عرض العناصر حسب علامة : نصائح مهنية

الإثنين, 22 فبراير 2021 12:20

تنمية ممارستك -بدون إضافة عملاء جدد

ليس سرا أن المنافسة اليوم شرسة. أضف ذلك إلى عام الوباء حيث كانت العديد من الشركات تكافح من أجل البقاء

معلومات إضافية

-

المحتوى بالإنجليزية

Growing your practice — without adding new clients

By Charles Hylan

February 17, 2021, 9:00 a.m. EST

3 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

It’s no secret that competition today is fierce. Add that to the year of the pandemic where many businesses were struggling to survive, and the thought of growth may seem like a stretch goal. However, it was and is possible. And the best part is that you can likely grow your practice without adding new clients. A few simple steps and modifications or additions to your current business model can make all the difference.

1. Benchmark your firm with others your size and in your market. One of the first things you can do is to benchmark your firm with other firms in your space. The easiest way to accomplish this is to determine your financial and managerial metrics and compare them to similar firms in similar-sized markets. Although you may have to purchase comparisons for a small fee, there are numerous comparison metrics available for a multitude of categories. Examples of just a few reference metrics include income per partner, overall billing rate, administration as a percent of total headcount, staff-to-partner ratios, average annual billable hours per partner and per staff, professional staff turnover, and many more.

Benchmarking will allow you to make comparisons and determine where you lag behind industry norms. You can then develop an action plan to address and improve your performance in those areas.

2. Form strategic alliances to strengthen your firm’s service offerings. Another area to consider when growing your firm with your current clientele is to form strategic alliances with trusted firms and companies offering complementary services. For example, law firms that specialize in trusts or financial services firms are “low-hanging fruit” — obvious choices for partnering. Further, depending upon your clientele and their industries, you may want to partner with specialty tax, financial or engineering firms geared toward your client’s industry.

Two key takeaways when considering strategic alliances are to keep an open mind, and to thoroughly evaluate both your clients’ needs and the quality of the alliances with whom you partner. Forming optimal strategic alliances can allow you to better serve your clients, position your firm as the center of expertise, and increase firm profits per client.

3. Become a thought leader for your niche. While your offerings may be diverse, concentrating your efforts on a particular niche or specialized offering will lead your clients to start recognizing you as an expert or thought leader. Sharing your knowledge and expertise freely through multiple outlets including web forums, blog posts, FAQs on your website, social media posts, and publications will keep your name associated with specialized areas and information. Reaching your existing clientele with thought leadership content will keep them engaged and loyal by viewing you as a trusted advisor.

4. Manage your customer relationships and build loyalty. At the end of the day, it’s the people-to-people relationships that build firms, not marketing plans or campaigns. A vital piece of increasing revenue from your existing clients is to manage their experience and build loyalty. To effectively and efficiently accomplish this, there are multiple customer relationship management software packages available that can help. When choosing a CRM that’s right for your firm, a critical eye should evaluate it for its applicability, ease of use, and versatility. While there are many CRMs on the market, there are some built specifically for accounting firms.

A CRM software should help you efficiently and strategically manage marketing, sales, and client relationships. Your CRM system should not only assist you with managing these relationships, but it should also help identify the relationships that matter the most and offer a personalized experience.

5. Upsell your existing clients. The strategies above will provide a framework for upselling your existing clients with additional or more comprehensive services. With a CRM system supporting timely communication and thought leadership content that positions you as an expert in your field, your clients will organically inquire about related services and offerings that could benefit them and their business. You want to be the “go-to” firm for your clients’ financial lives, and you can lean on the strategic partnerships described above to fulfill any gaps in your existing services.

When looking to grow your business this year, the strategies above provide a powerful opportunity for you to do so without having to add additional clientele. By enriching the relationship, you are creating loyalty and growing your practice with your existing client base — it’s a win-win for your firm and your clients.

نشر في

موضوعات متنوعة

موسومة تحت

الثلاثاء, 24 مايو 2022 07:18

إنفوجرافيك..تدقيق بدون ألم!

يمكن أن تساعد عدة خطوات الممارسين على تجنب المزالق الشائعة التي تسبب ضائقة غير ضرورية لعملاء التدقيق

نشر في

إنفوجرافيك

موسومة تحت

الأربعاء, 21 سبتمبر 2022 12:17

استراتيجية جيدة أم استراتيجية سيئة أم عدم وجود استراتيجية على الإطلاق؟

كان جاك ويلش، رئيس شركة جنرال إلكتريك الأسطوري، يحب أن يقول، "إن الخطوة الأولى لجعل إستراتيجية حقيقية هي الاكتشاف"

معلومات إضافية

-

المحتوى بالإنجليزية

2021: Good strategy, bad strategy or no strategy at all?

By Kyle Walters

January 12, 2021, 11:12 a.m. EST

4 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Legendary GE chairman Jack Welch liked to say, “The first step to making a strategy real is figuring out the big ‘Aha!’ that gives you sustainable competitive advantage.” Following that logic, Welch said: “If you don’t have a sustainable competitive advantage, then don’t [try to] compete.”

