عرض العناصر حسب علامة : COVID19

5 تحديات أخلاقية ستشتد مع زوال الوباء

لأكثر من عام، تم اختبار العالم من خلال التحديات الناتجة عن جائحة COVID-19. ردا على ذلك، أظهر المحاسبون مرونة هائلة

معلومات إضافية

-

المحتوى بالإنجليزية

5 Ethics Challenges that Will Intensify as the Pandemic Wanes

For more than a year, the world has been duly tested by the challenges resulting from the COVID-19 pandemic. In response, professional accountants have shown tremendous resilience. However, as jurisdictions around the world progress toward a more hopeful future, the ethics challenges the accountancy profession and stakeholders face are far from over.

In fact, they might intensify.

As the pandemic fades, many entities will be eager to demonstrate their potential by posting quick wins and an accelerating recovery. Others will continue to navigate the intricacies of government support schemes, and, as those taper, some entities will find themselves on the brink of insolvency. Just as the economic impacts of this crisis unfolded in an uneven and unpredictable manner around the world, so too will recovery efforts. Professional accountants must anticipate a continued period of heightened uncertainty and prioritize their ethics responsibilities all the more.

Since Q2 of 2020, members of a Working Group formed by the International Ethics Standards Board for Accountants (IESBA) and National Standard Setters (NSS) from Australia, Canada, China, South Africa, the U.K., and the U.S. have been meeting regularly to discuss the key ethics issues exacerbated by COVID-19. The Working Group’s charge is to develop implementation support to assist professional accountants in effectively applying the International Code of Ethics for Professional Accountants (including International Independence Standards) (the Code) when facing circumstances created by the COVID-19 pandemic.

Below is an examination of several ethics considerations that will be especially pressure tested during this period of recovery. Facing these conditions simultaneously demands renewed focus on the dynamics that exist in the relationship between professional accountants and entities as they face extraordinary circumstances for at least the next few years.

1. Pressures from an Uneven Economic Recovery: Accountants Must Be Agile Yet Resolutely Committed to the Code of Ethics

Every entity, sector, and jurisdiction will emerge from this global crisis differently. While at least one dose of the vaccine has been administered to approximately 60% of people in Israel, 52% in the U.K., 43% in Chile and the 45% in U.S. as of early May 2021, other countries do not anticipate vaccine availability increasing until at least the second half of the year. For professional accountants, that might mean working within employer organizations and serving client entities that are in vastly different stages of recovery. The truth of the matter is even when an economy fully reopens, there is likely to be at least 12-18 months more of rebuilding and playing catch-up that still has to occur. During this time of profoundly uneven progression, professional accountants will be under huge strain.

We all face a new reality ahead. The pandemic created myriad opportunities for unethical behaviour. The uneven recovery might breed more of these opportunities. These might arise, for example, from increased estimation uncertainty because previous estimations established during the pandemic will be based on facts or assumptions that might no longer apply. In the context of audits of financial statements, pressures from the client and from the rapidly shifting landscape during the recovery might weigh on judgments and decisions regarding the use of non-traditional audit procedures without proper regard for the fundamental principles of objectivity, and professional competence and due care.

Agility will be a critical skillset in navigating the uncertain months and even years ahead. Importantly, while remaining nimble, professional accountants must continue to adhere to the Code, including applying its conceptual framework in these atypical situations.

2. Demands for Greater Support and Efficiency: Auditors of Financial Statements Must Carefully Consider Independence and Familiarity Issues

In the coming months, auditors of financial statements must balance a multitude of unexpected variables. Client demands will likely increase and fluctuate widely. Audit firms will be asked to do things, formally and informally, to support and advise their clients. It’s imperative that auditors continue to acknowledge that the provision of a non-assurance service to an audit client, including advice or recommendations, might create independence issues and heighten ethics pressures. For example, auditors must be cognizant of the pressure to turn a blind eye, act without due care, inadvertently take on a management responsibility for an audit client, or provide inappropriate opinions on the viability of business operations and assets that have likely fluctuated tremendously. In some jurisdictions, such as the U.K., missed filing deadlines and the failure on some companies’ part to apply for extensions have led to automatically downgraded credit ratings. As a result, companies are pressured to have their audits completed quickly at any cost. The ethical responsibility to comply with the Code’s fundamental principles of integrity, objectivity, professional competence and due care, as well as professional behavior must remain top of mind.

In the wake of particularly challenging financial periods, some entities – especially those that are small and less complex – might want to avoid the additional complications and costs of engaging more advisors and feel inclined to streamline professional support by turning to their auditors. Auditors that provide such non-assurance services (NAS) to audit clients must continue to comply with the Code’s NAS and Fee-related provisions. In particular, auditors should be on the lookout for changes that might affect an audit client’s ability to make all judgments and decisions that are the proper responsibility of management. Further, it is important that the pressures of the pandemic do not undermine the auditor’s obligation to identify, evaluate and address threats to independence that might arise from the provision of such NAS.

The business environment in which the broader accountancy profession operates has gone through unprecedented changes. Such changes have implications on employing organizations, the internal operations of firms, the clients they serve, as well as the nature of certain client interactions and relationships. For professional accountants to maintain the highest standards of ethical conduct, and where applicable, be independent, they must remain alert to new information and changes in facts and circumstances. For example, think about public companies that link the finance team’s compensation to the organization’s performance. In such instances—especially at a time when these companies might be struggling financially—professional accountants (both in business and in public practice) must be keenly attuned to what motivates management, and how these motivations might bias key performance factors or indicators such as revenue forecasting, assumptions and estimates.

3. Risks Regarding Rapid Digitalization: Accountants Must Be Alert to Cyber Crimes

The rapid speed of digitalization and tech adoption has raised questions about how accountants and firms are to identify, evaluate and address threats to compliance with the fundamental principles and independence that might be created by the development, use and implementation of technology. In Australia alone, 79% of small and medium businesses say they are expanding software purchases for a more digital future, according to a Gartner study. Nearly half say digital solutions upgrades are happening as a direct result of the pandemic. Even under the best circumstances, the acceleration of digital transformation presents risks. In crisis circumstances, those risks increase exponentially.

