عرض العناصر حسب علامة : COVID19

رسالة دكتوراه: نظم المناعة التنظيمية وقدرتها التأثيرية على تحسين جودة القرارات التنظيمية الاستثنائية أثناء جائحة كوفيد 19 وما بعد الجائحة والرجوع إلى الوضع الطبيعي الجديد

تسعي هذه الدراسة إلى معرفة القدرة التأثيرية لنظم المناعة التنظيمية علي جودة القرارات التنظيمية الاستثنائية اثناء وبعد جائحة كوفيد -١٩؛ لتحقيق ذلك تم اختيار عينة عشوائية مكونة من ١٠٠ مفردة ممثلة لمجتمع الدراسة وهي عشر شركات سياحية موزعة في مصر والسعودية. تم الاعتماد على برنامج smart-pls لتحليل البيانات المستخرجة من قائمة الاستقصاء الموزعة، واختبار الفروض.

3 طرق يمكن للبرامج أن تحسن بها اتصالاتك مع العميل

تتيح برامج التقارير المرئية للمحاسبين القانونيين التواصل بشكل أكثر فعالية مع العملاء حيث يمكن أن تظهر الشركات بالتفصيل وضعها المالي وأين تتجه.

معلومات إضافية

-

المحتوى بالإنجليزية

3 Ways Software Can Improve CPA-Client Communication

Visual reporting software enables CPAs to communicate more effectively with clients. CPAs can show businesses in detail their financial status and where they are headed.

CPAs are skilled in analyzing financial data and determining how it impacts the clients they serve. While this financial prowess is a valuable tool for businesses, effective communication is a skill that is equally important. Communication is so essential that 97 percent of employers said soft skills like communication were as important or more so than hard skills.

While good communication is a key skill for CPAs, it does not always come naturally. It is often something that must be developed and worked on consistently. Luckily, in this day and age, there is often a technological tool to help. Along with working on interpersonal communication tactics, CPAs can take advantage of software to improve communication with clients.

Be More Accessible

Sometimes, the biggest hindrance to communication is the availability of a CPA when a client comes calling. CPAs can utilize technology to ensure they are accessible to their clients and their relationship of trust is not compromised by being hard to reach. CPAs do not need to be at a client’s beck and call 24 hours a day, seven days a week. However, making the effort to talk to clients regularly—even checking in outside normal hours—lets them know their CPA is a trusted member of their team.

The COVID-19 pandemic ushered in a sudden need to communicate from afar—and it showcased technology that makes it possible. CPAs can use video conferencing software to conduct virtual meetings from anywhere in the world. Firms can also put Voice Over Internet Protocol software to use, allowing CPAs to use a secure phone line from anywhere to communicate with clients while protecting their data. Using these software options ensures CPAs can be there for their clients when they need them most.

Give Instant Feedback

When clients have questions or concerns, they want to know their CPA is on the ball and ready to assist them. Great communicators are quick to respond and provide feedback, reassuring clients that they are in good hands. Enter cloud-based software that can give near instantaneous results and act as a conduit between clients and their CPAs. Recent research showed that companies using cloud accounting software exclusively saw 15 percent growth year over year. Better communication with clients is no small part of this success.

Using cloud-based software allows CPAs to be more responsive to their clients and communicate quickly and accurately. Using the cloud to enter data and deliver analysis to clients gives them answers right away, and dashboards allow clients to see their financial performance in real time. Often, when clients have questions for their CPA, dashboards can be configured on the spot to show them what they need to know. CPAs can communicate rapid responses and accurate results for their clients with cloud software.

Provide Clearer Information

Have you ever had a conversation with a client, then felt as though your insights and advice fell on deaf ears? It’s quite possible that your analysis of the client’s financial data didn’t have the impact you hoped, but it may not be because your client didn’t want to hear it. Talking with clients is important, but people don’t always fully retain the information they hear. One study found that as many as 80 percent of people are visual learners, when compared to auditory learning. Your clients are much more likely to hang on to your every word when your advice comes with visuals.

CPAs provide their clients with valuable financial information, and good communication means ensuring clients understand that information. Visual reporting software enables CPAs to communicate more effectively with clients. CPAs can show businesses in detail their financial status and where they are headed. This software allows CPAs to explain their analysis more clearly, while clients are also more likely to retain and utilize the data for the benefit of their businesses.

CPAs must be good communicators as they build relationships with their clients and provide invaluable financial analysis and advice. This software and others can help CPAs improve their communication with clients as trusted advisors.

Ph.D: The Pedagogy of Blended Learning and Intellectual Capital Disclosure in Higher Education post COVID 19

Purpose - This frame aims to develop a framework for measuring intellectual capital disclosure in higher education institutions after Covid19. In addition, this paper uses the proposed framework to measure the level of intellectual capital disclosure in a wide range of faculties of higher education institutions.

محاربة الاحتيال في بيئة عمل هجينة

يأتي مع بيئات العمل الهجينة الجديدة لدينا إيجابيات وسلبيات. في مهنة المحاسبة على وجه التحديد، يؤدي تطبيق التكنولوجيا الجديدة إلى عمليات أكثر كفاءة، ولكن يمكن أن يؤدي أيضًا عن غير قصد إلى مخاطر إضافية مثل الاحتيال.