I know what you’re thinking: “Our firm is doing well, but I don’t know if we really have a sustainable competitive advantage.” Actually, you do have a competitive advantage: It’s called your relationship with your clients. And if you’re thinking to yourself: “Geez, now I have to develop a strategy on top of getting through busy season,” that’s actually a good thing. It puts you ahead of most of your peers.

I’ve found that many highly motivated people confuse goals with strategy. There’s a big difference. There’s a great book by Richard Rumelt called Good Strategy, Bad Strategy. Rumelt believes there are three key elements at the core of every good strategy:

1. The diagnosis;

2. The guiding policy;

3. The coherent actions.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

Rumelt calls those three elements the “kernel” of a strategy. Let’s take them one at a time.

Step 1: The diagnosis. Like most people, many CPAs have a hard time simplifying all the complexity in their lives. It could be figuring out how to bring in great people to their firms, or improving their systems and processes. or getting better at marketing. Well, you can’t solve tough problems unless you diagnose them properly.

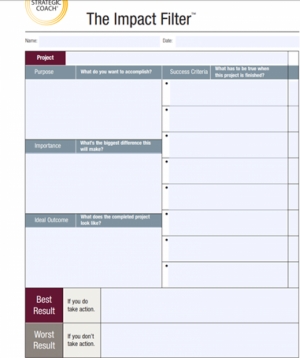

Charles Kettering, the iconic former head of research for General Motors liked to say, “A problem well stated is [already] half solved.” Using an "Impact Filter", which I discuss later in this article, can be a great, simple tool for helping you ask the right questions.

Step 2: The guiding policy. After diagnosing the problem, the next step is figuring out how you are going to deal with it. What’s your overall approach? What’s your big-picture plan? January is when most people, full of hope, talk about all the things they’re going to accomplish in the year ahead. Unfortunately, just talking about what you’re going to do is not going to move the ball down the field. Instead, you must be very intentional about how you plan to use your firm’s resources.

You only have so many resources — time, money and people — to go around. A truly coherent strategy forces you to pull resources toward areas of higher expected return and away from areas of lower expected return. You can’t allocate all your resources to every single initiative on your list. If you do, you’ll find yourself spread too thin and not making progress on anything.

Sound familiar?

Step 3: The coherent actions. According to Rumelt, these are the clear steps that need to be coordinated to carry out your guiding policy (see Step 2 above). In other words, identify what needs to be done, by whom and by when to implement your strategy.

Famed Silicon Valley venture capitalist Peter Thiel believes that with the right strategy in place, you can reach your 10-year goals in just six months. You don’t have to be a high-flying tech firm or a pharma company developing a COVID vaccine to accomplish this. You just need to determine the areas of your business that you need to be accelerated ASAP — and then allocate the necessary resources to support those areas.

What I learned the hard way

When I started my firm, I was full of boundless energy. I thought I had really solid 10-year goals and enough energy to tackle every opportunity that came my way. I learned over time that I did not have a coherent strategy. I did not have a kernel, as Rumelt would say. I simply had aspirations such as growing 10 percent each year, making three great new hires a year, or providing best-in-class client service.

Great ambitions, but I wasn’t thinking carefully about how many additional resources I’d need to deploy to reach those goals. I wasn’t thinking about where I’d have to sacrifice resources from other areas.

Resources and techniques to help you prioritize

One of the best ways to formulate a well-asked question is to use a simple Impact Filter. It’s a simple one-page form developed by Dan Sullivan, a.k.a. The Strategic Coach. The filter forces you to crystallize your thinking about an idea or initiative and helps you arrive quickly at a tangible go/no-go decision. If nothing else, the Impact Filter will prevent you from meandering and wasting precious time and resources.

90 Day Rocks, pioneered by EOS Software, are great for prioritizing your goals and resources — and for measuring your progress as you pursue them. Write down the top five things you could accomplish at your firm over the next 90 days:

1. Having a better client onboarding process;

2. Building a better client portal/vault;

3. Implementing a better CRM;

4. Just making April less stressful;

5. Improve your staff’s continuing education program.

Now pick one of those items above — just one — and cross off the other four. Be 100-percent committed to doing the one thing you selected. Make sure everyone at your firm is onboard with that decision, too.

Often the hardest part about developing a new habit is just getting started. Once you do, you’ll become a bona fide Anti-Fragile CPA before you know it — a trusted advisor who adapts well to change and who always helps clients and team members make better decisions.

Talk about a competitive advantage!

نشر في

موضوعات متنوعة

موسومة تحت

الثلاثاء, 09 فبراير 2021 11:43

30 دقيقة من وقتك يمكن أن توفر لك 30 يومًا من العمل

معلومات إضافية

-

المحتوى بالإنجليزية

30 minutes of your time could save you 30 days of work

By Kyle Walters

June 11, 2019, 3:58 p.m. EDT

5 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

How many times has an excited colleague burst into your office requesting a meeting to discuss a great new idea they have? How many times have you had your own ideas for a new project or initiative that could be a bona fide game-changer for your firm?

And how many times have those great ideas come to fruition? Not many, right?