For example, the pandemic saw cybercrimes and fraud increase globally as unusual and remote circumstances were taken advantage of and new ways to exploit a broader and deeper range of organizations and individuals were found. In the U.S., cybercrime reports nearly doubled in 2020, according to the Federal Bureau of Investigation. The U.K. saw at least a 30% increase. In parts of Latin America, cybercrimes spiked 60% in the early months of COVID when compared to the same period in 2019. This stark trend is unlikely to abate during the recovery phase, highlighting the continuing challenges to adhering to the fundamental principles of integrity, objectivity, professional competence and due care and confidentiality, especially as companies might have skipped steps or cut corners on cyber security and related measures to keep doing business in the remote environment. Professional accountants and firms should consider whether circumstances may warrant the use of specialists during this time to assist in identifying, evaluating and addressing new risks, such as cyber threats.

Moreover, as jurisdictions see some return to pre-pandemic norms, many entities will likely choose not to return to fully in-person workplaces, and many professionals, including accountants will elect to continue working remotely where possible to preserve the flexibility afforded to them during COVID. Employing organizations must become ever more diligent and innovative in transitioning back to in-person work. It is critical to consider architecting hybrid or virtual protocols that consider best practices, including for example, data hosting and management functions while faithfully abiding by ethical obligations. The risks of complacency are far too great. Professional accountants must apply a deeper understanding of data analytics and technology to their work while being fully attuned to the ethical risks in order to uphold the profession’s good reputation.

As professional accountants continue to evolve ways of working in a world that is more hybridized, with companies operating from both offices and employees’ homes, several personnel factors should be considered. First are concerns about the skills required to operate effectively and ethically in a more digital environment. The profession will need to further invest in professional competencies regarding technology and information systems. Related to that are concerns around capabilities and learning for new talent, who might be at a disadvantage stemming from a lack of in-person interaction with more senior colleagues.

4. Burnout and Mental Health of Teams and Talent: Accountants Must Strive for Resiliency and Solutions

There is growing concern around mental wellness and the state of mind that is required to think critically, rather than just accept information at face value. More than a year into the pandemic, individuals are under immense stress and many are suffering emotionally. In 2020, various studies showed that many adults in jobs that did not normally require them to work outside of their homes reported symptoms of depression and anxiety.

The accountancy profession must be cognizant of the mindfulness required to act competently, with integrity and due care, and to be objective in exercising judgments without being compromised by bias. As such, professional accountants must be conscious of issues colleagues could be facing—and not talking about—that might impact judgments and ethical decision making.

The need for strong organizational culture, with established and open communication channels, as well as protocols for how to address circumstances where staff might not be able to bring their full mental acuity to a particular task or job, is essential as complexities and stressors proliferate.

5. Predisposition to Focus on the Past: Accountants Must Recognize the Shift and Focus on the Future

One of the biggest challenges professional accountants face amidst the pandemic recovery will be continuing to seek out a better understanding of the issues that still lie ahead and what the ethics consequences of them might be. For example, the pace of digital transformation and use of technology such as machine learning automation in products and services has been unprecedented. In addition to the challenges related to cyber security and fraud mentioned above, it is imperative the profession stay on top of responsible automation.

As trusted advisors, it is the duty of professional accountants to be competent in these advancements where they are involved in their development and implementation. This involves attaining and maintaining the knowledge and skill required for the job. In the context of today’s world, this means learning how to properly understand threats to the fundamental principles of ethics from the technology. As new or unresolved issues from the pandemic emerge, it will result in higher degrees of uncertainty which will make it increasingly difficult to keep a focus on evolving the profession for the future, but this will be a necessity. Together, professional accountants must acknowledge how the pandemic changed companies and social norms and strive to be a step ahead.

Professional accountants, like others in the workforce, are operating within an unusual context right now. Around the world, corporate priorities and public expectations are changing rapidly. These changes will have implications on the accountant’s role. For example, the rise in stakeholder capitalism and subsequent call for Environmental, Social and Governance (ESG) reporting are leading investors to not only seek more reliable and comparable information in the area of ESG reporting, but also obtain assurance on such information. Professional accountants must answer that call.

While we begin to realize life beyond COVID-19, we must all be increasingly thorough in assessing the impact these changes are having on views and perceptions about ethics requirements, especially as it relates to the relationship between the accountant and the entity. Just as the pandemic increased risks of unethical behaviour, efforts to rebuild will equally increase opportunities to evolve for the better.

3 مفاتيح تقنية لتمكين المحاسبين

معلومات إضافية

-

المحتوى بالإنجليزية

3 tech keys for empowering accountants

By Clayton Weir

September 10, 2021 10:43 AM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Much like every business vertical, accounting has seen its fair share of disruption as a result of the COVID-19 pandemic. And although digital transformation efforts have pushed innovation forward in many industries, accountants, by and large, unfortunately have to deal with fractured processes and outdated tools from pre-pandemic times. Not only do accountants have to tackle daily tasks with antiquated technology, but they have to find ways to make this tech meet the modern demands of today’s financial industry. And as the world around them continues to evolve and modernize, accountants are understandably struggling to keep up.

With that in mind, it is time for banks to allocate more attention and resources toward revamping their accounting infrastructure. Here are a few areas in particular that they need to focus on in order to make this happen.

Cloud migration

technology-and-telecom.jpgWith the number of tools that accountants are forced to deal with on a daily basis, remote work is a nightmare for those who are still forced to work with on-premise infrastructure. Moreover, given a significant portion of the financial industry still relies heavily on this “traditional” technology, on-premise is one of the foremost hurdles that is holding accountants back today. That said, the fix is quite simple: adopt the cloud.

By leveraging a cloud-based infrastructure, businesses can immediately boost the efficiency of their accounting teams by giving them easy, instant access to the data and solutions they need from anywhere. Additionally, it can also make onboarding new tools and processes far less painstaking than doing so with on-premise legacy systems.

Embrace automation

With CFOs and accounting teams now expected to participate more fully in business strategy and other non-finance tasks, the amount of time these teams have to engage in manual tasks continues to shrink. And as such, calls for greater automation within finance departments continue to grow.