معلومات إضافية

-

المحتوى بالإنجليزية

Fighting fraud in a hybrid work environment

By Vinay Pai

December 17, 2021, 9:00 a.m. EST

4 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

With our new normal of hybrid work environments come both pros and cons. Specifically in the accounting profession, the implementation of new technology creates more efficient processes, but can also inadvertently lead to additional risks such as fraud.

While all industries face privacy and data security challenges in hybrid environments, the sensitive and confidential information in accountants’ routine work demands a higher level of cybersecurity to ensure that all client data is totally secure. It is essential that accountants remain vigilant for possible fraud and actively safeguard network systems to ensure continued strategic growth for small and midsized businesses.

How does fraud happen?

Advances in Tech brings together some of the latest software and technologies that are helping the industry move forward.

ACCOUNTING TODAY

Fraud can occur in many ways. While the concept of physical fraud risks may seem outdated (especially in hybrid environments), the majority of confidential data — such as Social Security numbers and credit card information — is still stolen the “old-fashioned” way, via theft of physical laptops or important documents (e.g., paper checks, invoices, sticky notes) from unsecured areas. Even with the potential of artificial intelligence to reduce the burden and risk of many manual processes, many accountants and bookkeepers are still remarkably reliant on paper with 40% of bookkeepers still printing and mailing checks.

Hybrid and remote work models have also exacerbated many existing cybersecurity risks for many accounting firms. In the early days of the pandemic — when the transition to remote work needed to happen essentially overnight — it wasn’t uncommon for firms to put necessary “Band-Aid” solutions in place. Many companies and accountants moved their data to the cloud for the first time, which is a positive development, but not a silver bullet to safety.

Phishing attempts have continued to rise, preying on the stress of employees and owners, and the lack of updated protections and employee education as they managed through a crisis. These deceiving emails and notes, often disguised as emails from colleagues, are one of the most common ways that hackers can gain access to even the most secure networks. Now is the time to refine and improve those new processes put into place over the past two years, prioritizing more secure practices and the safeguarding of sensitive data.

Preventing fraud

There are a variety of practices that firms can implement to mitigate the risks of fraud in hybrid work environments. From a data security perspective, it starts with the cloud.

Cloud-based solutions and Software-as-a-Service providers are the most secure way to store client data, as these systems have more secure encryption methods than what accounting firms can offer in-house. This also removes the risk of stolen computers from a “smash and grab” robbery. While it’s now generally accepted that storing data in the cloud is far more secure than relying on a paper trail, decentralized personnel and the lack of pre-developed protocols for remote work left many firms exposed to additional cyber risks from unsecure networks and personal devices.

Going forward, accounting firms should ensure that all accountants are trained on an ongoing basis in the best cybersecurity practices while in a hybrid environment, including how to identify, prevent and address all types of fraud threats, from physical to digital. Employees should be vigilant about diversifying their passwords, keeping their login credentials private and updating them regularly.

It’s also critical to use secure devices and networks, implementing multifactor authentication for all services, and software to monitor for phishing and other scams. Lastly, with the rise in popularity of automated workflows to process data and transactions in daily accounting practices, accounting firms should consider investing in and implementing AI systems that scan for mistakes, such as duplicate payments, fraud — and even basic human error.

Strengthening tech security

In light of many major players in the accounting profession embracing more permanent hybrid and remote work models, accounting firms of all sizes should identify what, if any, interactions really require paper or physical interaction. For practices (such as accounts payable and payroll) that can easily be digitized, accounting firms should ensure they’re supporting those practices through secure, online systems and cloud-based storage solutions to ensure the highest levels of data protection.

Additionally, for communication with clients, firms should establish secure portals for the transfer of sensitive documents that contain personal or sensitive information, such as Social Security numbers, bank account information and credit card details. Never send these documents over email. A cloud-based document sharing solution is much more secure. All-in-one SaaS solutions that allow you to manage your workflow, approvals and payments can provide high security and convenience in hybrid environments.

Prior to the pandemic, many accounting processes were based primarily on physical work models and paper-based processes, but the acceleration of flexible and remote work models has only increased the overdue need for accountants to embrace automated technologies and AI-enabled workflows.

As firms seek to implement new workflows, it’s essential to prioritize educating the teams about how to mitigate new and emerging fraud risks and secure data on cloud-based servers before the Trojan horse is wheeled through the front gates.

دليل لإدارة العاملين عن بُعد

معلومات إضافية

-

المحتوى بالإنجليزية

A Guide to Managing Your Remote Workers

07 December 2020

The world we have found ourselves living in right now is unsure, scary, brand new, and exciting all at once. All of our lives have changed in one way or another over the past year due to the crisis of Covid-19, with the majority of us having to adjust to working from home.

Moving your organization from an office setting to a makeshift workplace is definitely not easy, especially when it is abrupt and unexpected. There are so many inevitable challenges that both employees and managers come up against: slips in concentration, distractions, loneliness, ineffective communication, and much more.

However, remote working doesn’t have to equal disaster. That’s why we’ve put together this guide to managing your remote workers effectively so that you have one less thing to worry about. Living through a pandemic is difficult enough without your business having to struggle.

