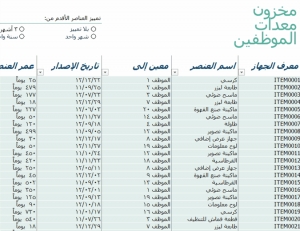

عرض العناصر حسب علامة : المخزون

الأربعاء, 23 نوفمبر 2022 09:40

رسالة ماجستير: المعالجة المحاسبية للمخزونات بين المخطط المحاسبي الوطني والنظام المحاسبي المالي

يعتبر الاقتصاد الوطني لكل دولة مقياساً لمدى مواكبتها للاقتصاد العالمي، لذلك تسعى كل دولة لتطوير العجلة الاقتصادية وتسريعها لضمان البقاء ضمن المنافسة العالمية، وهذا ما يجعلها تجدد التنظيمات والقوانين التي تحكم اقتصادها الوطني.

نشر في

رسائل ماجستير و دكتوراة

الثلاثاء, 13 سبتمبر 2022 12:35

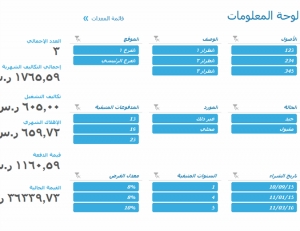

ما هو نظام المحاسبة المتكامل

باستخدام برنامج المحاسبة المتكامل الصحيح، يمكنك قضاء وقت أقل في إدارة مهام المحاسبة وتقليل أخطاء إدخال البيانات المكلفة المحتملة. إليك كل ما تحتاج لمعرفته حول كيفية عمل تكامل نظام المحاسبة وكيفية اختيار الأداة المناسبة لعملك.

نشر في

تكنولوجيا المعلومات

الأحد, 21 نوفمبر 2021 15:23

الواقع البديل لإدارة الأرباح الحقيقية

معلومات إضافية

-

المحتوى بالإنجليزية

The Alternate Reality of REM

Real earnings management may generate short-term financial gains, but it could be concealing fraud.

Robert J. Knisley and Hui LinNovember 18, 2021Comments

Among the pandemic’s many impacts, occupational fraud risk has increased substantially in many companies and industries worldwide. Nearly three-fourths of respondents to the Association of Certified Fraud Examiners’ (ACFE’s) Fraud in the Wake of COVID-19: Benchmark Report–September 2020 Edition predicted fraudulent behavior to increase in the following 12 months.

As revenue streams and planned spending have been dramatically upended and altered, organizations have eliminated or drastically cut operational spending to account for the lost revenue. That opens the door for financial statement fraud risks. Financial statement fraud represents only 10% of fraud cases in ACFE’s 2020 Report to the Nations global study, yet it accounts for the highest median loss ($954,000). Further, such schemes can go undetected for as long as two years.

Real earnings management (REM) can be construed as a type of financial statement fraud in which managers intentionally create an alternative reality of what is going on within the organization’s accounts. With this fraud, management deviates from normal business practices to meet short-term earnings thresholds. That can delay bad news but eventually could cause a more significant market disappointment. As financial regulators increase scrutiny of companies’ earnings management practices, internal audit can help preemptively by assessing and monitoring operational decisions to ensure financial reliability and effective risk management.

REM PRACTICES RAISE RISKS

REM can raise audit concerns about a company’s accounting practices, and those practices also may have legal risks. Green Mountain Coffee Inc. is among several companies that have faced class-action securities fraud lawsuits stemming from the controversial practice of inflating product demand by building up inventory.

There are five ways that companies perform REM:

Overproduction to decrease cost of goods sold (COGS) expense.

Cutting desirable research and development expenditures.

Cutting general and administrative expenses of sales.

Timing the sale of fixed assets to report gains to boost current period earnings.

Encouraging customers to take excess inventory accompanied with unusual discounts or rights of return, also known as channel stuffing.

Internal auditors should be aware that managers’ intentions distinguish acceptable REM from fraudulent REM activities. For example, a manager may intentionally engage in fraud-ulent REM to achieve a bonus or avoid missing an earnings target. This behavior creates an alternate, fraudulent reality through a deliberate distortion of the financial statements.

THE ILLUSION OF COST-CUTTING

Auditors can better understand about REM practices by taking a closer look at how companies overproduce inventory to decrease COGS expenses. U.S. Generally Accepted Accounting Principles require absorption costing when valuing inventory for external financial reporting. This costing method allows companies to allocate the full manufacturing costs (variable and fixed) to a product.

Absorption costing occurs when a company assigns the direct material, direct labor, and manufacturing overhead to the product in the work-in-process account during production. Once the product is completed, the company transfers the cost of goods manufactured (COGM) from the work-in-process account to the finished goods account, where those costs reside on the balance sheet. When the finished product is sold, the company transfers the COGM off the balance sheet to the income statement as COGS.

Manufacturing overhead represents a significant percentage of overall manufacturing costs. In addition, management has discretion in determining a basis for allocating the overhead to the product, such as based on direct labor, machine hours, or volume. Therefore, internal auditors should be aware of the method management uses to allocate the overhead and whether it may have fraudulent implications. Auditors can learn this by asking the production manager or cost accountant about the allocation method in place and why it is used.