According to a guide produced by Sage, 93% of finance workers say they would be happy to have tech do their daily accounting tasks. In addition, as budgets remain tight and workforces are continuously expected to do more with less, empowering accounting teams with automation will be pivotal to business efficiency and overall success.

Choose fintechs wisely

No two finance departments are exactly the same. So it is imperative that businesses take a step back and consider their needs properly before adopting tools and processes. Sure, a tool might seem to make sense on the surface, but what if it actually complicates things or makes tasks more challenging? All too often businesses jump into the fintech pool without fully understanding what their needs are and what they need to solve them.

Accountants have incredibly full plates to begin with. And without the support infrastructure and tools they need to juggle these tasks, it is virtually impossible for them to keep up with modern demands. Therefore, businesses need to work in close consultation with finance teams to identify their most pressing needs and find the solutions that are best tailored to them. Granted, with a global remote workforce, this may seem like a daunting prospect. By getting all of their ducks in a row early, not only will businesses be able to make the onboarding process far easier for their accounting teams, but they will also save valuable time and money down the road.

Accountants are integral to helping businesses achieve financial success. And with that, the time has come for these teams to be supplied with the modern tools that their work deserves. Without it, accountants will continue to struggle to meet their full potential and will not be able to help businesses achieve the growth they are looking for.

زيادة إيرادات Deloitte العالمية إلى 50.2 مليار دولار

ذكرت شركة Deloitte أن إيراداتها العالمية نمت بنسبة 5.5٪ في السنة المالية المنتهية في 31 مايو 2021 لتصل إلى 50.2 مليار دولار حيث زادت الشركة قوتها العاملة بنسبة 3.2٪ إلى 345000.

معلومات إضافية

-

المحتوى بالإنجليزية

Deloitte global revenue increases to $50.2B

By Michael Cohn

September 09, 2021, 11:54 a.m. EDT

4 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Deloitte reported its global revenue grew 5.5% in the fiscal year ending May 31, 2021 to $50.2 billion as the firm increased its workforce 3.2% to 345,000.

Despite the challenges of the global pandemic, the firm grew its business, with financial advisory services growing at the fastest pace at 12.9%, followed by audit and assurance, which grew 6.1%. Risk advisory services revenue grew 5.6%. Consulting services grew 5%. Tax and legal revenue grew 2.3%.

Government and public services was the fastest-growing industry, followed by technology, media and telecommunications. Financial services clients contributed 27% of Deloitte's total revenue.

Deloitte Canadian office in OttawaBrent Lewin/Bloomberg

Among the different regions, the Asia Pacific region grew at the fastest rate at 14%, followed by the Europe, Middle East and Africa (EMEA) region, which grew 11.3%. Deloitte also expanded its global alliance and ecosystem business by 24%. The firm managed to adapt during the COVID-19 pandemic.

Start Preparing for CECL

The long awaited CECL standard is on its way. Is your financial institution ready?

PARTNER INSIGHTS

SPONSOR CONTENT FROM MOODY'S ANALYTICS

"Events of this past year have had an unprecedented impact on the world and our organization,” said Deloitte Global CEO Punit Renjen in a statement Wednesday. “From the COVID-19 pandemic to more frequent, extreme climate events, and social upheavals, we are grateful that we've been able to continue to help clients and support our people as we all navigate through this challenging environment. While the past year was difficult and defined by uncertainty, it has shown what can be achieved at speed and scale when businesses, governments and society work together to tackle tough global challenges. This cooperative approach is a model that we must continue to build on."

On the audit and assurance side, Deloitte deployed its global audit platforms, Deloitte Omnia and Deloitte Levvia, to deliver audit services worldwide. The firm’s audit and assurance professionals have also been helping clients and stakeholders address environmental, social and governance reporting needs. The Deloitte Center for ESG Solutions supplied decarbonization, hydrogen, electricity, and other quantitative energy models to support major sustainable energy transformation projects.

Deloitte also released its first ESG report as a firm. Deloitte's FY2021 societal impact investment was $223 million, bringing its five-year investment total to $1.15 billion.

The Deloitte Global Impact Report includes in-depth reporting of the firm’s impact on the environment and on society, as well as a more detailed look at the structures and processes of the organization. In FY2021, Deloitte began reporting against the World Economic Forum's Stakeholder Capitalism Metrics.

Deloitte also issued its first report following the recommendations of the Task Force on Climate Related Financial Disclosures detailing its processes for addressing climate change risks and opportunities in the areas of governance, strategy, risk management, and metrics and targets. The report quantifies climate change impacts in financial terms and also examines risks and opportunities under two different climate scenarios.

Through Deloitte's WorldClimate strategy, it is driving responsible climate choices within the organization and beyond. It is asking its more than 345,000 professionals to take individual and collective climate action alongside clients and communities. In collaboration with the World Wildlife Fund, Deloitte developed a climate learning program for all Deloitte professionals.

As part of the World Economic Forum's Alliance of CEO Climate Leaders, Renjen joined over 70 CEOs in an open letter urging world leaders to support "bold and courageous commitments, policies and actions." Deloitte's greenhouse gas reduction goals were validated by the Science Based Targets initiative. Deloitte also committed to all three Climate Group initiatives supporting 100% renewable electricity, 100% electric vehicles adoption, and energy efficiency and productivity within the organization. During FY2021, Deloitte said it reduced absolute carbon emissions by 41% and carbon emissions per full-time employee by 44% from its base year of FY2019.

The firm also created a Deloitte Center for AI Computing to help with technology consulting.

Deloitte began an initiative with the government of Haryana state in India to help public health infrastructure. The program is being expanded to Africa, Brazil and Southeast Asia.

In the area of diversity, equity and inclusion, Deloitte is pursuing a strategy it calls “ALLIN,” with an emphasis on respect and inclusion. Built upon this foundation are three pillars: working toward gender balance, fostering LGBT+ inclusion, and supporting mental health.

To meet the needs of the firm’s people during the challenges of the pandemic, Deloitte set up a mental health baseline for measuring well-being factors, made a global commitment to mental health within the organization and in society at large, and became a Founding Partner of the Global Business Collaboration for Better Workplace Mental Health, which aims to raise awareness of the importance of mental health in the workplace and facilitate the adoption of best practices that enable employees to thrive in the workplace.