Keep reading and you’ll find out just how to identify any potential issues that your company could be experiencing due to having to work remotely, and a definitive list of tried-and-tested ways to combat these issues.

Common Challenges Managing Remote Work

There are many challenges that you may well come up against when you begin managing your newly remote employees. We’ve outlined the key issues that you could face, as it’s always best to be aware of them. There’s no need to worry though, we’ve also put together a handy list of tricks for you all about how managers can best support their team remotely.

Many people who work in roles like remote illustration jobs or remote SEO jobs may be more used to working from their homes. However, for the vast majority of staff, it will be an entirely new experience to work for their organization from a distance.

Identifying challenges is the first step towards solving them. Many of these issues are somewhat inevitable due to the nature of remote work.

Communication

Initially, one of the hardest challenges that you’ll come up against is learning how to effectively communicate with your employees.

Besides the obvious problem of not being able to see the people you work with and interact with them on a daily basis, there are more implicit communication issues that your managers need to tackle to keep your employees happy.

Firstly, a lot of the intent behind online messages can get lost in translation as it can be hard to detect someone’s mood or tone from a simple text or email. This is especially if you are communicating with a member of the team with who you are not as well acquainted!

Failing to communicate regularly with your staff can have disastrous consequences. Top tips for avoiding this include never canceling on a team call or one-on-one check-ins. Any cancellations, unless totally necessary, will cause your employees to lose confidence in your business and feel as though their time has been wasted.

Making people feel important and listened to is vital within a successful company, and effective communication is the key to this.

Supervision

With remote working comes a new sense of independence and responsibility for your team members, which many will struggle with.

A lack of face-to-face supervision and managerial feedback can be tough for all involved. For supervisors, there will be worries that employees are not working as hard or efficiently as they should be, and for employees, there will be struggles without proper access to the support and communication that supervision provides.

Remote working is a new concept for the vast majority of people, and so it is likely that we’re going to slip up. This could mean that a lack of in-person supervision which in turn, reduces productivity and confidence.

Access to information

A huge challenge to be overcome is the barriers to access to information. Many newly remote workers will end up spending a lot of time trying to locate information from the company or from co-workers in a way that they wouldn’t in an office. Everything takes longer: sending an email requires waiting for a response, whereas leaning over a desk to ask your colleague something takes seconds.

Limited access to information will not do any favors for the culture of your organization or the confidence of your staff. This is why it is so important that you have the best software and tools, as with outdated technology or poor organization your team members will struggle to find information that they need, become confused, and possibly make harmful mistakes.

Social isolation

A very sad reality of working remotely for many is an impinging feeling of social isolation. Spending the majority of your time by yourself trying to concentrate without any face-to-face interaction can definitely take its toll.

This can be especially hard if you are used to working in an environment where you are surrounded by people. To go from this to being somewhat isolated can be a difficult and sudden transition. A potential side-effect of this isolation over an extended period of time is that some workers feel a diminished sense of belonging to their company.

Home Distractions

Somewhat unavoidable is the problem of home distractions with remote work. Some people are more equipped than others to be able to work despite distractions, but the majority of us will succumb to them to an extent.

A sudden transition to remote work means that many will not have a dedicated workspace ready to use in their homes. This means that they will be working in communal spaces or areas which are not conducive to concentration. We must also take into consideration that more than one member of a given household could be working from home, which can increase the possibility of home distractions.

Common distractions around the house include family members or friends, parenting responsibilities, pets, and loud noises. Fostering a level of closeness between employees and with managers can help to create a culture of openness in which everyone can share their best tips for how to avoid getting distracted.

Home distractions

How Managers Can Support Remote Employees

After reading of the challenges that can arise from managing remote teams, you may be feeling worried about the future of your business. We’re here to tell you that there’s no need for concern!

All of the aforementioned issues can be remedied. As long as you have the right tools and attitudes, there is no reason not to be able to still connect with your employees and keep them moving with positivity and an excellent work ethic!

We’ve outlined some of the ways in which you can combat common issues with remote working, whether this be with part-time remote jobs or roles which are more traditionally suited to an office environment.

Daily Structured Routine

It is absolutely essential to come up with and stick to a daily structured routine. This should be implemented and monitored by supervisors to ensure that some sense of normality and system is adhered to.

An excellent and simple method to incorporate routine into how your employees work is to schedule a daily check-up via a video or audio call using software like Zoom. Some supervisors prefer this to be a series of one-on-one calls, whilst others would rather have a call with all team members. Topics to be covered during these calls include asking how work is progressing, if anyone has concerns or questions, and laying out plans of action for future projects or tasks.

Any way in which you want to check up on your staff is valid, as long as it is pre-planned and regular. This gives your staff a sense of structure reminiscent of their old work environment and lets them know that you are there if they need to communicate anything to you.

Another benefit of incorporating a daily structured routine into the lives of your teams is that managers will get to interact with employees potentially more than they did before the work environment went remote. An employee will now feel like they can put a name to a face for many of their colleagues which can be a great step in bringing the business together and encouraging trust and productivity.

Provide Tech Solutions

The days in which email alone was a sufficient means to communicate with colleagues are over. Managing your new remote workers requires a more sophisticated way to communicate.