Most of the time people start working on something exciting without knowing where they are going or why they are doing it. Inevitably they run out of time, energy and support from colleagues. Sound familiar?

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

In the old days, firms would assign someone — usually the champion of the idea or an outside consultant — to write a business plan or to conduct a feasibility study of the idea before moving forward. But, in today’s fast-paced world, the window of opportunity might close (or a competitor might have already moved in) by the time the business plan or feasibility study is completed. Fortunately, there is something called an Impact Filter that can rapidly crystallize your thinking about an idea or initiative and quickly arrive at a go or no-go decision.

Source: The Strategic Coach, Inc.

The Impact Filter, developed by renowned entrepreneur coach Dan Sullivan, may look like a simple one-page grid on the surface. Trust me; it’s not simple at all. One thing I really like about filling out an Impact Filter is that it prevents you from meandering. It forces you to “filter out” all the noise and distractions in your day-to-day life so you can focus 100 percent on your idea or opportunity. You have no choice but to stop and think carefully about what success really looks like before you start working on a new project or initiative. Isn’t that a lot better than the alternative — just winging it — or even worse, “analysis paralysis”?

If you, or someone on your team, is not willing to fill out an Impact Filter before starting a project, that’s a pretty good “acid test” that the project is not worth doing. Spending half an hour defining what success looks like on a project will really help you understand it and make you better able to communicate your vision of a successful project or initiative to others at your firm. That type of communication is essential for building support and commitment.

How CPA firms can use Impact Filters

Sure, filling out an Impact Filter will be a little more work on the front end, but it will save you tons of time, effort and confusion on the back end. That’s why Dan Sullivan’s company, Strategic Coach, Inc. uses the mantra, “30 minutes saves you 30 days.”

The Impact Filter has a wide variety of uses. It can be used to evaluate the merits of a new website your firm is considering. It could be used to assess the viability of a new client onboarding process you’re considering, a new hiring plan or marketing plan, new tax software or a new branch office.

Let’s take a new marketing plan. Instead of just saying, “We need to post more on social media,” the Impact Filter helps you answer big questions such as:

What are you trying to accomplish?

What does it look like when it’s completed?

Or suppose your firm is deciding whether or not to open a new branch office. The Impact Filter will help you decide why you really want to expand, what you’re really trying to signal strength to the marketplace (i.e., “we’re growing fast and we’re prosperous”), and whether or not you really need a more convenient location for the staff.

If the answers you come up with are not compelling, you might realize you shouldn’t be spending time, effort and money expanding the office after all.

At our firm, everyone from partner to administrative assistant is required to fill out the Impact Filter before taking on a new project. In fact, we won’t hold a meeting to discuss a new project until an Impact Filter has been completed. More often than not, the person with the great idea will answer their own questions about the project’s feasibility just by completing an Impact Filter — the team meeting to discuss the merits of the idea often becomes unnecessary.

Guardrails, not brakes

Impact Filters were originally developed for entrepreneurs and business owners — notoriously scattered creatures who are certainly not CPAs. Most entrepreneurs are so busy working in the business they don’t have time to work on the business. They typically have a host of unfinished projects, or the projects have been completed, but haven’t been implemented. Think of the Impact Filter as a tool for getting organized around projects. Again, the Impact Filter is not for higher-ups at an organization to shoot down a project. It’s for getting the champion and the project crystal clear on what success looks like.

Let’s say your firm does a quarterly planning meeting. What are these big hairy projects that always come up? Do an Impact Filter for each one. It will help you understand which ones will be most valuable for your organization, or more importantly, which ones are most valuable but need more time to be unpacked?

Thirty minutes will save you 30 days, but don’t get hung up on the 30-minute rule

Half an hour might be pretty aggressive for completing an Impact Filter thoroughly, especially for new users. I generally set aside an hour, sometimes two hours, to complete it. The key is to let your brain decompress first and make sure you can carve out some undistracted deep-thinking time. No phone calls, no email, no social media.

Filling out an Impact Filter will get easier each time you do it. The reason it’s so hard for many people at first is because they’re not used to thinking. That’s right. We don’t spend much time actually thinking during the workday. We spend the majority of the day reacting — putting out fires and racing to meetings and deadlines. Thinking and reacting are very different things.

Don’t be a perfectionist

As CPAs, we tend to be highly detailed people accustomed to rigid rules, best practices and deadlines. The Impact Filter is an iterative, ongoing exercise that has to keep evolving. That’s a big mindshift for many CPAs. But I can tell you for certain, if you commit an hour of uninterrupted thinking to the Impact Filter, it will be a lot better than anything else you had before. You can always make adjustments. Just get started and get your next project documented and on the right track.

Give the Impact Filter a try. Feel free to send it over to me for a complimentary assessment. After reviewing your Impact Filter, I’ll give you three follow-up questions to think about.

نشر في

موضوعات متنوعة

موسومة تحت

الأحد, 07 فبراير 2021 12:49

هل بيانات شركتك آمنة؟

معلومات إضافية

-

المحتوى بالإنجليزية

Is your firm's data safe?