كوفيد -19 تضخم تحديات النزاهة للشركات في الأسواق الناشئة

يظهر تقرير "النزاهة العالمية 2020" الصادر عن شركة EY تفاوت وتنوّع تأثيرات كوفيد-19 على السلوكيات الأخلاقية في الأسواق الناشئة

معلومات إضافية

-

المحتوى بالإنجليزية

As organizations transition from managing the COVID-19 crisis towards building economic resilience, the EY Global Integrity Report 2020 reveals some diversity regarding the impact on company ethics. The findings are part of a survey highlighting the views of 2,948 board members, managers, and employees from emerging markets around the globe. In the Middle East, the survey covers interviews with 175 respondents in the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA).

The report reveals that 63% of global respondents believe that businesses operating in emerging markets are likely to be impacted adversely by the current disruption.

The survey also highlights that regulatory scrutiny and remote working aggravate these issues. A total of 32% of global respondents in emerging markets said they believe that bribery and corrupt practices present the greatest risk to the long-term success of their businesses, roughly on a par with 30% of respondents in the UAE and 31% in KSA.

Globally, 30% of respondents believe that a cyber and ransomware attacks are a significant risk to the long-term success of organizations. This is lower than in KSA, where 32% believe it is a threat, but is significantly higher than in the UAE, where only 15% expressed concerns.

Mohammad Malkawi, KSA Forensic & Integrity Services Leader at EY, said:

“The disruption caused by COVID-19 poses a risk to ethical business conduct, making it imperative for corporations and firms of all sizes to continue being vigilant on compliance related issues. This holds true for organizations around the globe, as well as in the UAE, KSA and elsewhere around the region. Business leaders must make a firm commitment to encourage a culture of integrity and trust among all stakeholders. Particular attention must be placed towards risks of fraud, bribery and corruption, the threat of cyber attacks, and a constantly evolving regulatory environment. Ultimately, this will be the key towards creating long-term value and ensuring stability.”

The report highlights four key areas that organizations should consider to manage the risk of corporate misconduct more effectively:

Corporate integrity should be a top priority in management’s playbook

Business leaders are in a key position when it comes to taking difficult decisions. The report highlighted that 55% of global respondents in emerging markets say that their management communicates frequently with them on the importance of operating with integrity.

Voicing misconduct through whistleblowing channels

Globally, 37% of respondents in emerging markets say that they not reported concerns about integrity due to apprehensions about their career progression.

In the UAE, 29% reported keeping concerns to themselves because they were concerned about their future career. A slightly larger figure - 31% - said they felt like their concerns would not be acted upon. In KSA, 27% said they stayed quiet as a result of career concerns, compared to 39% who felt their concerns would not be acted upon.

In a post-pandemic environment, businesses must take steps to ensure that employees feel comfortable reporting instances of misconduct and protect would-be whistle-blowers from retaliation of any kind. Training and awareness programs should become institutional pillars in the corporate governance framework of organizations.

Embracing disruptive technologies while protecting data

Around the world, emerging markets are embracing new and disruptive technologies and adapting towards a general shift towards the digital realm. This shift, however, brings with it a host of potential security problems and amplifies risk exposure for organizations. Notably, the report showed that in emerging markets, 55% offered training to employees on prevention of data security breaches, compared to 45% in developed markets, leading the way to mitigate risks. Emerging markets also performed well with regards to organizational preparedness, with 42% of global respondents having an incident response plan in place.

Tackling third party integrity risks

The need to establish remote working protocols in many locations as a result of the pandemic has also made it riskier to manage third-party relationships – and conducting adequate due diligence before onboarding a third-party vendor is critical to mitigate long-term risks. According to the survey results, 35% of businesses in emerging markets are confident that their third-party partners operate with integrity. This was even higher in KSA - with 43% of respondents comfortable with the integrity of their third-party partners, but markedly lower in the UAE, where only 20% of businesses reported confidence.

Charles de Chermont, UAE Forensic & Integrity Services Leader at EY, added:

“The results show that many businesses around the world have faced challenges when it comes to maintaining integrity as they build a pathway towards economic recovery. However, there are reasons to be optimistic. Around the world – and in the UAE and KSA in particular – companies are recognizing the need to take steps to address these issues. With proper management, organizations can manage the risk of corporate misconduct effectively, and assure all stakeholders that they are committed to doing the right thing at all times.”

ارنست اند يونج EY معترف بها كشركة رائدة في تقييم موردي خدمات الأمن الاحترافية لدول الخليج

معلومات إضافية

-

المحتوى بالإنجليزية

EY has been named a Leader in Professional Security Services in the GCC region by the IDC MarketScape.

The report is based on a comprehensive framework assessing 20 providers in the regional professional security services market on their current capabilities and future strategies in addressing the cybersecurity challenges faced by end-user organizations across the region.

According to the IDC MarketScape: GCC Professional Security Services 2020 Vendor Assessment, “EY has been able to create one of the largest teams of cybersecurity professionals in the region. Alongside the company's history of cybersecurity consulting worldwide and its partnerships with local and global technology and services players, this SOC makes EY one of the strongest cybersecurity services providers in the region. The company has invested in developing local talent and creating a large staff of cybersecurity professionals who are bilingual (in Arabic and English) and are nationals of GCC countries, which gives EY an added advantage in driving customer relations and satisfaction.”1

Wasim Khan, EY MENA Consulting Leader, says:

“We are extremely proud to be recognized by the IDC MarketScape as a GCC Leader in Professional Security Services. The diversity, depth and breadth of our team are a testament to our dedication to supporting security practices in the GCC region. The COVID-19 pandemic fast-tracked digitalization across all sectors, leaving no room for security uncertainty. Our broad cyber consulting portfolio which includes managed security services, have been crucial to executing critical turnkey programs quickly and efficiently for our clients in uncertain times.”

Clinton Firth, EY Africa, India and Middle East Cybersecurity Leader, says:

“The EY Cybersecurity team is very happy for recognition of the hard work over the years to build a world leading practice in the GCC, that is absolutely focused and driven to solve the most complex issues that our clients face. We will continue to invest and grow our cybersecurity business from strength to strength with the right professionals and assets to solely serve the continuing client demand; all in the face of the ever-increasing cybersecurity threats our client face.”