Those who work from home benefit from having multiple technology solutions, such as video conferences and direct messages. There are so many tech solutions out there, it’s just a matter of choosing the ones that work for you and your employees the best.

Managing remote workers makes the arranging of meetings much harder. You can no longer walk into a room and round everyone up for a talk. Instead, you’ll have to find the right technological solutions that work for everyone. The best tools will enable managers and employees to stay on the same page and organize part of your time for you.

A communication tool that is audio-visual such as video conferencing or phone calls can have many advantages for workers, such as allowing for increase shared knowledge and reducing a sense of social isolation.

What’s more, there are much better ways of expressing particular tones and intents than sending a rudimentary email. What can be much better is communicating through video or by using GIFs and emoticons on a messaging application such as Slack.

Provide tech solutions

Clear Terms and Outlined Brief

In order to further maintain structure and efficiency, it is a good idea for supervisors to outline clear briefs and terms.

An excellent system that supervisors can use to do this is by setting rigid expectations for their teams in terms of communication and workload. For example, let your workers know when is the best time for them to contact you, when to expect video conference calls, and when it is appropriate to use direct messaging, email, and so on.

Organizing rules of engagement is a great method of keeping consistency within your business and can be very satisfying then carried out efficiently.

It is important to establish clear times and an outlined brief as soon as possible when managing remote employees. This way every member of the team will be able to communicate effectively with each other, share information as needed, and set the tone for what is expected of them while working at home.

If you work within a large organization, there is a chance that members of your staff will be working in different time zones. Keep this in mind when creating schedules and check-ins, as not every employee will be available at the same time as others.

Many employees struggle with working remotely initially because they fail to adapt to no longer being in their workplaces. Making everything clearly outlined and detailed, with tips for them to follow during their first time working without direct contact is a great method of inspiring confidence and providing support.

Social Engagement

One of the easiest and most important ways that managers can support remote workers is through engaging in social interaction whenever possible. A simple means to do this is allowing time at the beginning or end of a work call to discuss non-work related topics, such as how everyone is doing, or what they are up to.

It may seem obvious, but social engagement can do wonders for any business, remote or otherwise! Going from working in an office surrounded by people to being stuck inside by yourself all day can be really tricky, so managers should always try and encourage social interaction.

Human beings are social creatures, so at the very least your colleagues should all know each other by first name and be comfortable chatting. Failure to foster social engagement in your organization can have serious health impacts on your staff.

A long-term impact of loneliness (which can be triggered from remote work) is the development of a depressive or anxious state. A good manager will be aware of this and be actively working towards avoiding their teams reaching such a state.

Not only this but encouraging employees to interact with each other can also be effective in reducing feelings of social isolation and increasing mutual knowledge. Virtual events or even informal chats over a messaging app or on the phone can be really helpful in building up trusting relationships.

Team Player

As a manager, one of the biggest mistakes you can make is to distance yourself from your employees too much. You want to be personable and approachable in order to cultivate a culture of transparency and openness in your office. The alternative to this is coming across as either intimidating and far-removed from the work and lives of the employee, which is definitely not desirable.

To combat this common issue, supervisors should engage with their employees by offering encouragement, work advice, and emotional support if necessary. In the context of remote work, where many people experienced an abrupt and stress-inducing change to their lives, it is important for managers to empathize with this and listen to their employees.

Easy ways to become more of a team player include encouraging social interaction amongst colleagues, taking the time to listen to concerns or feedback from an employee, and providing reassurance and resources when needed.

Many companies who work remotely will organize an event once a week or fortnight as a way to check in and be present with its employees. A great way to do this is by hosting virtual parties or starting a club where managers and employees can send a book or article they enjoyed recently, for example.

Final Thoughts

Trying to manage many employees remotely for the first time is challenging and can feel difficult or frustrating at times. The majority of companies who have had to go remote in the past year did not plan on doing so, meaning that they had to overcome many unknown dilemmas and hurdles.

It is a learning process for everyone within a business to figure out how to effectively work from home, but it is the job of managers to ensure that the transition to working remotely for the first time is successful and as smooth as possible.

However, it is entirely possible for companies to be just as successful with a remote team as they were within an office setting. Some of the rules and methods may be a little different or unconventional, but the fundamentals of managing a team remain the same.

Make sure to follow the guide that we’ve given you, and always be aware of any challenges that either you or your employees are facing. The most important part about managing remote teams is making sure that everyone is happy and actively wanting to continue working. Ensuring this means sticking to the tips we’ve outlined for you above, and always remembering to be a team member.

We will get through the Covid-19 pandemic together, and if you manage your newly remote workers well, your company can come out the other side more successful than ever!

تجنب هذه الأخطاء الصغيرة في مسك الدفاتر

عندما تصبح الأوقات صعبة، تستمر الأمور الصعبة. في حين أدى جائحة COVID-19 إلى زوال بعض الشركات الصغيرة، فإن حالة عدم اليقين أشعلت موجة من روح المبادرة لدى العديد منها، مما حفز إطلاق عدد غير مسبوق من الشركات الجديدة.