By Ted Needleman

January 29, 2021, 9:00 a.m. EST

11 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

It seems like not a day goes by without news of networks being breached and data hacked. One of the most recent, the SolarWinds hack, led to breaches within multiple areas of our government, while individual ransomware attacks on vital parts of our economy, including entire towns and hospitals, are being reported more and more frequently.

Given the chaos that the COVID-19 pandemic has caused through 2020, and with no quick resolution in sight, the last thing you need is for your practice to be hacked or held for ransom. But the plain truth of the matter is that the need to work remotely, fueled by the coronavirus, has made your practice and your clients more vulnerable than they were in the past.

“The rash of lucrative ransomware attacks over the past year pointed to organized hacker groups specifically targeting medical, legal and accounting businesses where they could not only invoke the ransom but also steal a treasure trove of client/business information,” said Roman Kepczyk, director of firm technology strategy at Right Networks. “This allowed the hackers to threaten to release confidential client information or intellectual property if the ransom was not paid. In addition to using the personally identifiable information to fraudulently file tax returns and instigate identity theft, in some instances the hackers contacted clients of the firms for further extortion, threatening to release confidential, compromising or embarrassing information.”

Article Managing Cash Flow– a Critical Factor to Small Business Success

Your small business clients are a key pillar of the U.S. economy, providing income to their families and delivering growth and innovation to the...

PARTNER INSIGHTS

SPONSOR CONTENT FROM CHASE INK

Obviously, protecting your systems and data from outside intrusion is important. But even more important is protecting your clients’ systems and data. And the fact that many of us are working from home, and will likely continue to do so, at least part-time, for the foreseeable future, only increases the risk of exposure.

The steps you can take range from very basic to ultra-sophisticated. Your first lines of defense are great backup procedures and using a good anti-malware application. But these are just the beginning. You need to take active measures to protect your systems, whether they are in your physical office, or your office on the kitchen table.

It takes two

Two of the most common and easiest security measures to implement are two-factor authentication and encryption. While two-factor authentication can be a bit annoying, having to enter both a password and a verification code sent to an email account or messaged to a mobile account significantly reduces the chances of a breach if someone is able to get hold of your password.

Stronger passwords with greater security are also a must. Too many are still using weak passwords such as the names of their spouses, children or dogs, or even “Password123.” Many remote applications are now insisting on stronger passwords containing upper- and lower-case letters, numbers and special symbols. But keeping track of these, especially when they are different for every application, is a major concern for many users. If this is the case with your practice, there are several ways you can use difficult-to-guess passwords and still not have to write them down to remember what they are for each application.

The most common of these is to use a password manager that tracks your passwords and inserts the proper difficult-to-remember password into the appropriate application. Popular password managers include 1Password and LastPass, but there are plenty of similar applications for PCs, Macs, smartphones and tablets.

Another alternative is to use a hardware authentication key that plugs into a USB-A oe USB-C port or provides NFC (near field connectivity — the technology used in tap-and-pay credit cards and some phones) to work with mobile devices that incorporate this feature. One popular key is offered by Yubico, though they are far from the only vendor.

“The YubiKey provides users with a hardware-backed strong multifactor authentication solution that has a proven track record for protecting accounts,” Chad Thunberg, chief information security officer at Yubico, told us. “Not every service provider or application — including some of the popular accounting software suites — have yet adopted the FIDO [Fast IDentity Online] authentication standards that we use for the YubiKey. However, many of these applications support using a single sign-on [SSO] identity provider that does support the use of YubiKeys. To get started, users can enroll their YubiKey with their favorite identity provider (e.g., Google, Apple or Microsoft) and then use that identity provider to log onto their accounting software. I took a brief look at some of the popular offerings, and FreshBooks, QuickBooks Online and Sage Accounting all support SSO.”

Encryption is yet another option that you should be aware of. Richard Kanadjian, encrypted USB business manager at Kingston Technology, pointed out that, “Encryption basically means that if you encrypt the data on that USB drive and you lose it, the probability that somebody can actually retrieve that data is actually infinitesimal. It’s actually almost zero. And the reason is we have password controls. For example, you have a password or a pin for your USB drive and our encrypted drive will only let you enter the password 10 times. So, if you enter it more times and if somebody’s guessing, the drive will literally wipe its contents and erase the data. You will actually not have any data to be exposed to a breach.”

Keeping the data for your applications on an encrypted drive is a usable approach, but keep in mind that the data on an encrypted drive should be backed up to a secure location, be it the cloud or a second encrypted drive, just in case the encrypted drive containing important data is lost or stolen.

You should also be very aware of where you are using your laptop. Too many people go down to the local coffee shop or library, where the internet is freely available, and don’t take reasonable precautions against infections and intrusions. Infecting the routers at these locations with malware is becoming very common, and the compromised internet at these locations can infect hundreds or even thousands of the systems being used there, as well as any networks that the infected systems are then attached to.