Varun Kukreja, Senior Program Manager at IDC, says:

“Though EY has been a critical Digital Transformation player in the region for more than a decade, their Cybersecurity practice has been pivotal in differentiating itself in almost all facets of portfolio offerings. More so, EY cybersecurity team dedicates itself towards co-innovating with their client base and taking problem solving to an elevated level."

EY continues to expand its security offerings, talents, and investments in the five core competencies of: strategy, risk, compliance, and resilience; data protection and privacy; identity and access management; architecture, engineering, and emerging tech; and next-gen security operations and response.

الثقة الاقتصادية العالمية تنتعش بين المحاسبين

أظهر المحاسبون ثقة أكبر في الاقتصاد خلال الربع الأول من العام الحالي مقارنة بالعام الماضي، خاصة في أمريكا الشمالية، بحسب مسح جديد.

معلومات إضافية

-

المحتوى بالإنجليزية

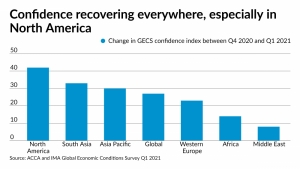

Accountants expressed much higher confidence in the economy during the first quarter of this year compared to last year, especially in North America, according to a new survey.

The survey, by the Association of Chartered Certified Accountants and the Institute of Management Accountants, polled more than 1,000 senior accountants and finance professionals around the world, and found the biggest quarterly jump in confidence in a decade, thanks to increasing supplies of vaccines and continuing fiscal stimulus from many governments. The ACCA and IMA’s Global Economic Conditions Survey saw a nearly 30-point jump in the confidence index globally and more than 40 points for North America in the first quarter of 2021, compared to the fourth quarter of 2020. However, the two “fear” indices in the survey, which measure concern that customers and suppliers could go out of business, offered contrasting messages. Fear that customers would go out of business declined significantly while fear that suppliers would do so rose slightly higher. But both factors remain at relatively high levels, underscoring the high level of uncertainty that remains in the world economy.

The rollout of COVID-19 vaccines in recent months have helped improve economic confidence in many parts of the world. However, the growing number of COVID-19 variants that seem to spread more easily has also led to uncertainty and some European countries have been forced to retreat on their reopening plans. In many parts of the world, access to vaccines remains severely limited. Accountants in Western Europe, Africa and the Middle East did not register as much of an increase in economic confidence as those in North America and Asia.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

“This crisis is different as its root cause is health and not economic,” said IMA vice president of research and policy Raef Lawson in a statement Monday. “For now, global COVID-19 infections are high relative to the vaccination rate, so risks remain significant. But the huge government support provided to both households and companies over the last year leaves both well-placed to resume spending once the health crisis is over. There are likely to be permanent changes in the pattern of spending and other long-term economic consequences of the COVID crisis.”

Economic activity indicators for orders, capital spending and employment all increased to some extent in the first quarter of this year, according to the survey, echoing the level of confidence in the fourth quarter of 2019 before the spread of the COVID-19 pandemic.

“Having suffered the biggest recession for several decades in 2020, the global economy is on course for a relatively quick rebound,” said ACCA chief economist Michael Taylor in a statement. “The good news is that vaccination plans with continued policy support are on course to lift the global economy out of the COVID abyss this year.”

The report acknowledged that vaccination rates vary significantly across different countries, and vaccination can replace lockdown measures as a way to control COVID-19, allowing economic conditions to return to normal. But government policy is also crucial. A major fiscal stimulus in the U.S. is likely to have a positive spill-over impact on other economies around the world this year. Particularly in advanced economies, a large pile of savings accumulated during the periods last year when spending was severely limited, and those funds can provide a source of extra demand once economic conditions improve. Based on those criteria, the U.S. and the U.K. seem to have better growth prospects than the Eurozone, while China is likely to continue to experience strong growth. Emerging markets may also benefit from increased global demand, but vaccination rates will probably remain low in many countries through the rest of this year.

اتجاهات التوظيف لعام 2021

شكلت التغيرات التنظيمية التي أحدثتها جائحة كورونا استراتيجيات ومتطلبات للتوظيف في شركات التمويل والمحاسبة

كيف تعمل الخدمات الاستشارية على تغيير المحاسبة؟

وسط الفوضى التي كانت سائدة في الأيام الأولى لوباء COVID-19، حيث لا يزال الكثير منا يتلاعب بالانتقال إلى العمل عن بُعد وكلنا قلقون بشأن حالة عدم اليقين التي تنتظرنا، وجد المحاسبون أنفسهم فجأة في وضع يمكنهم من تقديم ما تمس الحاجة إليه. الشعور بالأمان لعملائهم من الشركات الصغيرة.

معلومات إضافية

-

المحتوى بالإنجليزية

How advisory services are transforming accounting

By Elizabeth Beastrom

August 25, 2021, 11:47 a.m. EDT

4 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

A funny thing happened to accountants when the U.S. Small Business Administration launched the Paycheck Protection Program. There, amid the chaos of the early days of the COVID-19 pandemic, with many of us still juggling the transition to remote work and all of us worried about the uncertainty ahead, accountants suddenly found themselves in a position to offer a much-needed sense of security to their small-business clients. Sitting at the center of the financial information required for PPP applications, able to explain how subsequent loan forgiveness terms would work and well-positioned to help complete detailed applications, accountants quickly emerged as the steady hand we all needed in an otherwise fraught business environment.

For many, the experience has cemented their roles as trusted business advisors, creating new opportunities to grow their businesses beyond basic tax accounting functions and develop important new revenue streams. A recent Thomson Reuters survey found that 95% of accountants said their clients are now seeking business advice from their tax professionals.

One accountant who recently expanded their advisory practice is Stephen Morris in Los Angeles, who has seen his revenue increase by more than $200,000. “Expanding into advisory has been a mutually beneficial relationship for us,” said Morris. “Our clients receive personalized financial advice while we obtain predictable, recurring revenue.”

Inflo Digital Audit: The profession's first end-to-end digital audit platform

Do more with data, automate compliance, and improve your value with Inflo’s Digital Audit -- the accounting profession's first data driven audit solution...