معلومات إضافية

-

المحتوى بالإنجليزية

Avoid these small-biz bookkeeping mistakes

By Lawrence Levinson

November 18, 2021, 1:05 p.m. EST

4 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

When times get tough, the tough get going. While the COVID-19 pandemic led to the demise of some small businesses, the uncertainty sparked a wave of entrepreneurial spirit in many, spurring the launch of an unprecedented number of new ones.

According to the U.S. Census Bureau, more than 4.4 million new businesses were created in the U.S. in 2020 — that’s 24.3% more than in 2019. In June 2021 alone, more than 448,000 new business applications were filed.

As these new businesses take shape in a new and evolving landscape, it’s important to not overlook the fundamental elements that contribute to a business’s long-term financial health. While most business owners start a venture because they have a passion, talent or craft to share with others, neglecting the administrative side of running a business can impact its longevity.

Payroll Relief: The Ultimate Payroll Software for Accountants

SPONSOR CONTENT FROM ACCOUNTANTSWORLD

The good news is that many of these missteps can be addressed by building some best practices into the company's bookkeeping routine. Let’s explore the most common slip-ups and how to fix them.

Mixing personal and business finances

Although running your business is a big part of your life, when it comes to your finances, you still need to separate business from personal. Specifically, this applies to your bank accounts. Failing to do so will make it hard to figure out which expenses are business-related and tax deductible.

Even if you have separate accounts for business and personal finances, be cautious when you use personal funds to pay for business expenses. While a swipe of your personal card to cover an item here and there may seem innocuous, they quickly add up over time and can be hard to keep track of. What’s more, you might forget to account for these expenses and miss out on tax savings down the line.

Bookkeeping without a bank connection

Once you’re all set up with a separate business bank account, bookkeeping for your business becomes easier, as you can use the bank data to keep track of income and expenses. One thing you don’t want to get stuck with, however, is the painstaking and time-consuming task of having to enter your bank data manually.

Using accounting software that connects to your bank digitally eliminates the bulk of manual entry, and makes tracking sales and expenses much more efficient.

Failing to keep records in a safe place (or at all)

A small-business owner came to us for assistance last February to get their books in order for tax season. But here’s the plot twist: They had stored their receipts in their desk drawer, and had just completed a move across the country. In the process of moving, the people they hired to help them move cleared out the drawers and tossed the receipts out, so they were left with no record of their expenses.

Even with a designated business account, it’s still important to retain records and documentation of your transactions. These will come in handy at tax time as well as if you face an audit. They’re also helpful if you’re unsure of which category an expense goes under, so an accountant or tax professional can look at the receipt and advise.

The next time you make a transaction, scan your receipt and save it on your computer, or better yet, use accounting software that links to your bank card and digitally files receipts and invoice copies for safekeeping.

Not hiring the right professional for your business

One way to avoid some of the bookkeeping work is to outsource the task altogether. However, this can be a costly mistake if the person you hire doesn’t have experience relevant to your needs. It may be tempting to turn to a friend for “free” advice, or a fellow entrepreneur who claims to have a great handle on their own finances, but keep in mind that individual needs differ.

Modern bookkeeping and banking solutions can save business owners many hours and headaches. These solutions are designed to save you time and help you feel in control of your finances. Coaching from qualified experts can help take you to the next level of growth and provide advice and insights that are tailored to you. When business picks up and you’ve got a lot on your plate, delegating the task of bookkeeping makes sense as you focus on the bigger picture.

'Putting it off' until tax season

Since bookkeeping is a collection of small, separate tasks that build up over time, it can be tough to tackle all at once. Leaving it to the last minute can cause a lot of stress and lead to significant mistakes.

The best thing you can do is set aside some time throughout the year — I recommend at least once a quarter and ideally once a month — to review your records and ensure everything is up to date and accurate.

Keeping an eye on your books throughout the year can also give you a better idea of your cash flow, which can ultimately help you make smarter financially informed business decisions.

Nearly two years into the pandemic, it’s clear the business landscape has been forever changed. While optimism is high for the millions of new small-business owners across the country, the truth is that starting your own business is anything but a guaranteed success. By taking a proactive and intentional approach to bookkeeping, entrepreneurs can put themselves on the fast track to business longevity. - البلد الأردن

4 تغييرات ستستمر في المحاسبة لفترة طويلة بعد انتهاء الوباء

لقد أثرت التأثيرات بعيدة المدى لوباء COVID-19 على كل صناعة في جميع أنحاء العالم، ولم يعد خبراء حماية البيئة محصنين.

معلومات إضافية

-

المحتوى بالإنجليزية

4 changes that will stick with accounting long after the pandemic is over

By Justin Hatch

October 12, 2021 3:24 PM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The COVID-19 pandemic’s far-reaching effects have touched every industry around the world, and CPAs are not immune. Not only were CPA firms working to help the businesses they serve survive economic challenges, but they were fighting their own battles as well. According to one survey, approximately 90% of CPA firms reported concerns for their company, ranging from health to finances and operations. Despite the challenges, firms also reported facing the challenges with innovations like using cloud technology and innovation.

Necessity is the mother of invention — or in some cases, reinvention. The accounting industry was forced by COVID-19 to evolve almost overnight, and not all of the changes that occurred will be going away. Here are some of the adaptations that will be part of the industry going forward.