“One of the biggest concerns that we are seeing is so many employees were forced to work from home and all of a sudden they’re sitting on networks that are outside of the control of corporate IT,” Stephen Lawton, special projects editorial director at SC Media, pointed out. “If you let the employee simply use their home systems and their home networks without any IP control, quite frankly what you’re going to get is BYOD — not ‘Bring your own device,’ but ‘Bring your own disaster.’ The lack of security controls on most home networks is really quite astounding. Many people have never updated the firmware and their routers. They’ve never put any kind of security controls or software on their systems. If you’re going to have your workers working from home, the practice really needs to invest in laptops specifically for that purpose, that have security controls built into them. At the minimum you need some enterprise-class antivirus, anti-malware anti-ransomware software. You should also have the systems going over a virtual private network back to a home base. VPNs are certainly not foolproof, but they’re better than not having anything at all, or just going through the employee’s personal network.”

© Pedro Nunes/pn_photo - stock.adobe.com

Your face and your printer

Biometrics as a password substitute are also becoming increasingly common. No, you don’t have to have a retina scanner mounted on your PC or laptop, though it would hardly be surprising to see something along those lines using the almost-ubiquitous webcam in the near future. But while retinal scanners have been around for years, along with the handprint readers often seen in movies, they are pretty much relegated to very high security installations with equally high security budgets and resources.

But real, usable, biometric roadblocks to unauthorized network and device penetration have been available for years. Fingerprint readers, especially in laptops, are common these days. And both the iOS and Windows operating systems have facial recognition capabilities that can not only serve as an alternative to system passwords, but in many cases can also be used as passwords to sensitive applications such as bank and credit card accounts.

This is a handy inroad to your sensitive systems and applications, but is somewhat blunted by the fact that most of the facial recognition capabilities at the entry level, such as those included in the operating system, require that the entire face be visible to provide authentication. Wearing a mask, a necessity out in public or in your office these days, often defeats this handy sign-in method.

One area of vulnerability that’s been getting more attention recently are devices connected to the Internet of Things — components, such as printers and multifunction printers, that are connected to your network and also have their own pathways into the internet. Most of us are familiar with threats such as phishing and embedded malware, but there is another route into your network that you may have not considered.

“A lot of times the network perimeter has, in the past, been used as a way to secure devices.” Shivaun Albright, chief technologist of print security at HP, pointed out. “And in this day and age, with email, phishing attacks, clicking on something, any type of email or link, you cannot guarantee that your interior perimeter network is secured. You just can’t. And one of the things that we’ve seen, in fact last year, was an article from Microsoft in August of 2019. They had highlighted that they had caught Russian state hackers using IoT’s breached networks. And, by the way, they found that devices that had been hacked were Voice over IP phones and office printers.”

Clients are targets, too

There’s obviously a lot more to look at security-wise than what is covered here. And, as with many aspects of technology, IT security is a moving target — what’s true and secure today might be vulnerable tomorrow. Developing the expertise and knowledge to deal with the new threats that emerge every day is not only an ongoing process, but one that can be difficult to maintain and expand, which is yet another good reason to examine the practices and protocols in place in your practice and at your clients’.

Protecting your and your clients’ data is not only a fiduciary responsibility, it’s also good business practice. “Firms that have been breached will not only have to deal with a damaged reputation, but can expect to see client churn and having to deal with ongoing litigation from clients that were impacted,” warned Kepczyk.

It takes time and money to build expertise in this area. And even after an extensive immersion in security, it’s likely that you still might not have the experience to know just how to determine where your practice’s vulnerabilities are and how to address them when you do discover them.

One approach suggested by Randy Johnston, executive vice president of K2 Enterprises, that is especially applicable if you outsource some or all of your IT support, is to “choose reputable IT providers that understand and implement best practices for security to help your internal IT staff. While security risks morph over time, the provider must actively respond to new threats and continuously adjust their security protocols and technical setup to protect your firm.”

And Kepczyk added, “Employee training is critical, particularly in regards to phishing threats, which account for the entry of the vast majority of breaches, so we suggest you outsource that to third parties such as KnowBe4, PhishMe, Wombat Security, etc., that will do phishing testing and employee training.”

If you’re thinking of expanding your practice into this growing area of concern, or just want to better educate yourself, Jim Bourke, a partner and managing director of advisory services at Top 100 Firm WithumSmith+Brown, has a few suggestions on getting started. To start, “I would highly recommend getting your hands on the AICPA cybersecurity risk management reporting framework.”

Bourke added, “I would discuss the AICPA’s ‘SOC for Cybersecurity’ engagement with your clients. At Withum, we are all over that space. As CPAs, only we can issue a ‘SOC for Cybersecurity’ report! There is huge demand for this type of deliverable today. The AICPA has classes and workshops in this space, allowing any CPA to gain the knowledge and expertise that they need to perform these services.”

But whether or not you decide to add security consulting to your practice or partner with a company that has expertise and reputation in that area, keep in mind that the very last thing you want to tell a client is that you had a data breach, were hacked, or that your system is locked due to ransomware. A good backup strategy is a necessary first step, but where you go from there is going to determine just how secure your ongoing livelihood is going to be. And while there is no such thing as perfect security, you need to be aware of where you are vulnerable, and take steps to strengthen those areas of your procedures and practices.