SPONSOR CONTENT FROM INFLO

Earning the role of trusted advisor

It makes sense. Tax professionals occupy a unique space for their small business clients. Unlike financial advisors, who tend to focus on investments, or business consultants, who tend to focus on strategy and process, accountants are privy to the most intimate details of the inner financial workings of their clients' businesses and often form close working relationships with business owners. They’re also highly trusted. Consistently ranked among the top 10 most trusted professions — right up there with nurses and firefighters — CPAs have a reputation for shooting straight with their clients.

While that mix should create the perfect formula for building out an advisory business, not all tax pros have made that transition. The key to leaping from a transactional business rooted in the seasonality of tax filing to a year-round advisory business rooted in trusted counsel is building a business model that supports the transition.

In our work with small-business accounting firms worldwide, we’ve found that most firms pivoted to advice during the pandemic, but only some of them got paid for it. The difference between the two is having the right contract in place and the confidence to introduce the idea. Those who had contracted, retainer-style agreements in place with their clients were in prime position to engage in an advisory relationship, providing the necessary data and guidance on the PPP application, coaching clients through the best approaches to scaling down and scaling up throughout the volatile period, and filing for loan forgiveness. Those who had more transactional, quarterly filing-driven agreements with clients also ended up providing advice because it was the right thing to do, but they didn’t get paid for it.

Building a new business model

If there’s one thing every business professional learned over the past year, it is that the legacy structures of traditional business — from the lunch meeting to the office building — are not set in stone. That extends to underlying business models that can evolve and be adapted to suit changing demand and improved service offerings.

But before any of that can happen, tax pros need to find the confidence to see themselves as something more than tax preparers. According to our survey, even though 95% of tax professionals say their clients seek business advice, 59% say they are highly confident offering that advice. Moreover, among those who lacked confidence, female tax pros represented a disproportionate majority.

Many of the major business trends that have been unfolding for the last several years — many of which were amplified by the pandemic — have their roots in tax and accounting. The increased use of government incentives and relief packages, the introduction of more complex local tax and tax nexus reporting requirements, and changes in consumer behavior can have a major impact on small businesses. And no one understands them better, both from a compliance perspective and an anticipatory perspective, than a professional accountant. Thus, accounting firms should be in the pole position among trusted small-business advisors. Many are proving it’s possible to do just that by taking a more proactive role in their client relationships and putting the right structures in place to turn good advice into good business.

Along the way, these pioneers are helping transform accounting from a transactional business rooted in quarterly compliance deadlines to one that is strategically aligned with the growth of its clients.

التوظيف من أجل النجاح

حفز الدور الرئيسي للتدقيق الداخلي في معالجة التهديدات الرقمية الحاجة إلى خبرة في مجال الأمن السيبراني في فريق التدقيق.

معلومات إضافية

-

المحتوى بالإنجليزية

Internal audit's key role in addressing digital threats has spurred the need for cybersecurity expertise on the audit team.

Geoffrey NordhoffAugust 24, 2021Comments

Organizations are moving gingerly into the post-pandemic world with a heightened focus on cybersecurity, with overall cybersecurity spending projected to grow as much as 10% this year, according to IT research firm Canalys. Regulators — already concerned about cybersecurity — have ratcheted up their oversight, vividly illustrated by the U.S. Office of the Comptroller of the Currency's $80 million fine against Capital One last year (see "Capital One Data Breach" below). In fact, cybersecurity was one of the top-ranked risks identified by board members, management, and chief audit executives (CAEs) in The IIA's OnRisk 2021 report.

In this environment, internal audit, as part of its oversight function, has a critical role of helping organizations manage cyber threats by evaluating risks and providing an independent assessment of controls. In turn, this role has spurred the need for cybersecurity skills in internal audit functions.

The heightened concern around cybersecurity has inevitably increased the demand for suitably experienced auditors, says Jamie Burbidge, founder of Bickham Montgomery, a London-based internal audit recruiting firm. "Due to cybersecurity being a relatively recent concern for business leaders, the number of internal auditors at the senior level with relevant experience is quite small," he noted. At present, potential internal audit hires who have the experience and a good grasp of cybersecurity likely are coming from the Big Four accounting firms at slightly more junior levels.

Regardless of the talent source, experts point to several skills and qualifications to look for when hiring. They also cite the importance of soft competencies, the need to plan ahead for resource needs, and the advantages of developing skills internally.

The Right Expertise

Shawna Flanders, director, IT Curriculum Development, at The IIA, says two general skills are important for internal auditors who will be involved in cybersecurity audits: data analysis capabilities and critical thinking. "Deploying critical thinking skills gives auditors the ability to determine how a cyber threat in the wild could impact their organization," Flanders says. Plus, they need to be able to use data to discover unusual activity, inappropriate access, and fraud, and possess a broad understanding of IT general controls as well as application, network, and information security controls, she adds.

In addition, practitioners need to have a deep understanding of relevant threats, such as malware, ransomware or spyware, denials of service, phishing, and password attacks. Given the demands, internal audit functions should consider building dedicated expertise on their team, says Jim Enstrom, senior vice president and CAE at Cboe Global Markets of Chicago. The type of person who can fill this role probably has come up through a technology, cybersecurity, or consulting background, rather than internal audit, he adds.

Ongoing training and an emphasis on more technical cybersecurity-related certifications should also be a focus area, Enstrom says. Certifications demonstrate a basic level of aptitude and indicate that a person is motivated for self-improvement and self-learning. The IIA offers several seminars on IT topics, including cybersecurity, as well as more than a dozen IT courses on-demand. In mid-July, The Institute launched its IT General Controls Certificate, demonstrating the certificate holder's ability to assess IT risks and controls.

In addition, more universities are offering advanced degrees in cybersecurity, in which students also are learning the principles of assurance, as well as how to evaluate controls and risk. For example, the University of Central Florida in Orlando, which offers a certificate in cybersecurity, will begin offering a master's degree in cybersecurity and privacy this fall that will include a technical track covering topics such as hardware, software, and security, and an interdisciplinary track that addresses the human aspects of cyberattacks. These types of programs are an opportunity for recruiting, Enstrom says.

