they were concerned about their future career. A slightly larger figure - 31% - said they felt like their concerns would not be acted upon. In KSA, 27% said they stayed quiet as a result of career concerns, compared to 39% who felt their concerns would not be acted upon.

In a post-pandemic environment, businesses must take steps to ensure that employees feel comfortable reporting instances of misconduct and protect would-be whistle-blowers from retaliation of any kind. Training and awareness programs should become institutional pillars in the corporate governance framework of organizations.

Embracing disruptive technologies while protecting data

Around the world, emerging markets are embracing new and disruptive technologies and adapting towards a general shift towards the digital realm. This shift, however, brings with it a host of potential security problems and amplifies risk exposure for organizations. Notably, the report showed that in emerging markets, 55% offered training to employees on prevention of data security breaches, compared to 45% in developed markets, leading the way to mitigate risks. Emerging markets also performed well with regards to organizational preparedness, with 42% of global respondents having an incident response plan in place.

Tackling third party integrity risks

The need to establish remote working protocols in many locations as a result of the pandemic has also made it riskier to manage third-party relationships – and conducting adequate due diligence before onboarding a third-party vendor is critical to mitigate long-term risks. According to the survey results, 35% of businesses in emerging markets are confident that their third-party partners operate with integrity. This was even higher in KSA - with 43% of respondents comfortable with the integrity of their third-party partners, but markedly lower in the UAE, where only 20% of businesses reported confidence.

Charles de Chermont, UAE Forensic & Integrity Services Leader at EY, added:

“The results show that many businesses around the world have faced challenges when it comes to maintaining integrity as they build a pathway towards economic recovery. However, there are reasons to be optimistic. Around the world – and in the UAE and KSA in particular – companies are recognizing the need to take steps to address these issues. With proper management, organizations can manage the risk of corporate misconduct effectively, and assure all stakeholders that they are committed to doing the right thing at all times.”