نشر في

تكنولوجيا المعلومات

موسومة تحت

الثلاثاء, 24 مايو 2022 07:20

إنفوجرافيك.. مستقبل التدقيق يأتي أسرع مما تعتقد

نشر في

إنفوجرافيك

موسومة تحت

الأربعاء, 21 سبتمبر 2022 12:11

استشارات الميزانية للمحاسبين لعام 2021

معلومات إضافية

-

المحتوى بالإنجليزية

Budgeting advice for accountants for 2021

By Helen Braswell Kakouris

Given the turbulence of the past year, agility should be at the forefront of our minds when building a budget and strategy for 2021. Business owners need to be prepared to navigate the continued uncertainty. The ability to pivot in an unpredictable business environment will be essential this year, and with revenue assumptions changed across all industries by the events of 2020, a fresh approach is needed.

The industry can look to PwC’s advice: “Protect growth and profitability through actions such as scenario planning [and] more frequent financial modeling exercises to improve resiliency.” It is time to shift the approach to the new environment, with small and medium-sized companies now requiring quarterly or monthly strategic advice. This will transform the way that the industry offers its services, with strategy and consulting services offered as a monthly retainer, pushing away from the traditional per hour format. With the software advances of recent years, switching accounting pricing models can be a near seamless transition.

Historically, only large enterprise companies had the means to invest in quality software to enhance their decision-making capabilities for strategy and budgeting. Small and medium-sized enterprises in contrast often relied on a semi-annual conversation with their CPA. In the last few years, countless new software products have come to the market geared toward SMEs. There has never been a more important time for accountants to look ahead and prepare themselves for strategy-based budgeting conversations rather than historical budgeting.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

First, let’s run through the ground rules for forming a budget, before looking more specifically at how the 2021 budget should differ.

The basics

When forming a budget, it has to align with the company’s vision and goals. Are the vision and goals specific, measurable, achievable, time-based and relevant? This is the S.M.A.R.T. acronym from a paper published by George Doron almost four decades ago. A well-formulated goal could be something like, “I want to increase company sales by 30 percent by the end of 2021.”

Understand the executive team: What is their management style? Are they aggressive or conservative? That will ultimately decide whether they are willing to absorb losses in order to achieve their growth goals and thus will shape the budget and give a clear picture on raising or securing necessary capital. Understanding management style and the decision-making approach is really a personal question for every business owner, which must be reflected on individually.

Get specific with the industry. Think about the industry and economic factors that will affect the company’s operations in the coming year. Naturally the whole business world has been radically changed by the events of 2020, but its effects will be distinct across different industries.

Consider the company’s overall revenue goal. Is it hoping to offer new products or services? If management wants to increase sales, perhaps it needs new sales personnel, and the budgeted payroll expense will likely depend on their level of experience.

Consider the company’s costs: Do they need greater inventory to satisfy orders? What is the staffing cost required for increased sales, or even the cost of outsourcing some tasks? Also, try to predict upcoming costs, like any equipment purchases that could be beneficial.

The last ground rule for forming a budget is to choose a budget framework — a historical budget or a zero-based budget. In normal times, a hybrid budget would be recommended, with historical data as a base to develop revenue and payroll, and all other expenses using the zeroed-out approach. However, the 2021 approach to budgeting is going to challenge the traditional ways.

The 2021 approach

A new business environment demands a fresh approach to budgeting. Zero-based budgeting should be the preferred framework, prioritized over the historical data approach. In fact, McKinsey even echoed this point in a recent study.

The historical data approach could be misleading this year. 2020 may have been a statistically anomalous year, meaning the data produced in the most recent year, which would usually carry the most weight, is difficult to utilize.

In building a budget, assumptions are one of the most important components because those will drive total annual budgeted revenue and expenses, and thus shape the entire report. For 2021, those assumptions are even more important and should be afforded greater scrutiny. Geographical and seasonal variables also require particular attention. With greater market fluctuations expected amid an unpredictable political and economic environment, accountants must make themselves available for up-to-the-minute advice. Businesses will need them to be on hand to review and adjust budgets throughout the year, to help adapt to environmental changes as they come.

The accountants who build that trust are likely to have a profitable 2021 and beyond. They should consider changing their own pricing model to a monthly retainer, rather than a by-the-hour model, so their company involvement can be more consistent and available for pivoting throughout the year.

In addition, the increase in automation is compounding the need for the new pricing model. Much of the traditional bread and butter work of accountants is being automated, meaning the professional role is becoming increasingly advisory, with trust key to the relationship. Accountants should realize where the industry is headed, and get ahead of the game.

Those professionals should consider acting as a strategic partner to businesses rather than a professional who gets called in for projects or regulatory requirements. While the ground rules remain an important point of reference, the 2021 budget demands the industry adapt to an unfamiliar economic environment. Being in such unchartered waters heightens the importance of the zero-based budgeting framework and requires deep thought on every single assumption included in the budget.

Accountants will be trusted with a weighty responsibility as their clients navigate and profit from an unpredictable 2021. Those who are on hand to course a way through choppy waters are sure to develop great relationships with their clients and gain a solid reputation in the industry.