Robert Berry, former executive director of internal audit at the University of South Alabama and now president of consulting firm That Audit Guy, says hands-on experience in cybersecurity is important in considering a hire. Berry says he would look for someone experienced in technology, especially with experience in how networks operate and are secured. "You want to look for somebody who is actively engaged and involved in the craft," he adds — the kind of person who builds his or her own network and tinkers with it, and who is active in chat rooms and forums.

Capital One Data Breach

The U.S. federal government's enforcement actions against Capital One in August 2020, which included an $80 million fine from the Office of the Comptroller of the Currency (OCC), illustrates its increased oversight of cybersecurity issues. The actions stemmed from a 2019 cyberattack that stole the personal information of about 100 million individuals. The OCC fine was the first significant penalty against a bank in connection with a data breach or alleged failure to comply with OCC guidelines. The OCC specifically called out Capitol One's internal audit function, saying it failed to identify numerous control weaknesses and gaps and did not effectively report them to the audit committee.

Training, Sourcing, and Collaboration

Rather than hiring from outside, developing skills internally is sometimes a better option, especially in small- to moderate-size departments, Berry says. That way, the auditor is already familiar with the organization and with the procedures involved in conducting engagements, he explains. This approach also might be advantageous for a small department in an industry that does not pay well, which likely will have a hard time recruiting cybersecurity expertise, Berry adds.

In a midsize department or a midsize organization with a small audit department, audit staff might not have the necessary IT knowledge. Keeping in mind The IIA's International Standards for the Professional Practice of Internal Auditing, the organization might consider a co-source provider, Enstrom says, adding that training, skill building, and certifications also are important for these departments. In addition, where the Standards allow, internal audit should consider collaboration with the organization's information security department, he says. Standard 1210: Proficiency, and Standard 2050: Coordination and Reliance, provide guidance in these areas.

Seek Out Soft Skills

"Curiosity is the cornerstone of internal audit," Berry says. "If you can't be curious and ask really good questions, you will fail in your career in audit." Soft skills are probably the most important skills, he says, because a person who possesses them can be taught audit skills. Critical thinking and other soft skills give internal auditors, especially those dealing in a technical area such as cybersecurity, the ability to communicate outside their area and to understand how a cyber threat could affect the organization.

When he started Bickham Montgomery about 10 years ago, Burbidge found that technical proficiency was by far the most sought-after trait for companies when hiring internal auditors. Now, he sees more emphasis on communication skills as part of an internal auditor's role. "You need to be able to communicate, need to be able to persuade, need to be able to partner with the business," he says.

Jeannie Alday, director of Internal Audit for Chatham County, Ga., says in hiring someone with an IT background, she wants to determine whether the candidate will be able to communicate with IT staff, and IT management, but also with county management and others who may have limited background in IT. "Those soft skills are huge, and they're not always easy to spot in the limited interview process," Alday says.

Looking Ahead on Hiring

Given the rapidly changing environment, cyber awareness is fundamental to the execution of an organization's strategy. "In any organization today, cybersecurity is one of the top risks," Enstrom says. In the present environment, boards, management, and other stakeholders need to focus continually on cyber risk and whether their organization has the right skills and resource strategy, he says. Importantly, organizations need to make necessary investments in skills and resources.

Post-pandemic, hiring likely will become more challenging because of pent-up demand, Enstrom says, and demand already exceeds the number of candidates. As a result, audit hiring managers should think more creatively about compensation and other job benefits. He also notes that many cybersecurity professional have had limited exposure to internal auditing and assurance, may see auditing as having limited opportunity for advancement, and might not consider going into the field.

This perception underscores the necessity of selling the opportunities and value proposition of the profession to prospective job candidates. Compared with going directly into information security, internal audit offers the potential for greater diversity of experience and breadth of opportunity — working with senior executives and board members — and exposure to different projects, Enstrom says. Moreover, because of the importance of good communication skills, time spent in internal audit can be a great learning opportunity for someone who is less comfortable in this area.

"Early in a person's career, working in internal audit really represents a great learning opportunity because you have so many different projects you can work on," Enstrom says. "I think we don't sell that enough as a profession."

As another area of focus for hiring, Enstrom emphasized the importance of partnering with outside firms, or organizations that can help with the candidate sourcing process. He highlights one example — the Greenwood Project. "The Greenwood Project is a nonprofit organization dedicated to introducing Black and Latinx students to careers within the financial industry," he says. "We've had success working with Greenwood Project and we continue to look for ways to strengthen our relationship and promote the profession of internal auditing to Greenwood students and diversity candidates. In addition to accounting and business students interested in financial services, we have been working with Greenwood to promote an interest in IT audit, data analytics, and cybersecurity roles in the internal audit profession."

Meanwhile, when recruiting through universities, internal audit functions need to look beyond the accounting and finance departments and build relationships with computer science and cybersecurity programs. "In my experience, many students in computer science or other IT disciplines are unaware of job opportunities in the internal audit profession," Enstrom says. "Given this, it's really important for the company and recruiter to understand and have relationships with faculty and staff in these colleges, not just the business schools."

The bottom line? "You have to offer competitive salaries, and you have to be very clear and crisp in your value proposition — how internal audit will benefit them in their career," Enstrom says. Moreover, companies recruiting in the post-COVID-19 marketplace will need to think more broadly and consider hiring candidates from outside their geographic area.

ماكنالي الرئيس الجديد لمعهد المحاسبين الإداريين

عين معهد المحاسبين الإداريين رسمياً ج. ستيفن ماكنالي كرئيس لمجلس إدارة IMA العالمي، وهو يخطط للتركيز على الحضور المتزايد للمؤسسة على المستوى الدولي.

معلومات إضافية

-

المحتوى بالإنجليزية

New IMA chair McNally embraces global focus

By Michael Cohn

July 16, 2021, 4:24 p.m. EDT

7 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The Institute of Management Accountants officially appointed J. Stephen McNally as chair of the IMA’s global board of directors, and he plans to focus on the organization’s growing presence internationally.