Adaptability

coronavirus-mask.jpgCPAs have learned to adapt quickly to changes in their work, whether it be major financial programs like the Paycheck Protection Program or adjusting the way they work with clients. Clients have come to expect continually up-to-date information from their CPA anytime they need it, and there will be no going back. Customers will expect their accountants to be able to come up with solutions at the drop of a hat, whether or not there is an international crisis.

Not only will customers continue to demand more agility from CPAs, but there will always be rapid changes that require accountants to think on their feet. CPAs stood tall when the challenge arose in 2020, and the pandemic only made them more able to face any new obstacles in the future.

Better communication

A lack of in-person interaction could be detrimental for some, but for CPAs, it may have actually been a boon. Trying to work remotely with clients forced CPAs to communicate more effectively. Cloud-based dashboards, video conference calls, chatting online, and sending frequent emails are the norm now, whereas both CPAs and clients may have been reluctant to give them a try before.

Clients couldn’t be left hanging during a pandemic that had major financial implications. They needed fast, insightful information about new programs and how they could help their business, and it was up to CPAs to stay on top of it all and boil it down for them. The result is CPAs who are better communicators for future clients as well.

Flexible work environment

COVID-19 brought about a sudden adjustment as workers moved from conference rooms to living rooms. Though many businesses, including CPA firms, later began bringing workers back, the office landscape has likely changed for good. More workers are staying in their home offices full time or choosing a hybrid option, with some working from home and some in the office. This shift not only affects the way a CPA firm runs internally but also how it will serve its clients — many of whom are shifting to more remote work as well.

CPAs and clients alike learned to work with each other from a distance, and that will add a level of flexibility going forward that will benefit everyone. Businesses will come to rely on their accountants outside of more traditional meetings and scheduled reports, and CPAs will be able to answer the bell from anywhere if needed.

Expanded services

The Paycheck Protection Program was a much-needed life preserver for struggling businesses in 2020, but the intricacies of the program were a lot to work through. Applications, required paperwork, loan forgiveness and other factors could make the program confusing for business owners. CPA firms reported expanding services to help businesses take advantage of the program, making up 39% of new services offered to clients.

Although this service was directly related to the pandemic, firms will continue to expand their offerings even after the pandemic is in the past. In a 2021 survey, 33% of firms reported they anticipated adding new services like financial advisory, cash flow and risk advisory in the next year.

Many of the changes brought on by COVID-19 were already in motion in the industry, but firms got the extra push they needed to move forward. Businesses have been seeking more advisory services from their CPAs for years, and many firms have begun to expand their offerings. The pandemic, and the severe economic impact it had across industries, helped move the transition along.

CPAs have fought alongside their clients through the COVID-19 pandemic, and their work has been vital to businesses’ success through the crisis. The lessons learned from the pandemic will have a long-lasting impact on the profession as CPAs continue to adapt and grow for the benefit of their clients.

المواقف المتميزة وسط الأزمة

في الوقت الذي لا يوجد فيه الكثير من الأخبار السارة في العالم للإبلاغ عنها، نحن متحمسون جدًا لأن نكون قادرين على القيام بذلك من خلال تقديم خبر "القادة الناشئين لعام 2021 لمجلة المدقق الداخلي".

معلومات إضافية

-

المحتوى بالإنجليزية

At a time when there’s not a lot of good news in the world to report, we are very excited to be able to do just that by introducing Internal Auditor magazine’s 2021 Emerging Leaders.

As we’re all well aware, working during a worldwide pandemic has introduced a host of new challenges for internal auditors, including remote work, travel restrictions, and communication issues, not to mention helping their organizations form COVID-19 response plans. This year’s Emerging Leaders have been required to address these and many other issues while continuing to add value in their daily work. And, as you will read in “Emerging Leaders: 2021,” they have done just that.

As Bill Mulcahy, longtime practitioner and IIA volunteer, explained in his nomination of honoree Christy Beers, “She handled the ultimate audit double dip — a large company merger while managing the changes that come with remote work during the pandemic.” Bill, who sadly passed away earlier this year, was one of Christy’s biggest advocates. “I’m grateful for having known him,” she told us. “I wouldn’t be where I am today without his mentorship.”

Bill was also a big advocate of Internal Auditor’s Emerging Leaders, nominating a young professional each year. Whenever one of his nominees was chosen, Bill would be sure to take out a full-page ad to congratulate him or her. We will greatly miss his dedication to, and enthusiasm for, advancing the next generation of internal auditors.

Bill’s 2021 nomination is one of 15 Emerging Leaders who hail from across the U.S. and five additional countries — The Bahamas, Canada, Ghana, United Arab Emirates, and Vietnam. Five men and 10 women from a variety of industries and backgrounds share their stories of success. From using virtual meetings and telehealth systems for virtual walk-throughs, to creating a collaborative onboarding portal and team intranet site, to creating new opportunities to be agents of change during the pandemic, their stories are diverse and impressive.

And speaking of impressive, beginning on page 41, we check in with some of our past Emerging Leaders. Whether they continue to rise through the ranks of internal auditing or are using their audit experience to move into a new profession, many of our past Leaders, as expected, continue to excel in their chosen career paths.