نشر في

موضوعات متنوعة

الثلاثاء, 26 يناير 2021 12:08

هل الانكار نهر في مصر أم هو حالة مؤسستك؟

معلومات إضافية

-

المحتوى بالإنجليزية

Is denial a river in Egypt or the state of your firm?

By Dom Esposito

We all know that denial is not a river in Egypt, but how many of us know that denial is the state of our firm?

In his 2008 book entitled “Strategy and the Fat Smoker,” David Maister wrote that we often (or even usually) know what we should be doing in both our personal and professional life. We also know why we should be doing it and (often) how to do it. Figuring all that out is not too difficult. What is very difficult is actually doing what you know to be good for you in the long run, despite short-run temptations. Therefore, many leaders, and by extension many small and midsized CPA firms, live in denial.

More often than not, what needs to be done by a firm’s managing partner or CEO is obvious. While it’s not always easy, he or she needs to make those tough decisions in the best interests of the firm. But many leaders are in denial and fall short of what’s required, and, in many cases, that’s the principal reason why so many firms can’t get to the next level or, worse yet, can’t perpetuate themselves.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

Presented below are the obvious but not easy things that a managing partner needs to do in today’s world of public accounting to be viewed as an effective leader who sits on top of a firm that is not in denial:

Walk and talk the vision, mission and strategy of the firm. Lead by example. “Do as I do, not as I say.”

Create an environment that breeds trust, persistency and consistency.

Shepherd senior partners and potential all-stars.

Create a firm-first (our clients vs. my clients) culture.

Be open to service diversification. Move away from the traditional accounting firm model to a professional services firm model.

Address ineffective partners on a timely basis.

Realize that size (with quality and profits) matters, and explore a business combination or two if that is in the long-term best interests of clients, staff and partners.

Deliver on the client promise of being a trusted advisor.

Create goal setting, accountability and discipline — first and foremost with the partners and then with the staff.

Drive industry specialization, the undisputed vehicle to provide client distinctiveness and value.

Implement a partner compensation plan that is fair and equitable, incentivizes high performers and potential all-stars, and avoids “sprinkles.”

Get value from non-billable time.

Create a balanced approach to partner and staff utilization that’s neither too lenient nor too overbearing.

Insist that a strategic plan may require a “no” when an idea doesn’t conform.

Develop an effective “farm system” for talent, particularly future partners.

Avoid being too many things to too many sectors.

Gain market permission from the gatekeepers such as investment bankers, attorneys and bankers who will enable you to move upstream with clients.

Grow for strategic purposes not simply for volume.

Require the proper mix of clients, marquee clients (credential builders) and other clients that help pay the rent and train the staff.

Have corporate governance and operating models that work for the overall firm.

Always have the desire (and ability) to invest in the future.

Help partners and staff realize that quality work doesn’t necessarily mean quality service.

From a quick review of the above, it’s clear that a managing partner is the heart and soul of a CPA firm, the one who must do what needs to be done to avoid denial and to ensure success. Having said that, many firms do not have effective managing partners. Here are four common mistakes to avoid when selecting managing partners:

1. Don’t ask the firm’s No. 1 biller to be managing partner.

While a successful managing partner usually carries a small client load to stay grounded in client service and to remain credible with the partner group, billings and chargeable hours are truly a small part of the job. In my view, a managing partner’s clients are the partners, giving them the opportunity to maximize their strengths while minimizing their weaknesses. A managing partner has to be readily available for big opportunities or problems.

2. Think long and hard before you ask someone from the outside to be managing partner.

Without a lot of due diligence and partner buy-in, an “outsider” is too risky, particularly if someone comes from outside the professional services firm environment. An outsider obviously doesn’t know the firm’s history or culture or the partners’ individual strengths and weaknesses. An outsider also isn’t attached to the firm’s vision, mission and strategy. Please stay away.

3. Don’t ask two partners to function as co-managing partners.

In the spirit of political correctness, it’s not unusual for firms to select co-managing partners. It’s a safe decision that doesn’t offend quality partners who compete for the position.

While from time to time, this kind of arrangement can work, many times it doesn’t and is therefore a step that should be taken with lots of caution. Too often firms with co-managing partners are plagued with inaction or conflicting directions with little, if any, consistency on strategy. If co-managing partners can be avoided, take the bold step and the tough decision: select the right person for the job today and make sure you do your best to retain the other contenders.

4. Don’t ask a part-time committee to be managing partner.

Firms can’t operate by part-time committees. A firm needs to make decisions and move on. Sure, a firm needs oversight committees such as a management committee or an operations committee to drive their day-to-day activities. A firm also needs an executive committee for corporate governance, partner matters and strategy. But a firm can’t easily do what is obvious if the key leadership role is delegated to a part-time committee that reacts to situations if and when time permits. It’s a recipe for disaster. No one is thinking about strategy and the future while, at the same time, making sure that the necessary blocking and tackling are being tended to.

So, why do some firms continue to live in denial and lack an effective managing partner? In many cases, it comes down to trust and security.