McNally, who is CFO of the Plastic Technologies group of companies and previously spent a long career as a finance executive at Campbell Soup, will chair the IMA global board for fiscal year 2022, from July 1, 2021, to June 30, 2022. He will be succeeded by Gwen van Berne of the internet registry RIPE NCC in the Netherlands (see story).

The IMA, like other accounting organizations such as the AICPA, have been putting more emphasis on broadening their international presence. McNally also hopes to advance the IMA’s thought leadership and research, especially around the future of work, and to advance the use of technology strategies in the accounting and finance profession and support members in being effective, well-rounded management accountants and finance professionals. He also plans to help members in the small business sector recover from the impact of the COVID-19 pandemic.

McNally also will be chairing the IMA's Governance Standing Board Committee and be a member of the Nominating Standing Board Committee. He is a member of the IMA's Toledo Chapter and a former board liaison to the IMA Committee on Ethics.

Using Too Many Systems? Accounting Practice Management all in One Place

Canopy is a full-suite practice management software for accounting firms offering client management, document management, workflow, and time and billing...

SPONSOR CONTENT FROM CANOPY

“I’m really excited and honored to be in the role as chair for IMA,” he told Accounting Today. “Clearly, we’re in a very dynamic environment and it’s just going to continue to ramp up and change, so one of my key priorities or goals is to support our members in becoming future ready, not knowing what that future looks like, but being future ready to do their work. That’s through things like keeping the CMA up to date, and doing various webinars and articles, all around just helping our members prepare for the future of work.”

J. Stephen McNally

McNally also plans to contribute to the IMA’s thought leadership work, especially around the use of internal controls over financial reporting, using the COSO framework, originated by the Committee of Sponsoring Organizations of the Treadway Commission.

“One of the things I’ve always been impressed with is how IMA is such a leader within the management accounting and finance profession on various topics,” he said”. I’m personally partial to COSO and internal controls and enterprise risk management. I had the honor of representing IMA on the COSO Advisory Council back in 2011-2012 that updated the internal control framework. IMA also drives thought leadership in the areas of sustainability and DE&I and ethics and so many areas.”

A big priority as global chair will be the IMA’s work internationally. “Over the last 10 to 12 years, we’ve very much evolved from a very U.S.-centric organization to a global organization, with over 140,000 members in over 150 countries,” said McNally. “Therefore, for me, it’s imperative that we reach out and listen to the voice of our global members, understand what they need, what their wants and desires are, and how IMA can support them.”

He also wants to do more to support small and midsized businesses. “I spent a good chunk of my career at Campbell Soup, which is obviously a big public company, but now I’m CFO of a small private company, and it was just an eye owner for me how it’s so important that smaller and midsized businesses have the financial talent to be successful. Therefore, it’s so important that we, IMA, support our members in smaller and midsized businesses so they can support their organizations.”

One way the IMA will be supporting businesses is by helping them get through the pandemic as the organization makes plans to once again hold in-person meetings and conferences. “On the one hand, I absolutely am hoping that through vaccinations and through the virus itself becoming more and more under control, hopefully we do have an opportunity to go back to meeting in person and having those live events,” said McNally. “For finance and accounting professionals, it’s important that we play a key role within our organizations and think through helping our organizations be ready for the future, whether that future is tomorrow, or a month out, or six months out. Even things like how do you go back — being completely remote, or is it a hybrid, or is it fully in person? As accounting and finance professionals, we’re inquisitive. We ask questions. That’s one of the key things we need to do within our cross-functional leadership team is ask those questions, to pressure test the decisions to ensure we’re making the best decisions as a company or as an organization.”

The IMA has also been collaborating with the California Society of CPAs on research examining diversity, equity and inclusion in the accounting profession (see story), and that fits in with the group’s international growth.

“I’m very proud of the fact that in the last 10 years alone IMA has gone from being very much U.S.-centric to a global organization, and is now represented in over 150 countries,” said McNally. “Along with that comes the importance of really ensuring that as an organization we hear the voice of our global members. This year, I’m really excited that on July 1, the same day that I became global chair, we’ve actually launched a brand-new, board-level standing advisory committee. It’s our Global Markets Committee. And at the same time, we’ve now launched regional advisory committees in China, India and the Middle East. This is one way that we’re going to ensure that we better hear the voices of our diverse members. And I’m also proud for the first time ever, my successor, Gwen van Berne, will be the first non-U.S. chair of the IMA, so from a governance perspective, we’re pushing very hard to ensure we’re really embracing all kinds of diversity, and giving appropriate representation, whether it’s on our global board or our global technical advisory committees. But also, IMA has played a key role in terms of educating the broader profession and community in regards to setting the tone when it comes to ensuring diversity and equity in our profession and, through that awareness, working toward improving that fact.”

The IMA has also been encouraging accountants to develop technology skills in areas like data analytics as part of its Management Accounting Competency Framework, and McNally hopes to continue that work.

“As CFOs and just generally as accounting and finance professionals, I think we need to take a leadership role,” he said. “Clearly technology plays such an important role in preparing for the future, preparing our respective organizations to be successful. It starts with individuals cultivating a technology savvy mindset, and as individuals, doing what we can. I know I read up on things like RPA and blockchain and data visualization, just staying connected with what the technology trends are, and again as management accountants and finance leaders setting the tone within our own organizations, and evaluating where we are today. What systems do we have? What processes do we have? Where can we be better, more efficient, more effective? How can technology help with that? With that said, typically small and midsized businesses don’t have excess funds to invest, so it’s also very important that we think through the return on investment. What is the technology investment otherwise? That’s another place where the accounting and finance professionals can really make a difference within their cross-functional leadership team in ensuring that we’re asking the right questions, and pressure testing so that we invest in the right technologies for us at this moment in time.”

Accountants need to monitor their organizations’ technology investments and make sure the money doesn’t get wasted. “Over my career, I saw too many times where investments were made in technology and you get yourself to that finish line of going live, and then the management team or the project team moves on, and you take away the budgets for training and such,” said McNally. “You can’t do that. If you’re going to make an investment in technology, it’s really important that you sustain it through the training, through the upgrades and such. That’s where we as management, finance and accounting professionals can make such a difference, especially because we’re the ones typically managing the budgets and have oversight of the budget and can ensure those investments are made for the long term.”