Hear more from past and current Emerging Leaders about just what it takes to be a leader in a series of videos on InternalAuditor.org.

Congratulations to our 2021 Emerging Leaders! You’ve persevered through a pandemic and are more prepared than ever to be leaders in your profession.

معهد المحاسبين الإداريين يقاوم تطور منهج شهادة المحاسب القانوني المعتمد

يعترض معهد المحاسبين الإداريين على الإلغاء المحتمل للمحاسبة الإدارية من الدورات المستقبلية المطلوبة للطلاب الذين يتابعون مهنة في المحاسبة.

معلومات إضافية

-

المحتوى بالإنجليزية

IMA pushes back on CPA Evolution

The Institute of Management Accountants is objecting to the possible elimination of management accounting from the future courses required for students pursuing a career in accounting.

The American Institute of CPAs and the National Association of State Boards of Accountancy are set to unveil the model accounting curriculum they have developed for their CPA Evolution project during an online event Tuesday co-hosted by the American Accounting Association. While the curriculum is still in progress, IMA officials are concerned that it may de-emphasize management accounting and cost accounting skills. Last week, the IMA posted an article from its vice president of research, Raef Lawson, and Roopa Venkatesh, chair of the IMA's Committee on Academic Relations and an associate professor of accounting at the University of Nebraska at Omaha, arguing against the possible changes. “IMA has concerns regarding the potentially deleterious effect dropping managerial/cost accounting from the required curriculum for CPAs proposed in the CPA Evolution model (and the Uniform Accountancy Act Model Rules of November 2020) will have on the ability of the accounting profession to protect the public and serve the public interest,” they wrote. “We challenge the implicit premise that a core knowledge of managerial accounting is not essential to the work of the CPA.”

The IMA is waiting to see what happens with the final curriculum. The IMA and the AICPA have had disagreements over the years after the AICPA and the Chartered Institute of Management Accountants jointly rolled out their Chartered Global Management Accountant designation in 2012 as a rival to the IMA’s Certified Management Accountant credential, but the organizations have since worked together on a number of initiatives. Still, the possible changes in the accounting curriculum are troubling to the IMA, and the board met to discuss their concerns on Saturday.

“There have been indications or innuendoes that management accounting or cost accounting would be an elective or an option, and that concerns us,” IMA president and CEO Jeff Thomson told Accounting Today. “We have to see what plays out, but we did issue a press release and a briefing. To be clear, it is absolutely not about a certification. It’s not about CMA, it’s not about CPA, it’s not about CGMA. In fact, we’re as concerned about CPAs in audit running CPA firms being prepared as we are about the profession. We’re concerned about the profession and the public interest. When you take away cost accounting, management accounting, and those kinds of domains, or make them electives, just think about it. These curricula for four-year or five-year programs are being squeezed today. It’s like a zero sum game. You can only fit in so much. And right now, data analytics and technology are forcing their way in, as they should. You want more data analytics and you want more technology courseware. But then if you’re saying, well, let's take away management accounting courses, all the stuff that’s in that competency framework, potentially, and make it electives or optional. Well, that’s all the stuff that generates decision support, planning, forecasting, risk, all the things that lead to insight and foresight for a CPA or a business advisor, consultative thinking, critical thinking, whether you're a CPA running a firm, a CPA in audit or tax, the rhythm of the numbers, the cadence of the numbers, not just producing the binary audit. We're speaking not so much from a CMA perspective, but from the perspective of the public interest, from the perspective of the profession, from a long-run integrated view.”

He is willing to take a wait and see approach. “Now, granted, these are just indications we've gotten,” said Thomson. “We’ve not seen an actual curriculum, but as we begin to see indications, we figured we should get ahead of what we were hearing and put out a briefing and put out a press release, and then we’ll express our views to AICPA and NASBA. It’s not about associations. It's not about certifications. It's about the profession in the long run. And it’s about the professionals, preparing them to be well-rounded thinkers.”

Institute of Management Accountants president and CEO Jeff ThomsonCourtesy of the IMA

The AICPA and NASBA issued a joint statement Monday to Accounting Today in response to the IMA’s briefing. “Feedback from stakeholders is very important to us, which is why we’ve worked closely with a broad range of individuals from the profession, academia and regulation to develop the CPA Evolution Model Curriculum,” said the joint statement. “We received IMA’s concerns, which we feel are unwarranted as they don’t accurately reflect the content in the Curriculum. We have invited IMA representatives and all interested stakeholders to attend our launch event tomorrow, review the Curriculum and share feedback at that time.”

Meanwhile, the IMA is aligning with the AICPA in its support for a bill that was introduced in Congress last week to make accounting part of the STEM curricula for science, technology, engineering and mathematics at schools (see story).