U.S. Financial Accounting Stand-ards Board (FASB) Statement of Fin-ancial Accounting Standards No. 151 provides discretion by allowing companies to account for normal excess capacity under absorption costing. However, FASB does not clearly define what constitutes normal excess capacity. This discretion provides managers an opportunity to increase manufacturing production above normal capacity — what the company is normally able to sell — to achieve analyst earnings per share, annual bonus, or enhanced financial statement performance expectations.

Although the organization’s financial statements are strengthened in the short term, the additional inventory can have an adverse long-term effect by eroding firm value and brand image. Internal auditors should determine whether the company has significantly built up inventory that exceeds planned production or forecasted sales. Such an increase would affect the inventory account on the balance sheet and the COGS account on the income statement, providing a red flag. Further, auditors should investigate the associated expenses related to the excess inventory, such as storage and insurance expenses, which would not have been incurred otherwise.

INTERNAL AUDIT AND FRAUD DETECTION

Internal audit is well-suited to examine management’s business decisions as well as investigate REM and its fraud potential. However, auditors may struggle to detect managerial intentions because of REM’s opaque nature and ability to be disguised as actual operational decisions. That is particularly unfortunate in the manufacturing industry, which suffers among the highest median losses from a case of financial statement fraud ($198,000), according to the ACFE’s Report to the Nations.

Internal auditors can use their broad access to organizational systems and many areas of the business to detect fraudulent REM activities such as overproduction of inventory. Those efforts may be helped by three types of analysis tools:

Horizontal analysis. Considers the financial performance of an account over time.

Vertical analysis. Compares the financial performance of an account to a base amount in a particular year.

Ratio analysis. Measures the relationship between financial statement accounts.

Internal auditors should use these three analysis tools together to identify areas of fraud risk and potential red flags in the financial statements. They can use horizontal analysis to compare the current balance of the inventory account to previous quarters and years. For example, if the inventory account is growing significantly over time without irregular sales volume, it could indicate there is inventory buildup for fraudulent reasons.

Vertical analysis, or common size analysis, is most useful when comparing industry benchmarks or competitors’ financial statement accounts. Common-sizing involves dividing each account into a base number — that is, the total assets for the balance sheet and revenues for the income statement — thereby showing each account as a percentage of the base number. By common-sizing the financial statements, it becomes easy to measure the relative importance of each account and provides an opportunity to compare companies of different sizes. For example, is the organization’s COGS account significantly less than industry benchmarks or competitors?

Finally, ratio analysis is helpful in measuring the relationship between the balance sheet and income statement accounts. Two ratios that would be of interest are inventory turnover and day’s sales in inventory. The inventory turnover ratio — the COGS divided by the average inventory — indicates the number of times an organization goes through its inventory in a year. If this ratio has decreased significantly over time, it could indicate an excessive buildup of inventory.

The day’s sale of inventory provides information on how much inventory an organization has available. It is calculated by dividing the ending inventory by the COGS and then multiplying by 365. A dramatic increase in this ratio could indicate an inventory issue.

Besides these analysis tools, internal auditors should monitor the organization’s budget-to-actual report monthly to identify any significant changes in inventory-related accounts. Furthermore, where analysis shows accounts with red flags, auditors should investigate further by performing more substantive tests of analytical procedures and the details of transactions and balances, as well as questioning operational personnel. Additionally, internal auditors should review the controls over manufacturing production and examine the master budget and its components. If internal auditors are familiar with REM and can detect when it is practiced, they can investigate whether the intention is to mask declining sales and report what they discover to management and those charged with governance.

THE SIGNS OF FRAUD

Buildup of inventory could be attributed to slumping sales or intense competition from competitors, rather than fraud. Being able to distinguish between fraudulent and legitimate practices is one reason why internal auditors should possess a solid understanding of their organization and the industry in which it competes.

Likewise, auditors should know what pressures and incentives influence managers’ behaviors and, ultimately, their decision-making. Analyst expectations and managerial compensation incentives can motivate managers to commit financial statement fraud through an REM fraud scheme. In turn, the manager’s REM decisions to increase manufacturing production intentionally deceive analysts, shareholders, and creditors. Such temptation is even more reason for internal auditors to take extra steps to help safeguard their organizations against fraudulent schemes in these volatile and uncertain economic times. - البلد الأردن

نشر في

موضوعات متنوعة

الإثنين, 30 مايو 2022 13:42

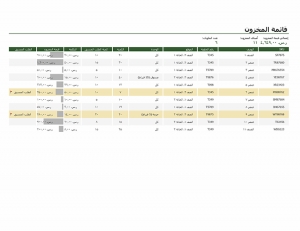

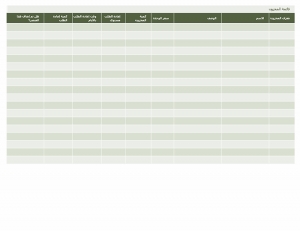

نموذج عمل: قائمة المخزون مع تمييز إعادة الطلب

نشر في

نماذج عمل مهنية

موسومة تحت