Many firms select a new managing partner from their ranks at an age somewhere between 45 and 53. Candidates are usually excellent client relationship partners with substantial client service responsibilities. The thought of giving up a substantial portion, if not all, of the client relationships that have been developed over years of service is scary to many. For sure, there is a risk in being a managing partner. Candidates may ask, “What happens if I’m not successful? In the spirit of trust, I lose most, if not all, of my client responsibilities and begin to lose touch with my outside referral sources. I’ll have nowhere to go but to exit the firm when I’m no longer the managing partner.”

This is a very real concern and many firms do not want to recognize the severity of the issue. Instead, firms say, “trust us,” and while that’s easy to say, history has shown that this trust has sometimes been misplaced. As a result, for the overall good and welfare of a firm, I recommend that a managing partner be offered an agreement that addresses what happens if he or she is no longer the leader of the firm. Such an agreement can address what happens to future compensation, what happens to employment, and what happens to retirement benefits or deferred compensation arrangements. It can pay huge dividends down the road for everyone.

نشر في

موضوعات متنوعة

موسومة تحت

الثلاثاء, 24 مايو 2022 07:22

إنفوجرافيك.. أربعة اتجاهات تقنية أساسية للإنتاجية في عام 2021

نشر في

إنفوجرافيك

موسومة تحت

الأربعاء, 21 سبتمبر 2022 11:40

كيفية جمع المستندات من العملاء أثناء العمل عن بُعد؟

مع عمل الكثير منا من المنزل بسبب فيروس كورونا ، فإن الطريقة التي نعمل بها مع العملاء بأكبر قدر ممكن من الكفاءة أصبحت أكثر أهمية من أي وقت مضى

معلومات إضافية

-

المحتوى بالإنجليزية

How to collect documents from clients while working remotely

PRACTICE MANAGEMENT, WORKFLOW TOOLS

April 23, 2020 / Mariette Martinez, EA

With the tax deadline postponed and many of us working from home due to the coronavirus, being as efficient as possible with the way we work with clients is more important than ever. To be successful, we need to move more clients online. This starts with operating a 100 percent cloud-based practice and implementing an effective process for document collection.

Since my clients’ technical skills varied from highly tech savvy to new online app users, it was essential that the technology and client implementation would be seamless and user friendly for my multiple client types. I also wanted to keep our workflow as simple as possible, so using the fewest number of applications would create the best-case scenario. I wanted to synchronize what I had already implemented in my current operational workflow, while partnering that with serving my clients’ needs to stay connected. Ultimately, these processes provide me the necessary documents to keep our work flowing seamlessly.

I know that making these kinds of changes in your practice isn’t easy – and it takes time, especially now that we’re sheltering in place. According to an Intuit® Accountant Panel survey in March 2020 that asked about the most pressing issues due to the coronavirus, 42 percent of the 247 respondents said that getting documents from their clients was by far their biggest struggle when working virtually.

Whether you’re very experienced in collecting documents from your clients without seeing them in person – or if this is new for you because of the coronavirus, here are several best practices I can share to make the process easier.

The essence of a strong document collection platform, also referred to as a document portal, is a centralized, secure location to share documents and collaborate with clients and staff.

We chose Citrix ShareFile for our preferred solution, but several other options include Box, Dropbox, Google Drive, SmartVault and Intuit Link.

Several platforms allow firms to personalize the document portal experience with their firm branding to provide a more trusted and professional client experience. These document platforms also commonly enable:

Collaborating on documents and editing in real time.

Encrypted client requests with notifications and reminders.

Encrypted email for those times when email is the best way.

Sending and receiving of large files.

Most importantly, the document collection solution you choose should include a high level of encryption for your files, large space storage capabilities that can scale with your firm, and online and desktop automated syncing of all stored files. You definitely don’t want to encourage clients to send you their documents over email. The bottom line is that you and your clients should be able to securely share, collect, and collaborate on documents no matter where you are.

In addition, several platforms integrate with other helpful tools. One of my favorite integrations is Slack with Google Drive. What are some of your favorite integrations? Leave a comment below to share your recommendations.

One other concern: What do you do if your clients don’t want to send you their documents through the cloud? These “shoebox” clients may not be tech savvy and prefer physically dropping off their information to you, but if you’re working remotely and cannot see them in person, what do you do? You don’t want to lose a long-term client, so here are several recommendations:

Sit down with them over a phone conversation, or if they can figure it out, a web call, to explain how your portal works. Walk them slowly through the process and perhaps have them practice or test uploading something to you.

Record a quick video that also explains the process and send this to your clients who may need help using the platform. You can also include a link to the video in your email signature. Here’s an example of this type of video.

If a client absolutely insists on dropping off or mailing their documents, the best advice I can give is to go with the flow, and ensure your clients have a secure, private place to leave their documents with you outside your place of work to avoid contact during drop off. Most likely, this will be a very small slice of your client base.

When you find and implement the winning platform, you not only stay safe during this time of social distancing, but you will save time on document collection in your practice and witness the magic of productive collaboration. Good luck!

نشر في

موضوعات متنوعة