“We want various stages, K through 12, to be thinking about the incredible pathways and careers that become open to how we have redefined accounting, how you can make a difference, how you can serve the public interest,” said Thomson. “Accounting has so many different facets to it. And this also ties into CPA Evolution. Accounting is audit. Accounting is compliance. It’s tax, it’s FP&A, it’s technology. It’s analytics, it’s supply chain. There are so many incredible pathways and careers and opportunities to make a difference. But if we narrowly define accounting, that’s where we kind of go off the rails. And so we need to make sure we define accounting from a holistic, interconnected perspective and not kind of pigeonhole or file it off as a certification. It's not about CPA or CMA or CGMA or CIA. It's about the holistic profession and all it has to offer. And if we tell that story, and if we begin telling that story to K through 12, let alone to millennials, I think we’ll attract the best and the brightest. Whether we call it STEAM versus STEM, it really is part of that interconnected set of disciplines beyond technology.”

The IMA has been modifying its own Management Accounting Competency Framework to include more technology skills and has been offering online courses in subjects such as robotic process automation and cybersecurity. The IMA is holding its annual conference online for the first time this week. On Monday it included a session on how data can be implicitly biased for or against some racial, ethnic or gender groups, and how accountants can be on the lookout for that.

“There could be positive outcomes or negative outcomes from bias because, at the source of capturing this data and transforming it, there is a human being that is aiding that machine to learn how to work on this data set or what to look for in future data sets,” said Venkatesh. “It almost becomes harder to identify it because most of us see the data in a usable structured format. We’re not out there capturing the data or standing by the video camera or monitoring that saying this is how we capture the traffic on this street or whatever it might be.”

Another recent course from the IMA discusses ethics in the digital age. “It talks about different types of biases in your data that you need to control for, like an algorithmic bias, algorithms that are preprogrammed that create unfortunate, targeted types of bias,” said Thomson. “You want to make sure when you program these algorithms that the algorithms are exposed in advance and don’t target certain minorities.”

He noted that the IMA recently issued a joint study with the California Society of CPAs on diversity, ethics and inclusion among U.S. accountants, and the IMA is working with think tanks on diversity solutions. “We’re going to be launching some global studies,” said Thomson. “We hired a director of DE&I and we’ve continued to do an awful lot on analytics.”

Overall the IMA has managed to increase the number of CMAs over the past year despite the pandemic. “We're actually going to end the year pretty strongly considering it’s the year of COVID,” said Thomson. “We expect to end the year with about a 5% increase in CMAs in the workforce. We’re going to be launching year six of our new CMA ad campaign, and we expect sometime in the summer or the September time frame to issue our 100,000th CMA certificate. The 50th anniversary of the CMA is next year, so there’s a lot going on.”

توقعات عن ارتفاع رسوم التدقيق بنسبة 62٪ هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

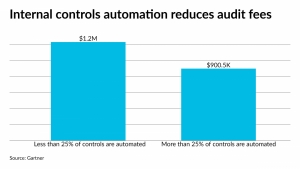

Clients anticipate that audit fees will increase in 2021 due to the impact of inflation, COVID-19, acquisitions and divestitures, according to a survey by Gartner.

The survey found that 62% of the companies polled are expecting audit fee increases this year, but that may be offset by technology savings. Organizations that automate at least 25% of their internal controls paid 27% lower audit fees on average, according to Gartner’s survey of 166 publicly traded and privately held companies. Of the respondents, 81% used a Big Four audit firm. Of the 166 organizations surveyed, Gartner analyzed 124 for the impact that internal controls automation had on the amount they ultimately paid in audit fees.

The survey revealed the steadily increasing amounts of audit fees, exacerbated by the inflationary pressures that have affected so many sectors of the economy this year as the U.S. and the rest of the world struggle to recover from the COVID-19 pandemic. The pandemic also accelerated the shift to technologies like remote audits over the past year, and the increasing use of automation for audits and internal controls as many auditors worked from home and away from their offices.

Companies with fewer than 50 controls, and more than 25% of them automated, reported 52% lower audit fees relative to ones with less than 25% of their controls automated. In comparison, companies with 50 to 250, as well as more than 250 controls and more than 25% automated, showed 27% lower audit fees.

“With audit fees increasing significantly, finance leaders should take note that organizations with higher levels of internal control automation saw substantially lower external audit fees on average,” said Ashwani Gupta, director in the Gartner Finance practice, in a statement Tuesday. “The biggest decreases were seen in organizations using between 1 to 50 controls, suggesting that getting internal control automation started has potential cost benefits when it comes to audit. Automation of internal controls can play a role in not only reducing financial reporting and audit risks but also audit costs. As organizations invest in internal controls automation it will likely become a prominent argument for audit fee reductions in the future."

Audit fee spiked the most last year in the banking and insurance sectors, with 69% of respondents in each category reporting increases. Financial services companies have more complex accounting processes and financial reporting exposures needing more auditor hours. Insurance companies also experienced some of the highest number of internal controls relative to companies in other industries.

On the other hand, the technology and telecom sector showed the lowest impact on fees, with only 41% of respondents reporting increases for 2020. The companies that did report fee increases most often indicated they were sizable, with 22% of overall respondents reporting “significant” audit fee increases of 6% or more, compared to the fees paid in 2019.

The main factors driving audit fee increases ranged from inflation to COVID-19 related, but organizations that negotiated on audit fees and made a strong case with their primary auditing firm were able to get a flat fee or a lower than expected audit fee increase. Of the respondents who attempted to negotiate their fees, 45% said their fees declined by over 6%, while half were able to cut their fees by between 3 to 6%.